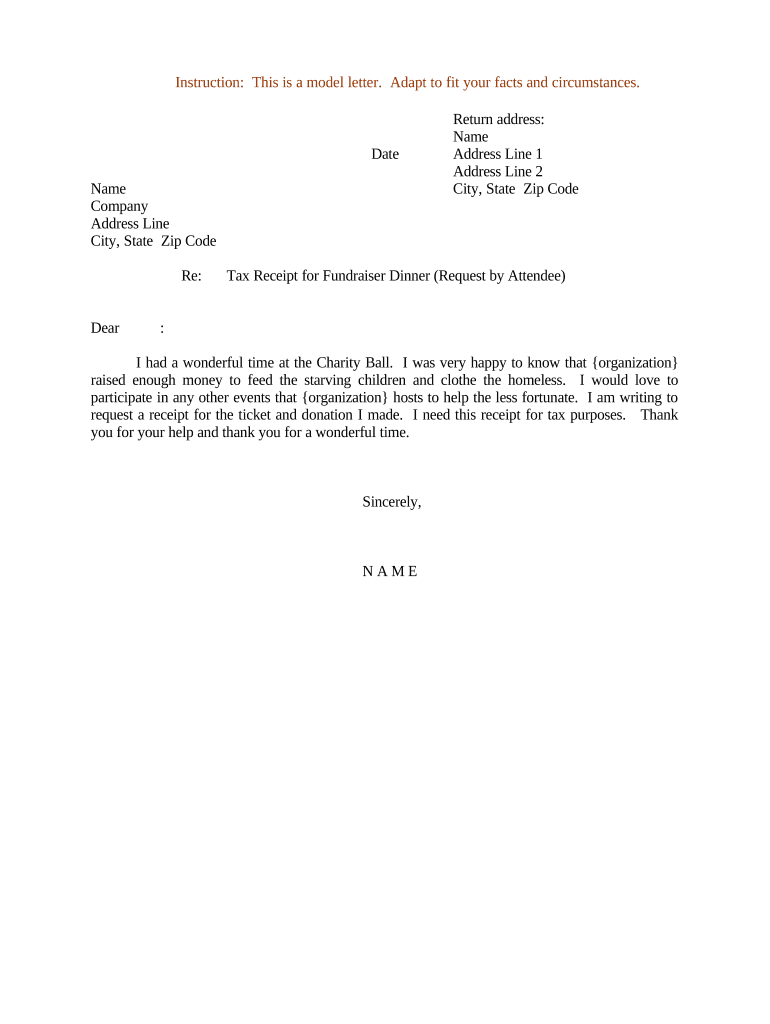

Tax Receipt Form

What is the Tax Receipt Form

The tax receipt form is a crucial document used by individuals and organizations to acknowledge donations made for charitable purposes. It serves as proof of the contribution, which can be used for tax deduction purposes when filing with the Internal Revenue Service (IRS). The form typically includes details such as the donor's name, the amount donated, the date of the donation, and the name of the charitable organization. This documentation is essential for both the donor and the recipient organization to maintain accurate records for tax compliance.

Key elements of the Tax Receipt Form

A well-structured tax receipt form should contain several key elements to ensure its validity and usefulness. These include:

- Donor Information: Full name and address of the donor.

- Organization Details: Name and address of the charitable organization receiving the donation.

- Donation Amount: The total amount donated, which is critical for tax deduction purposes.

- Date of Donation: The specific date when the donation was made.

- Statement of No Goods or Services: A declaration indicating whether any goods or services were provided in exchange for the donation.

Steps to complete the Tax Receipt Form

Completing a tax receipt form involves several straightforward steps. First, gather all necessary information, including donor and organization details. Next, fill in the donation amount and the date of the contribution. If applicable, include a statement regarding any goods or services provided. Finally, ensure that both the donor and the organization sign the form to validate it. Once completed, the form should be distributed to the donor for their records.

IRS Guidelines

The IRS has specific guidelines regarding the use of tax receipt forms. According to IRS regulations, donations of $250 or more require a written acknowledgment from the charitable organization. This acknowledgment must include the amount donated, the date of the donation, and a statement regarding any goods or services provided in exchange for the donation. It is essential for donors to keep these receipts for their tax records, as they may be required when filing tax returns.

Legal use of the Tax Receipt Form

The legal use of the tax receipt form is governed by IRS regulations and state laws. To be considered valid, the form must accurately reflect the details of the donation and comply with any specific state requirements. Organizations must ensure that they provide receipts for donations in a timely manner and that they maintain proper records for audit purposes. Failure to comply with these legal requirements can result in penalties for both the donor and the organization.

How to obtain the Tax Receipt Form

Obtaining a tax receipt form can be done through various means. Many charitable organizations provide their own templates that can be downloaded from their websites. Additionally, there are numerous online resources and software solutions that offer customizable tax receipt templates. It is essential to ensure that any template used complies with IRS guidelines and includes all necessary information for validity.

Quick guide on how to complete tax receipt form

Effortlessly Complete Tax Receipt Form on Any Device

Digital document management has gained traction among both organizations and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow offers you all the resources required to create, modify, and electronically sign your documents quickly without any hold-ups. Manage Tax Receipt Form on any platform with the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

The Easiest Way to Edit and Electronically Sign Tax Receipt Form

- Obtain Tax Receipt Form and then click Get Form to begin.

- Utilize the instruments we provide to finalize your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or mistakes that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Tax Receipt Form and ensure seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sample donation tax receipt?

A sample donation tax receipt is a document that provides a record of a charitable donation made by an individual or organization. It typically includes details such as the amount donated, the recipient organization, and the date of the donation. Using airSlate SignNow, you can easily create and manage your sample donation tax receipt to ensure compliance and provide necessary documentation for tax purposes.

-

How can airSlate SignNow help me create a sample donation tax receipt?

airSlate SignNow offers a user-friendly template that allows you to generate a sample donation tax receipt quickly and efficiently. With customizable fields, you can fill in donor information, donation amounts, and organizational details effortlessly. This streamlines the process and ensures that you have a professional-looking receipt ready in no time.

-

Are there any costs associated with obtaining a sample donation tax receipt through airSlate SignNow?

While airSlate SignNow offers a variety of pricing plans, generating a sample donation tax receipt can be done using even the most basic plan. This makes it accessible for all types of organizations without incurring any additional fees. You'll find that the tool is cost-effective and convenient for your receipt needs.

-

Can I customize the sample donation tax receipt template?

Yes, airSlate SignNow allows full customization of the sample donation tax receipt template. You can edit fields, add logos, and personalize the document to reflect your organization's branding. This helps maintain a professional appearance while ensuring that all necessary information is included.

-

Is electronic signing available for the sample donation tax receipt?

Absolutely! airSlate SignNow provides electronic signing features, allowing donors to sign the sample donation tax receipt securely online. This makes transactions faster and more efficient, as both parties can complete the process without the need for physical paperwork.

-

What integrations does airSlate SignNow offer for donation receipt management?

airSlate SignNow integrates seamlessly with various CRM systems, accounting software, and cloud storage services. These integrations make it easy to manage your sample donation tax receipt and keep all related documents organized. This can enhance workflow efficiency while ensuring that your data remains accessible.

-

How secure is my information when using airSlate SignNow for sample donation tax receipts?

Security is a priority at airSlate SignNow. The platform employs advanced encryption protocols to safeguard your information while creating and storing sample donation tax receipts. You can trust that your data is protected during transmission and storage, providing peace of mind for both you and your donors.

Get more for Tax Receipt Form

Find out other Tax Receipt Form

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document

- Can I Electronic signature Kentucky Legal Document

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word