Irrevocable Trust Children Form

What is the irrevocable trust children?

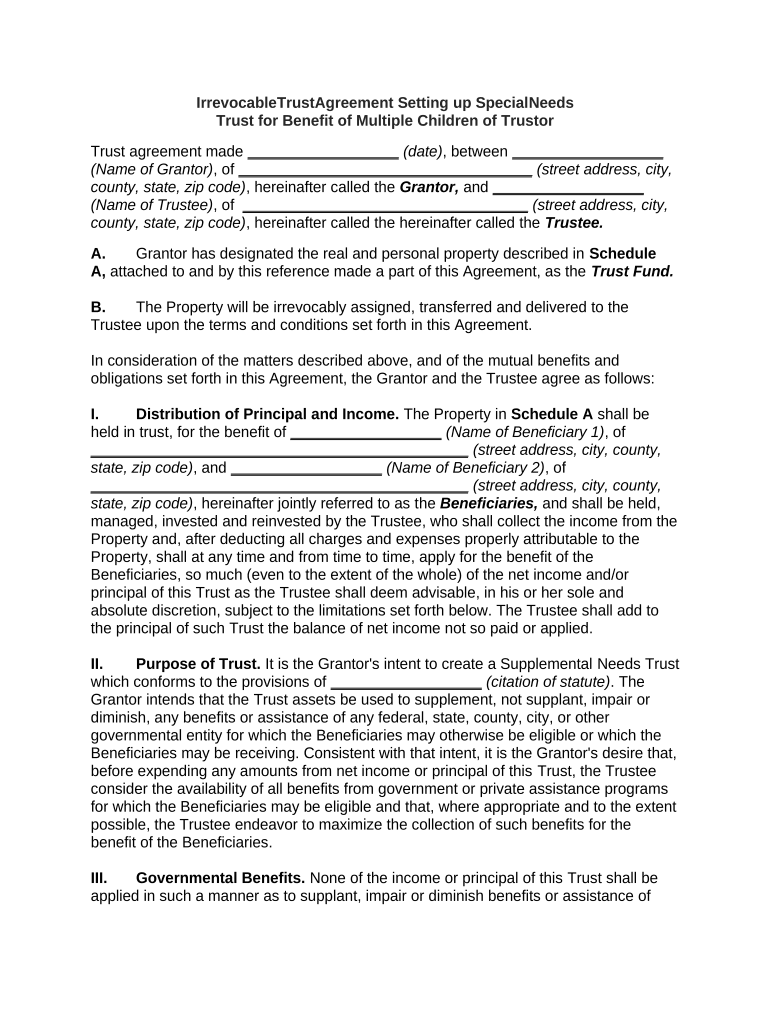

An irrevocable trust for children is a legal arrangement that allows a grantor to transfer assets into a trust for the benefit of their children. Once established, the terms of the trust cannot be altered or revoked by the grantor. This type of trust is often used for estate planning purposes, ensuring that assets are managed and distributed according to the grantor's wishes. It provides a level of protection for the assets, shielding them from creditors and potential legal claims while also potentially reducing estate taxes.

Key elements of the irrevocable trust children

Several key elements define an irrevocable trust for children:

- Trustee: A designated individual or institution responsible for managing the trust assets and ensuring compliance with the trust terms.

- Beneficiaries: The children who will benefit from the trust, receiving assets or income as specified in the trust document.

- Trust document: A legal document outlining the terms of the trust, including how assets are to be managed and distributed.

- Funding: The process of transferring assets into the trust, which can include cash, real estate, or other valuable items.

How to use the irrevocable trust children

Using an irrevocable trust for children involves several steps to ensure proper management and distribution of assets:

- Establish the trust: Work with an attorney to draft the trust document, specifying the terms and conditions.

- Transfer assets: Move assets into the trust, which may involve changing titles or ownership of property.

- Appoint a trustee: Select a reliable individual or institution to manage the trust and act in the best interest of the beneficiaries.

- Monitor the trust: Regularly review the trust's performance and ensure compliance with its terms.

Steps to complete the irrevocable trust children

Completing an irrevocable trust for children involves the following steps:

- Consult with a legal professional: Seek guidance from an estate planning attorney to understand the implications and requirements.

- Draft the trust document: Create a comprehensive document that outlines the trust's purpose, terms, and conditions.

- Fund the trust: Transfer the intended assets into the trust to ensure it is operational.

- Sign and notarize: Execute the trust document in accordance with state laws, ensuring it is legally binding.

Legal use of the irrevocable trust children

The legal use of an irrevocable trust for children is primarily focused on asset protection and estate planning. This trust type is recognized by law as a valid means to manage and distribute assets. It can help avoid probate, provide tax benefits, and ensure that the grantor's wishes are honored after their passing. Compliance with state laws is essential, as each state may have specific regulations governing trusts.

Eligibility criteria

To establish an irrevocable trust for children, certain eligibility criteria must be met:

- Age: The grantor must be of legal age to create a trust, typically eighteen years or older.

- Capacity: The grantor must have the mental capacity to understand the implications of creating an irrevocable trust.

- Assets: The grantor should possess assets that they wish to transfer into the trust for the benefit of their children.

Quick guide on how to complete irrevocable trust children

Prepare Irrevocable Trust Children effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly solution to conventional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents swiftly without delays. Manage Irrevocable Trust Children across any platform using airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The most efficient way to edit and eSign Irrevocable Trust Children with ease

- Obtain Irrevocable Trust Children and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important parts of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that task.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your updates.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Irrevocable Trust Children and ensure remarkable communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an irrevocable trust for children?

An irrevocable trust for children is a legal arrangement that cannot be modified or revoked once established. This type of trust is designed to protect assets for the benefit of your children, providing financial security and ensuring that certain conditions are met before they inherit. Using airSlate SignNow, you can easily create and manage documents related to an irrevocable trust for children.

-

How can an irrevocable trust benefit my children?

An irrevocable trust can provide various benefits to your children, including asset protection from creditors and potential tax advantages. By setting up an irrevocable trust for children, you can ensure that the assets are managed according to your wishes and are transferred smoothly, safeguarding their future. Utilizing airSlate SignNow helps streamline the document process for setting up these trusts.

-

What are the costs associated with creating an irrevocable trust for children?

The costs of creating an irrevocable trust for children can vary based on the complexity of the trust and any legal fees involved. Generally, there are initial setup fees along with possible ongoing management costs. AirSlate SignNow offers cost-effective solutions for document management, allowing you to save on administrative expenses while ensuring compliance.

-

Can I change the terms of an irrevocable trust for children?

No, once an irrevocable trust for children is established, its terms cannot be changed or revoked. This permanence ensures that the assets are safeguarded and managed according to your initial intentions. With airSlate SignNow, you can document your trust clearly, ensuring all parties understand the irrevocable nature.

-

Which features should I look for in a tool to manage an irrevocable trust for children?

When managing an irrevocable trust for children, look for features like secure document storage, eSignature capabilities, and compliance with legal standards. AirSlate SignNow provides an easy-to-use interface that simplifies document creation and management, ensuring your trust documents are always accessible and protected.

-

What types of assets can be placed in an irrevocable trust for children?

Various types of assets can be placed in an irrevocable trust for children, including real estate, investments, cash, and life insurance policies. This flexibility allows you to structure the trust according to your family’s needs. AirSlate SignNow facilitates the documentation process to ensure all assets are properly included.

-

How does an irrevocable trust for children affect taxes?

An irrevocable trust for children can have signNow tax implications, often removing assets from your taxable estate and potentially lowering estate taxes. It’s crucial to consult with a tax advisor when creating this type of trust to understand the benefits fully. Utilizing airSlate SignNow ensures that your trust documents comply with tax regulations.

Get more for Irrevocable Trust Children

- Adp client account agreement form

- 2018 2019 escc federal direct loan certification form

- Environmental questionnaire and disclosure timberland bank form

- Financial assistance application form atlanticare atlanticare

- Federal direct loan certification form escc

- Cdsc form

- Ncsl forms

- Business card order suny new paltz form

Find out other Irrevocable Trust Children

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement