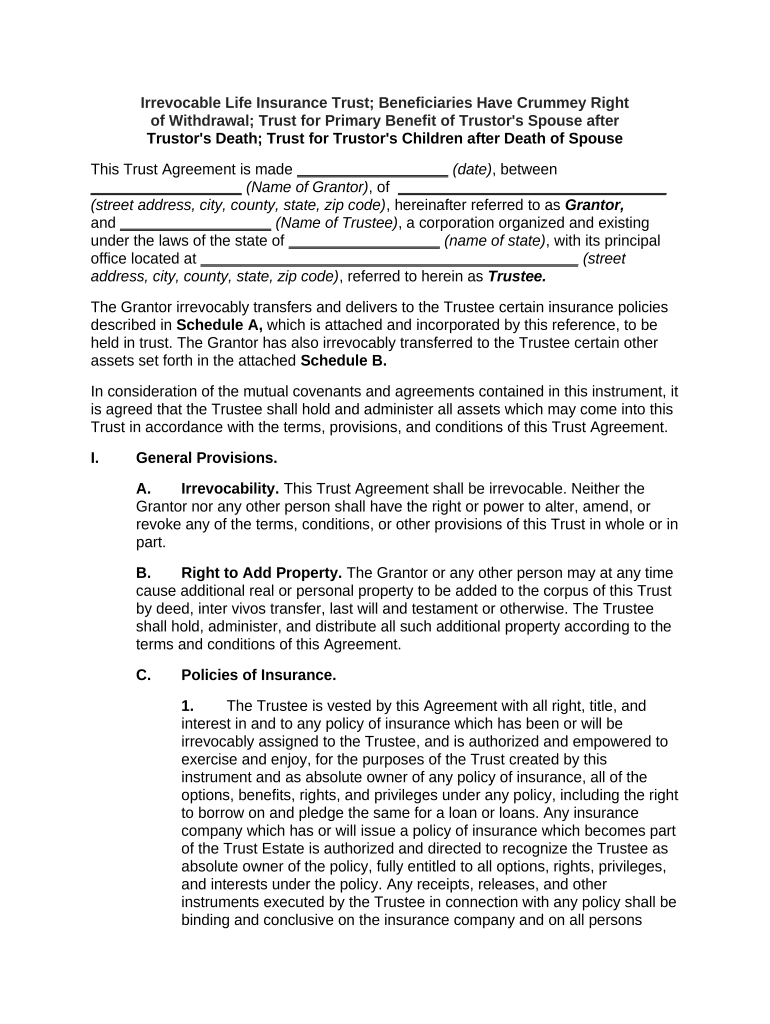

Irrevocable Trust Death Form

What is the irrevocable trust death?

An irrevocable trust death refers to the termination of an irrevocable trust upon the death of the trustor, or the individual who created the trust. This type of trust cannot be altered or revoked once it is established, which means that the assets within it are permanently transferred to the trust and are not part of the trustor's estate upon death. The primary purpose of an irrevocable trust is to protect assets from estate taxes and creditors, ensuring that the beneficiaries receive the intended benefits without interference.

Key elements of the irrevocable trust death

Understanding the key elements of an irrevocable trust death is essential for effective estate planning. These elements include:

- Asset Protection: The assets placed in the trust are shielded from creditors and may not be subject to estate taxes.

- Beneficiary Designation: The trust specifies who will receive the assets after the trustor's death, ensuring that the trustor's wishes are honored.

- Trustee Responsibilities: A designated trustee manages the trust assets and ensures proper distribution according to the trust terms.

- Tax Implications: The irrevocable trust may have specific tax benefits, such as reducing the taxable estate value.

Steps to complete the irrevocable trust death

Completing the irrevocable trust death involves several important steps:

- Review the Trust Document: Examine the trust document to understand the terms and conditions regarding asset distribution.

- Notify Beneficiaries: Inform all beneficiaries of the trust's termination and their respective entitlements.

- Gather Necessary Documentation: Collect all required documents, including death certificates and trust agreements.

- Distribute Assets: The trustee must follow the instructions in the trust document to distribute the assets to the beneficiaries.

Legal use of the irrevocable trust death

The legal use of an irrevocable trust death is primarily for estate planning and asset protection. By establishing this type of trust, individuals can ensure that their assets are managed according to their wishes after their death. The trust provides a clear legal framework for asset distribution, minimizing potential disputes among beneficiaries. Additionally, it can help reduce estate taxes and protect assets from creditors, making it a valuable tool for effective financial planning.

IRS guidelines

The IRS has specific guidelines regarding irrevocable trusts, particularly concerning taxation and reporting requirements. It is crucial to understand how the trust's income is taxed, as irrevocable trusts are generally considered separate tax entities. The trust must file its own tax return, and any income generated by the trust assets may be subject to taxation. Familiarizing oneself with these guidelines can help ensure compliance and avoid potential penalties.

Required documents

To effectively manage the irrevocable trust death process, certain documents are required:

- Trust Agreement: The original document outlining the terms of the irrevocable trust.

- Death Certificate: Official documentation confirming the death of the trustor.

- Asset Documentation: Records of the assets held within the trust, including property deeds and financial statements.

- Tax Identification Number: The trust may require a separate tax ID for filing purposes.

Quick guide on how to complete irrevocable trust death

Prepare Irrevocable Trust Death effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents rapidly without delays. Handle Irrevocable Trust Death on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to edit and eSign Irrevocable Trust Death with ease

- Locate Irrevocable Trust Death and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your PC.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Irrevocable Trust Death to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an irrevocable trust and how does it relate to irrevocable trust death?

An irrevocable trust is a type of trust that cannot be altered or revoked once it's established. Upon the death of the trust's creator, known as the grantor, the assets are transferred to the beneficiaries as per the trust's terms. Understanding the implications of irrevocable trust death is crucial for estate planning and minimizing tax liabilities.

-

How does an irrevocable trust affect taxes upon death?

When the grantor of an irrevocable trust passes away, the trust itself typically does not incur income taxes. Instead, the assets within the trust may pass on to beneficiaries with potential tax benefits, making it advantageous for estate planning. It’s essential to consult a tax professional to navigate the specifics surrounding irrevocable trust death.

-

What are the benefits of using airSlate SignNow for managing documents related to irrevocable trust death?

Using airSlate SignNow allows you to securely send and eSign important documents related to irrevocable trust death quickly and efficiently. The platform's user-friendly interface ensures that all parties can easily access and complete necessary paperwork, streamlining the process during a challenging time. Additionally, airSlate SignNow offers great value with its cost-effective pricing options.

-

Can I integrate airSlate SignNow with other estate planning tools for irrevocable trust death documentation?

Yes, airSlate SignNow easily integrates with various estate planning software and tools to enhance your document management system for irrevocable trust death processes. These integrations help ensure that all related documents are seamlessly signed and stored, reducing the administrative burden at a critical time. Check our integration options to find a solution that fits your needs.

-

What features does airSlate SignNow offer that can help with irrevocable trust death paperwork?

airSlate SignNow provides essential features like secure eSigning, document templates, and automatic reminders that can simplify the handling of irrevocable trust death paperwork. The platform ensures compliance and security while making it easier for users to manage and track the signing process, which is crucial during estate planning.

-

Is airSlate SignNow suitable for both individuals and businesses dealing with irrevocable trust death?

Absolutely! airSlate SignNow caters to both individuals and businesses, providing tools that facilitate the eSigning and management of documents related to irrevocable trust death. Whether you are an individual managing your estate or a legal professional handling multiple clients, our solution is designed to meet diverse needs efficiently.

-

What customer support options are available for airSlate SignNow users dealing with irrevocable trust death?

airSlate SignNow offers robust customer support through various channels, including live chat, email, and a comprehensive knowledge base. If you're navigating issues related to irrevocable trust death documentation, our support team is ready to assist you. We aim to ensure that all users have a smooth experience while using our platform.

Get more for Irrevocable Trust Death

Find out other Irrevocable Trust Death

- Can I eSign Hawaii Education PDF

- How To eSign Hawaii Education Document

- Can I eSign Hawaii Education Document

- How Can I eSign South Carolina Doctors PPT

- How Can I eSign Kansas Education Word

- How To eSign Kansas Education Document

- How Do I eSign Maine Education PPT

- Can I eSign Maine Education PPT

- How To eSign Massachusetts Education PDF

- How To eSign Minnesota Education PDF

- Can I eSign New Jersey Education Form

- How Can I eSign Oregon Construction Word

- How Do I eSign Rhode Island Construction PPT

- How Do I eSign Idaho Finance & Tax Accounting Form

- Can I eSign Illinois Finance & Tax Accounting Presentation

- How To eSign Wisconsin Education PDF

- Help Me With eSign Nebraska Finance & Tax Accounting PDF

- How To eSign North Carolina Finance & Tax Accounting Presentation

- How To eSign North Dakota Finance & Tax Accounting Presentation

- Help Me With eSign Alabama Healthcare / Medical PDF