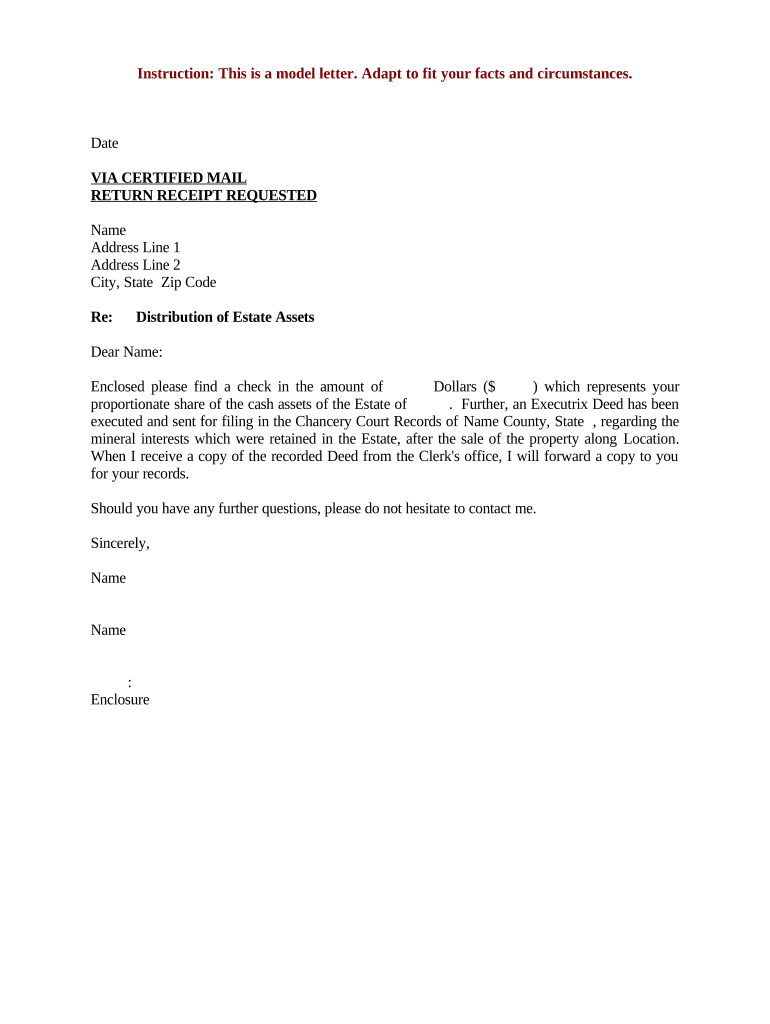

Distribution Estate Assets Form

What is the distribution estate assets?

The distribution estate assets form is a legal document used to outline the distribution of a deceased person's assets among beneficiaries. This form is essential in estate planning and management, ensuring that the wishes of the deceased are honored and legally recognized. It typically includes details about the assets, such as real estate, bank accounts, and personal property, as well as the names and relationships of the beneficiaries. Understanding this form is crucial for anyone involved in estate management, as it helps facilitate a smooth transition of assets after death.

Steps to complete the distribution estate assets

Completing the distribution estate assets form involves several key steps to ensure accuracy and legality. First, gather all relevant information regarding the deceased's assets, including property titles, bank statements, and personal belongings. Next, list the beneficiaries and their respective shares of the estate. It is important to be clear and precise to avoid disputes later. Once the information is compiled, fill out the form, ensuring that all details are correct. After completing the form, it should be signed by the executor and, if required, witnessed or notarized to validate the document legally.

Legal use of the distribution estate assets

The legal use of the distribution estate assets form is governed by state laws, which dictate how assets are to be distributed upon death. To be legally binding, the form must comply with relevant laws, including those concerning signatures and notarization. It is important to ensure that all legal requirements are met to prevent challenges from beneficiaries or other interested parties. Utilizing a reliable eSigning platform can help ensure that the form is executed according to legal standards, providing a digital certificate that confirms its validity.

Key elements of the distribution estate assets

Several key elements must be included in the distribution estate assets form to ensure it serves its purpose effectively. These elements typically include:

- Decedent Information: Full name, date of birth, and date of death.

- Asset Description: Detailed accounts of all assets, including real estate, financial accounts, and personal property.

- Beneficiary Information: Names, addresses, and relationships to the deceased of all beneficiaries.

- Distribution Plan: Clear instructions on how assets will be divided among beneficiaries.

- Executor Details: Information about the executor responsible for managing the estate and ensuring the distribution is carried out as per the form.

Form submission methods

The distribution estate assets form can be submitted through various methods, depending on state requirements and personal preferences. Common submission methods include:

- Online Submission: Many states allow electronic filing through their official websites, providing a quick and efficient way to submit the form.

- Mail: The form can be printed and mailed to the appropriate court or agency, ensuring it is sent to the correct address.

- In-Person Submission: Individuals may choose to submit the form directly at the local courthouse or relevant agency, allowing for immediate confirmation of receipt.

State-specific rules for the distribution estate assets

Each state in the U.S. has its own set of rules and regulations governing the distribution estate assets form. These rules may dictate how the form must be completed, signed, and submitted. It is essential for individuals to familiarize themselves with their state's specific requirements to ensure compliance. This may include understanding the necessary signatures, notarization requirements, and deadlines for submission. Consulting with a legal professional or utilizing resources specific to the state can provide valuable guidance in navigating these regulations.

Quick guide on how to complete distribution estate assets

Complete Distribution Estate Assets easily on any device

Digital document management has become increasingly popular among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents quickly and efficiently. Manage Distribution Estate Assets on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to change and eSign Distribution Estate Assets effortlessly

- Obtain Distribution Estate Assets and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message (SMS), invite link, or downloading it to your computer.

Eliminate the worry of lost or incorrectly filed documents, frustrating form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from your chosen device. Alter and eSign Distribution Estate Assets while ensuring excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are distribution estate assets and how does airSlate SignNow assist in managing them?

Distribution estate assets refer to the process of allocating a deceased person's assets among heirs or beneficiaries. airSlate SignNow simplifies the management of these assets by providing a secure platform for eSigning essential documents, ensuring everything is legally binding and efficient.

-

How does airSlate SignNow streamline the distribution of estate assets?

airSlate SignNow streamlines the distribution of estate assets by allowing users to create, send, and eSign necessary documents from any device. This eliminates delays in document processing and helps ensure that estate distribution is handled swiftly and effectively.

-

Is airSlate SignNow cost-effective for managing distribution estate assets?

Yes, airSlate SignNow offers a cost-effective solution for managing distribution estate assets. With competitive pricing and a user-friendly interface, businesses can save both time and money while ensuring compliance throughout the distribution process.

-

What features does airSlate SignNow provide for estate asset distribution?

airSlate SignNow includes features such as document templates, real-time tracking, and customizable workflows specifically tailored for distribution estate assets. These features enhance collaboration among stakeholders and simplify the entire document management process.

-

Can airSlate SignNow integrate with other tools for estate asset management?

Absolutely! airSlate SignNow integrates seamlessly with various third-party tools such as CRMs and document storage solutions, enhancing its functionality in managing distribution estate assets. This ensures that you can maintain a cohesive workflow across different platforms.

-

How does airSlate SignNow ensure the security of sensitive estate documents?

Security is a top priority for airSlate SignNow when it comes to distribution estate assets. The platform uses advanced encryption protocols and complies with industry standards to safeguard sensitive documents, providing peace of mind for all users involved in the estate distribution process.

-

What benefits does airSlate SignNow offer for legal firms managing estate distributions?

Legal firms can benefit signNowly from using airSlate SignNow for distribution estate assets by increasing efficiency and reducing turnaround time on documents. The platform’s automation features also help minimize human error, thereby enhancing the accuracy of critical estate management processes.

Get more for Distribution Estate Assets

- Metro tech 9 form

- Ulster county board of elections absentee ballot form

- Deposit central school form

- Jc cbc 14 form

- Opwdd establishing surrogacy form

- Toledo mud hens 2016 summer internship questionnaire milbcom form

- Employee incidentaccident report lpschools k12 oh form

- Release of medical info form indiana american health

Find out other Distribution Estate Assets

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template