Complaint for Impropriety Involving Loan Application Form

What is the Complaint For Impropriety Involving Loan Application

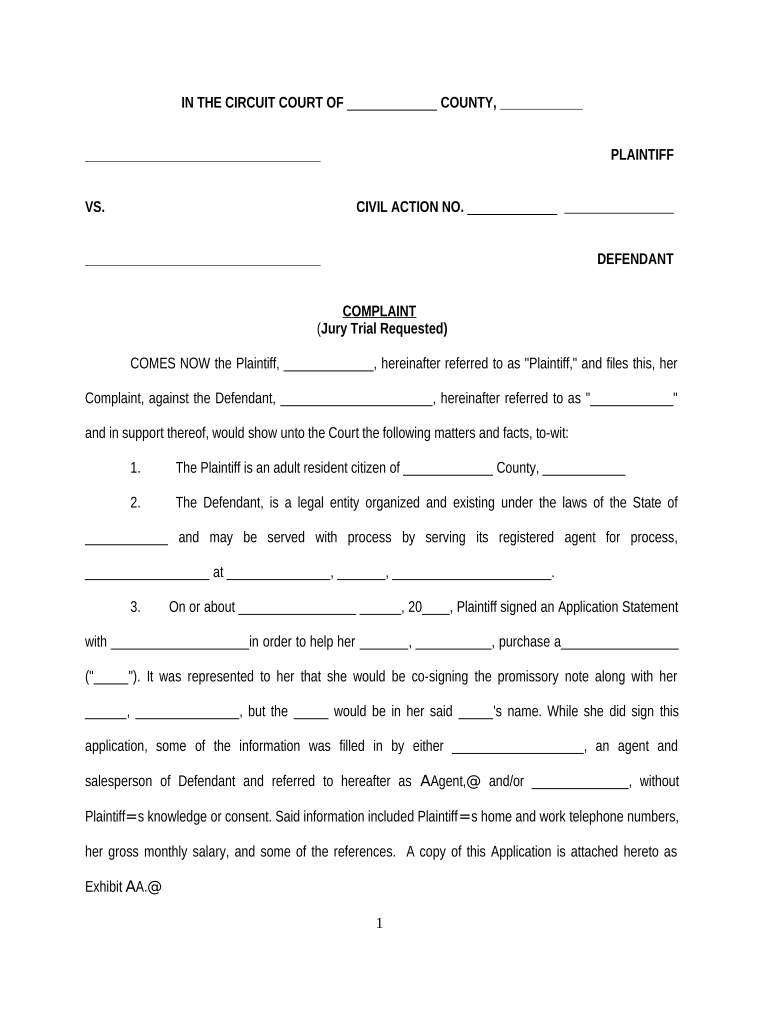

The Complaint For Impropriety Involving Loan Application is a formal document used to address issues related to the improper handling of a loan application. This complaint can arise when applicants believe that their rights have been violated or that there has been a failure to adhere to established lending practices. Such complaints may involve allegations of discrimination, misrepresentation, or failure to provide necessary disclosures. Filing this complaint is a critical step for individuals seeking redress and accountability from lending institutions.

How to use the Complaint For Impropriety Involving Loan Application

Using the Complaint For Impropriety Involving Loan Application involves several key steps. First, gather all relevant documentation, including your loan application, correspondence with the lender, and any evidence supporting your claims. Next, fill out the complaint form accurately, ensuring that all information is complete and truthful. It is important to clearly articulate the nature of the impropriety and how it has affected you. Once completed, submit the form according to the instructions provided, which may include mailing it to a regulatory agency or submitting it online.

Steps to complete the Complaint For Impropriety Involving Loan Application

Completing the Complaint For Impropriety Involving Loan Application requires careful attention to detail. Follow these steps:

- Gather all necessary documents related to your loan application.

- Review the complaint form to understand the required information.

- Fill in your personal details, including your name, contact information, and loan details.

- Clearly describe the impropriety, including specific dates and events.

- Attach any supporting documents that substantiate your claims.

- Review the completed form for accuracy before submission.

- Submit the form according to the specified method, keeping a copy for your records.

Key elements of the Complaint For Impropriety Involving Loan Application

When preparing a Complaint For Impropriety Involving Loan Application, it is essential to include key elements that will strengthen your case. These elements typically include:

- Your full name and contact information.

- The name and contact information of the lending institution.

- A detailed account of the events leading to the complaint.

- Specific allegations regarding the impropriety, such as discrimination or failure to disclose terms.

- Any evidence or documentation that supports your claims.

- Your desired outcome or resolution.

Legal use of the Complaint For Impropriety Involving Loan Application

The legal use of the Complaint For Impropriety Involving Loan Application is governed by various federal and state laws designed to protect consumers. It is important to understand that filing this complaint can initiate an investigation into the lender's practices. The complaint may be submitted to regulatory bodies such as the Consumer Financial Protection Bureau (CFPB) or state banking departments. These agencies have the authority to take action against lenders who violate laws or regulations, making the complaint a powerful tool for consumer rights.

Filing Deadlines / Important Dates

Filing deadlines for the Complaint For Impropriety Involving Loan Application can vary based on the nature of the complaint and the specific regulations governing lending practices. Generally, it is advisable to file your complaint as soon as you identify an issue. Some regulatory bodies may have specific time frames within which complaints must be filed, often ranging from thirty to ninety days from the date of the incident. Checking with the relevant agency for specific deadlines is crucial to ensure your complaint is considered.

Quick guide on how to complete complaint for impropriety involving loan application

Complete Complaint For Impropriety Involving Loan Application effortlessly on any device

Managing documents online has become increasingly popular among enterprises and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Handle Complaint For Impropriety Involving Loan Application on any device using airSlate SignNow's Android or iOS applications and improve any document-centric workflow today.

The easiest way to adjust and eSign Complaint For Impropriety Involving Loan Application effortlessly

- Find Complaint For Impropriety Involving Loan Application and press Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or obscure sensitive information with the tools that airSlate SignNow specially provides for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form—via email, text message (SMS), an invite link, or download it to your computer.

Forget about lost or misfiled documents, the hassle of searching for forms, or mistakes that require printing additional copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Adjust and eSign Complaint For Impropriety Involving Loan Application and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Complaint For Impropriety Involving Loan Application?

A Complaint For Impropriety Involving Loan Application is a formal grievance submitted to address wrongful practices during the loan application process. This could include issues like false information, predatory lending, or discrimination. Understanding this complaint can help individuals safeguard their rights while navigating loan agreements.

-

How can airSlate SignNow help with a Complaint For Impropriety Involving Loan Application?

airSlate SignNow provides a streamlined platform for documenting your Complaint For Impropriety Involving Loan Application. With our eSignature technology, you can easily sign and send necessary documents, ensuring they are legally binding and properly recorded. This can signNowly speed up the response time from lenders or authorities.

-

What are the features of airSlate SignNow for filing a Complaint For Impropriety Involving Loan Application?

Key features of airSlate SignNow include secure document storage, customizable templates, and real-time tracking for your Complaint For Impropriety Involving Loan Application. You can also integrate with various applications to enhance workflow and document management, making it easier to handle your submissions.

-

Is there a cost associated with using airSlate SignNow for my Complaint For Impropriety Involving Loan Application?

Yes, airSlate SignNow offers a variety of pricing plans to accommodate different needs. Our cost-effective solutions ensure that you can submit your Complaint For Impropriety Involving Loan Application without overspending. Review our pricing page to find the best plan for you.

-

Can I integrate airSlate SignNow with other tools for my Complaint For Impropriety Involving Loan Application?

Absolutely! airSlate SignNow supports integration with numerous applications, making it easy to manage your Complaint For Impropriety Involving Loan Application alongside other business processes. This ability to integrate streamlines communication and enhances efficiency in handling your case.

-

What benefits does airSlate SignNow offer for managing legal documents like a Complaint For Impropriety Involving Loan Application?

airSlate SignNow simplifies the management of legal documents such as a Complaint For Impropriety Involving Loan Application by providing an easy-to-use interface for signing, sharing, and storing your documents. Additionally, our platform enhances security, ensuring your sensitive information remains protected throughout the process.

-

How can I ensure my Complaint For Impropriety Involving Loan Application is processed quickly?

Using airSlate SignNow can signNowly accelerate the processing of your Complaint For Impropriety Involving Loan Application. By utilizing our fast eSignature feature and automated workflows, you eliminate bottlenecks and streamline document submissions, ensuring timely handling by relevant parties.

Get more for Complaint For Impropriety Involving Loan Application

Find out other Complaint For Impropriety Involving Loan Application

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free