Letter Close Estate Form

What is the Letter Close Estate

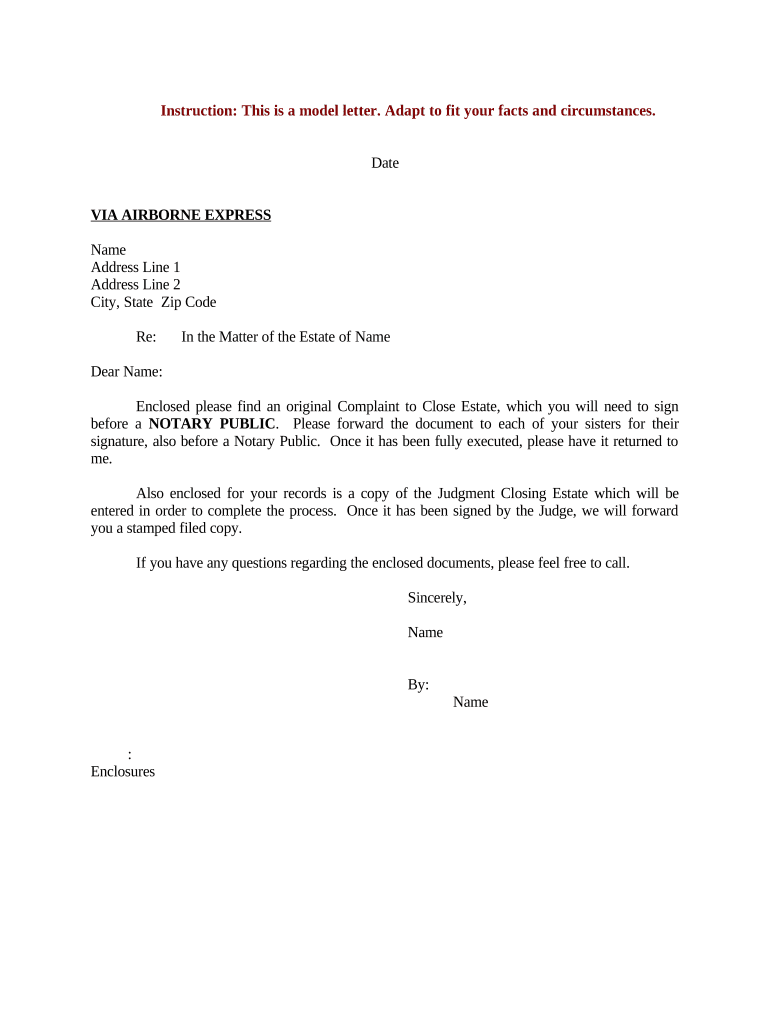

The letter close estate is a formal document used to request the closure of an estate following the death of an individual. It serves as a communication tool to inform relevant parties, such as executors, beneficiaries, and financial institutions, that the estate is ready to be settled. This letter typically outlines the request for final accountings, distributions, and any necessary documentation needed to complete the estate closure process.

Key Elements of the Letter Close Estate

A well-structured letter close estate should include several essential components to ensure clarity and legal validity. Important elements include:

- Sender's Information: Full name, address, and contact details of the person requesting the closure.

- Recipient's Information: Name and address of the executor or relevant authority handling the estate.

- Subject Line: A clear subject indicating the purpose, such as "Request for Estate Closure."

- Details of the Deceased: Name, date of death, and any relevant estate identification numbers.

- Request Statement: A clear request for the closure of the estate, including any specific actions needed.

- Signature: The sender's signature, which may need to be notarized for legal purposes.

Steps to Complete the Letter Close Estate

Completing a letter close estate involves several steps to ensure that all necessary information is included and that the document is legally sound. Follow these steps:

- Gather all relevant information about the deceased and the estate.

- Draft the letter, ensuring to include all key elements mentioned above.

- Review the letter for accuracy and completeness.

- Sign the letter, and consider having it notarized if required.

- Send the letter to the appropriate parties, keeping copies for your records.

Legal Use of the Letter Close Estate

The letter close estate must comply with specific legal requirements to be considered valid. It is essential to follow state laws regarding estate closure, which may dictate how the letter should be formatted, what information must be included, and the manner in which it should be submitted. Consulting with a legal professional can provide guidance tailored to individual circumstances and ensure compliance with all applicable regulations.

Examples of Using the Letter Close Estate

Understanding how to use the letter close estate can be facilitated by reviewing examples. Common scenarios include:

- Requesting the final accounting from an estate executor.

- Notifying beneficiaries of the estate's closure and distribution of assets.

- Communicating with financial institutions to settle any outstanding debts or accounts.

Required Documents

When submitting a letter close estate, certain documents may be required to support the request. These can include:

- The original will, if applicable.

- Death certificate of the deceased.

- Final accounting statements from the executor.

- Any relevant tax documents related to the estate.

Quick guide on how to complete letter close estate

Effortlessly prepare Letter Close Estate on any device

Digital document management has gained immense popularity among businesses and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely save it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly and without delays. Handle Letter Close Estate on any device using the airSlate SignNow apps available for Android or iOS and enhance any document-based process today.

How to edit and eSign Letter Close Estate with ease

- Locate Letter Close Estate and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight important sections of your documents or obscure sensitive details using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and click on the Done button to save your adjustments.

- Choose how you wish to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Letter Close Estate and ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sample letter close request?

A sample letter close request is a template that businesses can use to formally request the closing of a transaction or agreement. This letter helps ensure all necessary parties understand the terms of the closure, making it a valuable tool in your documentation process.

-

How can I use airSlate SignNow for creating a sample letter close request?

With airSlate SignNow, you can easily create a sample letter close request by using our customizable templates feature. Simply select a template, fill in the necessary details, and send it for eSignature to streamline the process and save time.

-

What are the pricing options for airSlate SignNow when using a sample letter close request?

AirSlate SignNow offers flexible pricing plans to accommodate businesses of all sizes. You can choose from individual plans or team plans based on your needs for sending and signing documents, including the convenient use of a sample letter close request.

-

Does airSlate SignNow integrate with other applications for sending a sample letter close request?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive, Salesforce, and many more. This allows you to send your sample letter close request directly from the tools you already use, enhancing productivity and efficiency.

-

What are the benefits of using airSlate SignNow for a sample letter close request?

Using airSlate SignNow for sending a sample letter close request offers numerous benefits, including an efficient workflow, secure document storage, and the ability to track signatures in real time. This ensures that your requests are processed quickly and professionally.

-

Is there customer support available for help with sample letter close requests?

Absolutely! AirSlate SignNow provides comprehensive customer support to assist you with any questions regarding creating or sending a sample letter close request. Our support team is available via chat, email, or phone to ensure your experience is smooth.

-

Can I modify a sample letter close request after it has been sent?

Once a sample letter close request has been sent for signature, modifications are not allowed. However, you can create a new request with the necessary changes if needed. AirSlate SignNow's platform makes it easy to manage your documents effectively.

Get more for Letter Close Estate

- Notice commencement city form

- Surcharge remittance report ftri ftri form

- Pain management updated 12 9 18docx form

- Florida telecommunications relay inc monthly tasa surcharge form

- Volunteer registration form school district of clay county oph oneclay

- Child accident or unusual form

- Florida form 5112

- Self employed self declaration of income samples form

Find out other Letter Close Estate

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure