Trust Disabled Child Form

What is the Trust Disabled Child

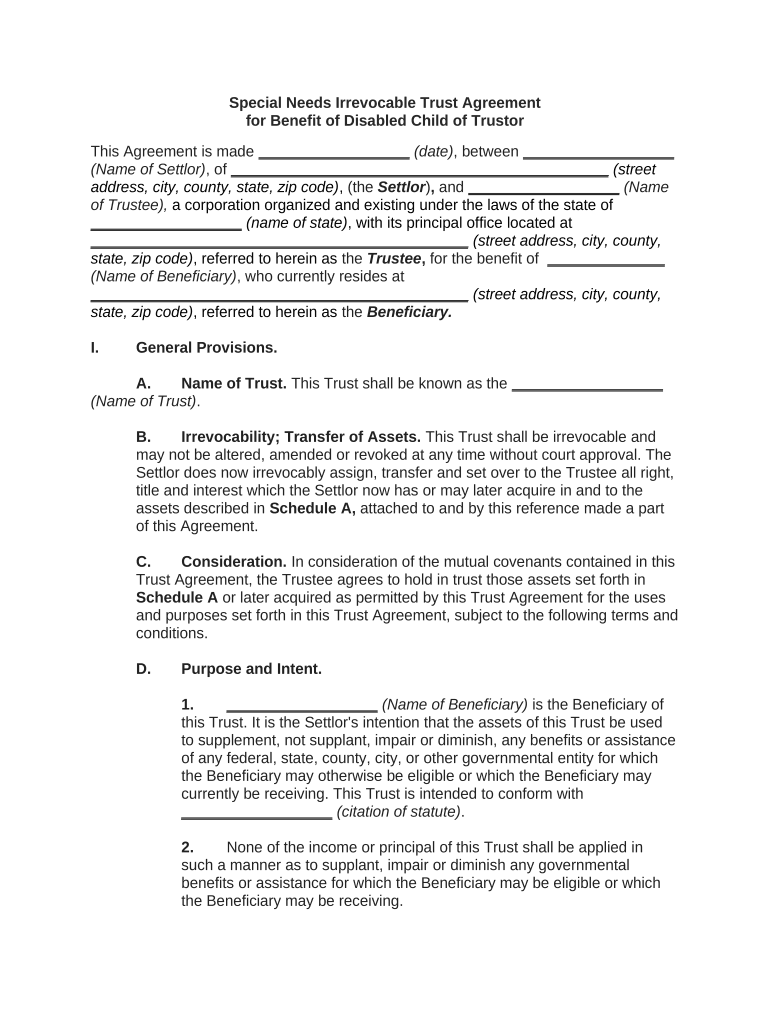

The trust disabled child is a legal arrangement designed to provide financial support and protection for a child with disabilities. This type of trust allows assets to be held for the benefit of the child while preserving their eligibility for government benefits, such as Medicaid or Supplemental Security Income (SSI). The trust is typically established by a parent or guardian and can include various assets, such as cash, property, or investments. By creating this trust, families can ensure that their disabled child receives the necessary care and support without jeopardizing their access to vital public assistance programs.

How to use the Trust Disabled Child

Using a trust disabled child involves several key steps to ensure that it operates effectively. First, the trust must be properly funded with assets that will benefit the child. This can include cash, real estate, or other valuable property. Next, the trustee, who is responsible for managing the trust, must be appointed. This individual or institution will oversee the trust's assets and ensure that distributions are made according to the terms of the trust. It is crucial to follow the specific guidelines set forth in the trust document to maintain compliance with legal requirements and protect the child's interests.

Steps to complete the Trust Disabled Child

Completing a trust disabled child involves a series of important steps:

- Determine the need for a trust based on the child's financial and medical needs.

- Consult with an attorney specializing in estate planning and special needs trusts to draft the trust document.

- Choose a qualified trustee who understands the responsibilities involved in managing the trust.

- Fund the trust with appropriate assets, ensuring they comply with government regulations.

- Regularly review and update the trust as necessary to reflect changes in the child's needs or financial situation.

Legal use of the Trust Disabled Child

The legal use of a trust disabled child is governed by specific regulations that ensure the trust operates within the law. It is essential to comply with federal and state laws regarding special needs trusts to avoid penalties or loss of benefits. The trust must be irrevocable, meaning that once it is established, the assets cannot be removed for personal use. This legal structure helps protect the child's eligibility for public assistance programs while allowing for the management of funds for their benefit. Consulting with a legal professional can help navigate these complex regulations.

Key elements of the Trust Disabled Child

Several key elements define a trust disabled child and contribute to its effectiveness:

- Irrevocability: The trust cannot be altered or revoked once established, ensuring long-term protection for the child.

- Beneficiary designation: The trust specifically names the disabled child as the beneficiary, ensuring that funds are used solely for their benefit.

- Trustee responsibilities: The appointed trustee must manage the trust assets in the best interest of the child, adhering to legal and ethical standards.

- Compliance with regulations: The trust must align with federal and state laws to maintain the child’s eligibility for government benefits.

Eligibility Criteria

Eligibility criteria for establishing a trust disabled child typically include the following considerations:

- The child must have a qualifying disability as defined by federal or state regulations.

- The trust must be established for the sole benefit of the disabled child, ensuring that it does not serve other purposes.

- Assets placed in the trust should not exceed certain limits to preserve eligibility for government assistance programs.

Quick guide on how to complete trust disabled child

Complete Trust Disabled Child seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Trust Disabled Child on any device with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Trust Disabled Child effortlessly

- Obtain Trust Disabled Child and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Choose how you would like to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

No more lost or misfiled documents, tiring form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and eSign Trust Disabled Child and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

How can airSlate SignNow help me trust disabled child with document management?

airSlate SignNow provides an intuitive platform that simplifies the signing and management of documents for families with a disabled child. By streamlining processes, it allows parents and guardians to maintain a secure and organized approach to important paperwork. This ease helps in building trust in the system that you rely on for sensitive legal matters.

-

What features of airSlate SignNow are beneficial for trust disabled child?

With features like customizable templates, audit trails, and secure storage, airSlate SignNow ensures that documents related to a trust for a disabled child are both protected and easily accessible. Moreover, its user-friendly interface makes it easy for parents and guardians to navigate through the signing process. These features collectively enhance the security and convenience of managing trusts.

-

Is airSlate SignNow affordable for managing trust disabled child documents?

Yes, airSlate SignNow offers a cost-effective solution designed to meet diverse budget needs, especially for families managing a trust for a disabled child. By offering various pricing tiers, users can select a plan that suits their specific requirements, ensuring affordability without compromising on quality. This makes it accessible for all families in need.

-

Can I integrate airSlate SignNow with other tools while managing trust disabled child paperwork?

Absolutely! airSlate SignNow allows you to seamlessly integrate with various applications to manage trust documentation for a disabled child more efficiently. Whether it's cloud storage services or CRM tools, these integrations facilitate synchronization and enhance your workflow. This ensures that all relevant data is connected and manageable in one place.

-

How secure is airSlate SignNow for managing trust disabled child documents?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive documents related to a trust for a disabled child. The platform utilizes advanced encryption and compliance measures to protect your information. This ensures that only authorized individuals can access these crucial documents, maintaining confidentiality and peace of mind.

-

What support does airSlate SignNow offer for families managing trust disabled child?

airSlate SignNow provides comprehensive support resources for families navigating the complexities of managing a trust for a disabled child. This includes detailed tutorials, a responsive customer support team, and a robust knowledge base. Users can quickly find answers to their questions, ensuring they feel confident while using the platform.

-

Does airSlate SignNow allow multiple users to collaborate on trust disabled child documents?

Yes, airSlate SignNow supports collaboration among multiple users when dealing with documents linked to a trust for a disabled child. This feature simplifies the process of collecting signatures and obtaining feedback from necessary parties. It fosters clear communication and teamwork, essential for efficient document management.

Get more for Trust Disabled Child

- Nippon life claim form

- Pediatric ophthalmologyadult strabismus new patient form

- Premier health form

- Clinical and molecular cytogenetics laboratory form

- Patient registration form romagosa dermatology group

- Optumrx direct member reimbursement form

- General incident form

- Clinical pathology accession form use general uvdl accession form for other testing requests

Find out other Trust Disabled Child

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors