Closing Estate Form

What is the Closing Estate

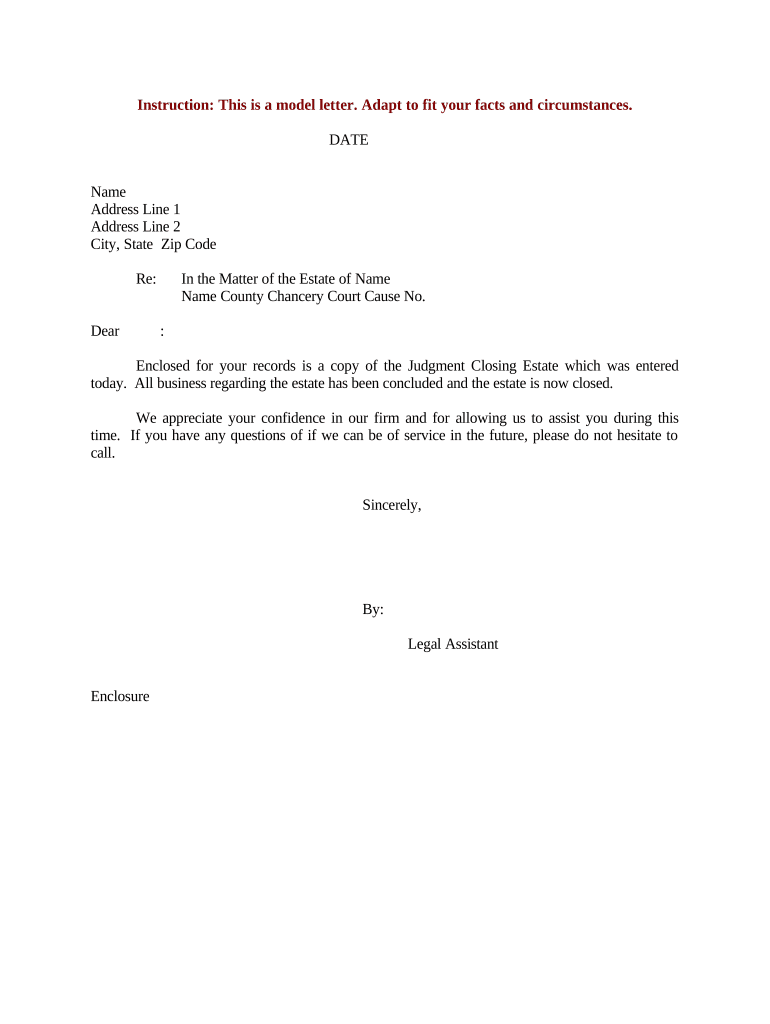

The closing estate is a legal document used to finalize the distribution of a deceased person's assets. This form outlines how the estate's assets will be allocated among beneficiaries, ensuring that all debts and taxes are settled before distribution. Understanding the closing estate is crucial for executors and beneficiaries alike, as it serves as a formal declaration of the deceased's wishes regarding their estate.

Steps to Complete the Closing Estate

Completing the closing estate involves several key steps that ensure compliance with legal requirements. Here is a general outline of the process:

- Gather necessary documents, including the will, death certificate, and asset inventories.

- Identify and notify beneficiaries of their inheritance.

- Settle any outstanding debts and taxes owed by the estate.

- Prepare the closing estate form, ensuring all information is accurate and complete.

- Obtain signatures from all relevant parties, including beneficiaries and witnesses.

- Submit the completed form to the appropriate court or authority, as required by state law.

Legal Use of the Closing Estate

The closing estate must adhere to specific legal guidelines to be considered valid. In the United States, the document should comply with state probate laws, which govern the distribution of assets. This includes ensuring that all required signatures are obtained and that the document is filed within the designated time frame. Failure to comply with these legal requirements can lead to disputes among beneficiaries and potential challenges in court.

Key Elements of the Closing Estate

Several key elements must be included in the closing estate to ensure its validity:

- Identification of the deceased: Full name, date of birth, and date of death.

- List of assets: Detailed inventory of all assets, including real estate, bank accounts, and personal property.

- Debts and liabilities: A comprehensive list of all outstanding debts and obligations of the estate.

- Beneficiary information: Names and contact details of all beneficiaries entitled to inherit from the estate.

- Executor details: Information about the appointed executor responsible for managing the estate.

Who Issues the Form

The closing estate form is typically issued by the probate court or the state’s estate administration office. In some cases, the executor may need to prepare the document themselves, ensuring it meets all legal requirements. It is advisable to consult with an attorney specializing in estate law to ensure that the form is completed correctly and submitted to the right authority.

Required Documents

To successfully complete the closing estate, several documents are required:

- Death certificate of the deceased.

- Last will and testament, if available.

- Inventory of estate assets and liabilities.

- Notices to beneficiaries and creditors.

- Any relevant tax documents related to the estate.

Quick guide on how to complete closing estate

Accomplish Closing Estate seamlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to generate, modify, and eSign your documents swiftly without interruptions. Manage Closing Estate on any platform using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign Closing Estate effortlessly

- Obtain Closing Estate and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to share your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign Closing Estate and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer for closing estate documents?

airSlate SignNow provides a variety of features for closing estate documents, including customizable templates, secure eSignature options, and real-time tracking of document status. These features ensure that the closing estate process is streamlined and efficient, allowing you to finalize your documents without hassle.

-

How does airSlate SignNow improve the closing estate process?

airSlate SignNow simplifies the closing estate process by offering an intuitive platform that allows users to send and sign documents digitally. This reduces the time spent on paperwork and helps avoid common delays, making your closing estate procedures faster and more efficient.

-

Is there a free trial available for airSlate SignNow to support closing estate requirements?

Yes, airSlate SignNow offers a free trial to help prospective users evaluate the platform's capabilities for closing estate needs. This trial allows you to experience the features and benefits firsthand, ensuring it meets your requirements without any financial commitment upfront.

-

What are the pricing plans for airSlate SignNow for closing estate services?

airSlate SignNow offers competitive pricing plans tailored to meet various business needs, including options specifically designed for users focused on closing estate transactions. Each plan provides essential features to facilitate document management, making it a cost-effective choice for your needs.

-

Can airSlate SignNow integrate with other software commonly used for closing estate?

Absolutely! airSlate SignNow can seamlessly integrate with popular software such as CRM systems, document management tools, and other applications that many users rely on for closing estate tasks. These integrations streamline workflows and enhance productivity by connecting all aspects of the closing estate process.

-

What are the benefits of using airSlate SignNow for closing estate?

Using airSlate SignNow for closing estate offers numerous benefits, including enhanced security for your documents and compliance with legal standards. The platform's user-friendly interface also makes it easy for all parties involved in the closing estate to collaborate efficiently, saving time and reducing errors.

-

How secure is airSlate SignNow when handling closing estate documents?

airSlate SignNow prioritizes the security of your data, employing advanced encryption protocols and compliance with industry standards to protect closing estate documents. This commitment to security ensures that sensitive information remains confidential and is safeguarded against unauthorized access.

Get more for Closing Estate

- 2013 706me ez form

- 1040me mainegov maine form

- Nonresident members of pass through entities go to the mrs website at www form

- 4594 2016 michigan farmland preservation tax credit 4594 2016 michigan farmland preservation tax credit form

- Treasury michigan income tax filing requirements of flow form

- Form 4582 2011 michigan business tax penalty and interest

- Form 1019 notice of assessment taxable state of michigan michigan

- Michigan withholding exemption certificate form oakland

Find out other Closing Estate

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement