Letter Regarding Payment Form

Understanding the Letter Regarding Payment

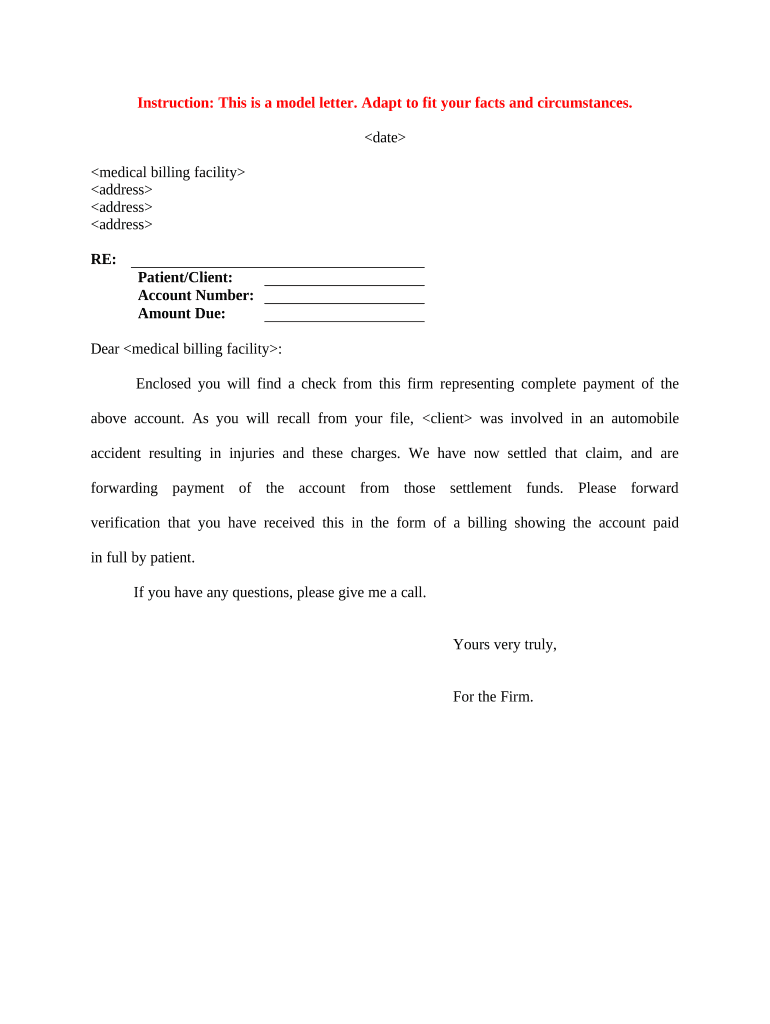

The letter regarding payment serves as a formal communication between a creditor and debtor, outlining the details of a payment agreement or request. This document is essential for maintaining clear records of financial transactions and obligations. It typically includes information such as the amount owed, payment due dates, and any relevant terms or conditions. By clearly stating these elements, the letter helps prevent misunderstandings and establishes a legal basis for the creditor's claims.

Steps to Complete the Letter Regarding Payment

Completing a letter regarding payment involves several key steps to ensure it is effective and legally binding. First, identify the parties involved, including the creditor and debtor. Next, specify the amount owed and the payment due date. It is also important to include any payment methods accepted, such as bank transfers or checks. Additionally, clearly outline any penalties for late payments or defaults. Finally, both parties should sign and date the letter to confirm their agreement to the terms presented.

Key Elements of the Letter Regarding Payment

To create a comprehensive letter regarding payment, certain key elements must be included. These elements typically consist of:

- Creditor and Debtor Information: Names, addresses, and contact details of both parties.

- Payment Details: The total amount owed, payment due date, and any applicable interest rates.

- Payment Methods: Accepted forms of payment and instructions for submitting payments.

- Consequences of Non-Payment: Potential penalties or actions that may be taken if payment is not received.

- Signatures: Signatures of both parties to validate the agreement.

Legal Use of the Letter Regarding Payment

For a letter regarding payment to be legally binding, it must comply with relevant laws and regulations. In the United States, the letter should adhere to the principles of contract law, which require an offer, acceptance, and consideration. Additionally, the letter should be clear and unambiguous to ensure that both parties understand their obligations. It is advisable to retain a copy of the signed letter for record-keeping purposes, as it may serve as evidence in case of disputes.

Examples of Using the Letter Regarding Payment

There are various scenarios where a letter regarding payment may be utilized. For instance, a landlord may send a letter to a tenant requesting overdue rent payments. Similarly, a service provider may issue a letter to a client for unpaid invoices. Each example highlights the importance of formal communication in financial matters, ensuring that both parties are aware of their responsibilities and the consequences of non-compliance.

Obtaining the Letter Regarding Payment

Obtaining a letter regarding payment can be straightforward. Many templates are available online, which can be customized to fit specific needs. Additionally, legal professionals can assist in drafting a letter that meets all necessary legal requirements. It is important to ensure that any template used is appropriate for the particular situation and complies with state laws.

Quick guide on how to complete letter regarding payment 497333349

Complete Letter Regarding Payment effortlessly on any device

Digital document management has become popular among businesses and individuals. It offers an ideal environmentally-friendly substitute for traditional printed and signed papers, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents swiftly without any hold-ups. Handle Letter Regarding Payment on any device using airSlate SignNow’s Android or iOS applications and streamline any document-related processes today.

How to modify and eSign Letter Regarding Payment with ease

- Obtain Letter Regarding Payment and then click Get Form to begin.

- Make use of the tools we provide to finalize your document.

- Highlight important sections of the documents or mask sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select your preferred method for submitting your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your requirements in document management with just a few clicks from any device you choose. Edit and eSign Letter Regarding Payment and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is creditor payment, and how does it work with airSlate SignNow?

Creditor payment refers to the process of settling amounts owed to creditors. With airSlate SignNow, businesses can streamline this process by electronically signing and sending relevant documents, ensuring timely transactions and reducing delays in creditor payments.

-

How can airSlate SignNow help improve my creditor payment process?

AirSlate SignNow enhances your creditor payment process by providing a secure and efficient platform for document management. You can automate workflows, reducing manual errors, and speed up the entire approval process, which ultimately leads to faster creditor payments.

-

Are there any fees associated with using airSlate SignNow for creditor payments?

Yes, airSlate SignNow offers various pricing plans depending on features and the number of users. However, investing in this solution can lead to savings through improved efficiency and faster creditor payments, making it a cost-effective choice.

-

Can I integrate airSlate SignNow with my existing financial software to manage creditor payments?

Absolutely! airSlate SignNow integrates seamlessly with popular financial software, allowing you to manage creditor payments directly from your existing systems. This integration helps centralize your operations and enhances the overall workflow.

-

What features does airSlate SignNow offer to support creditor payment management?

AirSlate SignNow provides features such as electronic signatures, templates for recurring creditor payments, and secure cloud storage. These tools simplify document handling and ensure that all creditor payment documentation is easily accessible and organized.

-

Is airSlate SignNow safe for handling sensitive creditor payment documents?

Yes, airSlate SignNow prioritizes security with advanced encryption and compliance with data protection regulations. This ensures that your sensitive creditor payment documents are secure from unauthorized access and bsignNowes.

-

How does airSlate SignNow enhance communication regarding creditor payments?

AirSlate SignNow enhances communication by allowing you to share documents and obtain signatures in real-time. With instant notifications and updates, all parties involved in creditor payments can stay informed, minimizing miscommunication.

Get more for Letter Regarding Payment

Find out other Letter Regarding Payment

- eSign Hawaii Rental agreement for house Fast

- Help Me With eSign Virginia Rental agreement contract

- eSign Alaska Rental lease agreement Now

- How To eSign Colorado Rental lease agreement

- How Can I eSign Colorado Rental lease agreement

- Can I eSign Connecticut Rental lease agreement

- eSign New Hampshire Rental lease agreement Later

- Can I eSign North Carolina Rental lease agreement

- How Do I eSign Pennsylvania Rental lease agreement

- How To eSign South Carolina Rental lease agreement

- eSign Texas Rental lease agreement Mobile

- eSign Utah Rental agreement lease Easy

- How Can I eSign North Dakota Rental lease agreement forms

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online

- eSign Tennessee Rental lease agreement template Myself