Ctr Form 2011-2026

What is the CTR Form

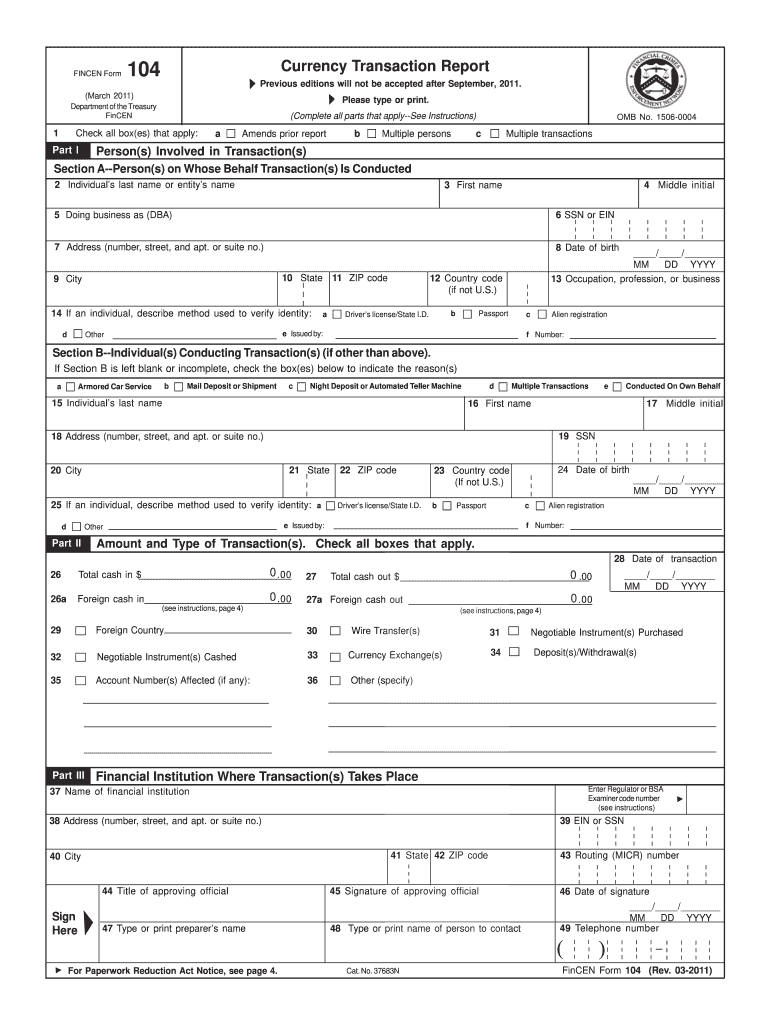

The Currency Transaction Report (CTR) form, officially known as the FinCEN Form 104, is a critical document used by financial institutions to report cash transactions exceeding ten thousand dollars. This form is mandated by the Financial Crimes Enforcement Network (FinCEN) to help combat money laundering and other financial crimes. By collecting data on large cash transactions, the CTR form aids in monitoring suspicious activities that may indicate illegal financial behavior. The information gathered includes details about the transaction, the parties involved, and the financial institution processing the transaction.

How to Use the CTR Form

Using the CTR form involves several steps to ensure compliance with federal regulations. First, financial institutions must accurately identify transactions that meet the reporting threshold. Once identified, the institution must complete the FinCEN Form 104, providing all required information, including the names and addresses of the individuals or entities involved, the amount of the transaction, and the date it occurred. After completing the form, it must be submitted electronically to FinCEN within 15 days of the transaction. Maintaining a record of the submitted form is essential for audit purposes.

Steps to Complete the CTR Form

Completing the CTR form requires careful attention to detail. Here are the key steps:

- Gather necessary information: Collect details about the transaction, including the date, amount, and parties involved.

- Access the FinCEN Form 104: This form can be completed online through the FinCEN website or using approved software.

- Fill out the form: Input all required information accurately. Ensure that all fields are completed, as incomplete forms may lead to penalties.

- Review the information: Double-check for accuracy and completeness before submission.

- Submit the form: Send the completed form electronically to FinCEN within the required timeframe.

Legal Use of the CTR Form

The legal use of the CTR form is governed by federal regulations aimed at preventing money laundering and other financial crimes. Financial institutions are legally obligated to file a CTR for any cash transaction that exceeds ten thousand dollars. Failure to file the form or filing inaccurate information can result in significant penalties, including fines and legal repercussions. It is crucial for institutions to have robust compliance programs in place to ensure adherence to these regulations.

Key Elements of the CTR Form

The CTR form consists of several key elements that must be accurately reported. These include:

- Transaction details: Date, amount, and type of transaction.

- Parties involved: Names, addresses, and identification numbers of individuals or entities.

- Financial institution information: Name, address, and contact details of the reporting institution.

- Signature: The form must be signed by an authorized representative of the financial institution.

Form Submission Methods

The FinCEN Form 104 can be submitted electronically, which is the preferred method for reporting. Financial institutions are required to use the BSA E-Filing System to ensure timely and secure submission. This system allows for easy tracking and management of submitted forms. In some cases, institutions may also be required to keep copies of the submitted forms for their records, adhering to the retention requirements set forth by FinCEN.

Quick guide on how to complete ctr form 21169126

Complete Ctr Form with ease on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly substitute for conventional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without interruptions. Manage Ctr Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented task today.

How to modify and eSign Ctr Form effortlessly

- Locate Ctr Form and then click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize key sections of your documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or mistakes that need new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and eSign Ctr Form and ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ctr form 21169126

Create this form in 5 minutes!

How to create an eSignature for the ctr form 21169126

How to create an electronic signature for your PDF in the online mode

How to create an electronic signature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to create an eSignature straight from your smart phone

How to create an electronic signature for a PDF on iOS devices

The best way to create an eSignature for a PDF document on Android OS

People also ask

-

What is the fincen form 104 and who needs to file it?

The fincen form 104 is a report used by certain financial institutions to disclose their currency transaction activities. Businesses engaged in specific financial transactions might need to file this form to comply with anti-money laundering regulations. Understanding when and how to file the fincen form 104 is crucial to ensure compliance and avoid penalties.

-

How does airSlate SignNow help with managing the fincen form 104?

airSlate SignNow streamlines the process of creating, signing, and managing the fincen form 104 electronically. Our platform provides secure templates and intuitive tools that simplify the eSigning process, enabling you to focus on maintaining compliance rather than getting bogged down in paperwork. This efficiency can save your business time and resources.

-

What are the pricing options for using airSlate SignNow for fincen form 104?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes that need to manage the fincen form 104. Our pricing tiers provide a range of features, allowing you to choose an option that best fits your operational needs and budget. Whether you're a small business or a large enterprise, we have a plan for you.

-

Is airSlate SignNow compliant with regulatory requirements for the fincen form 104?

Yes, airSlate SignNow is built with compliance in mind, ensuring that your handling of the fincen form 104 meets all applicable regulations. Our platform incorporates robust security features, including encryption and authentication, to protect sensitive information. This commitment to compliance helps you confidently manage your documentation.

-

Can I integrate airSlate SignNow with other software for managing the fincen form 104?

Absolutely! airSlate SignNow offers integrations with various accounting, CRM, and document management systems, making it easy to manage the fincen form 104 alongside your existing workflows. This seamless integration enhances efficiency and allows for a more streamlined process in handling financial documentation.

-

What features does airSlate SignNow provide for completing the fincen form 104?

airSlate SignNow provides features such as customizable templates, reminders, and real-time tracking to facilitate the completion of the fincen form 104. Our user-friendly interface allows you to easily fill out forms, collect signatures, and monitor the status of your documents. These features help ensure that your submissions are processed efficiently.

-

How does airSlate SignNow enhance the security of the fincen form 104?

With airSlate SignNow, the fincen form 104 is protected by advanced security measures, including encryption, secure cloud storage, and user authentication. These measures safeguard your sensitive financial data against unauthorized access. By using our platform, you can focus on your business knowing that your documents are secure.

Get more for Ctr Form

- Sample hawaii certificate of vendor compliance form

- Motor accident report spence insurance spenceinsurance co form

- Why youre addicted to your phoneand what to do about it form

- Edi employer type codes form

- Accident incident report clean up australia cleanup org form

- Cancel estate agent contract template form

- Cancel email contract template form

- Cancel service contract template form

Find out other Ctr Form

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile