Testamentary Trust for Form

What is the Testamentary Trust For

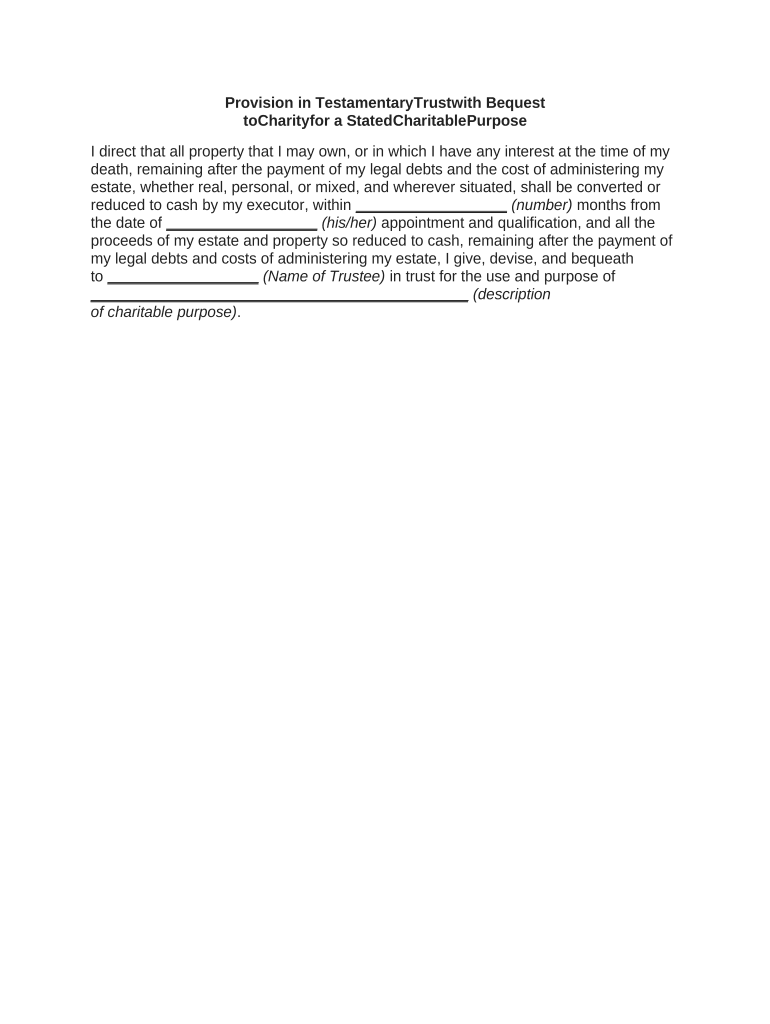

A testamentary trust is established through a will and comes into effect upon the death of the individual who created it, known as the testator. This type of trust is designed to manage and distribute the testator's assets according to their wishes. The primary purpose of a testamentary trust is to provide financial support to beneficiaries, which may include family members, friends, or charitable organizations. By specifying how and when assets are to be distributed, the testator can ensure that their charitable purpose is fulfilled, whether it involves funding education, healthcare, or other philanthropic endeavors.

Steps to Complete the Testamentary Trust For

Completing a testamentary trust involves several key steps to ensure that the document is legally binding and accurately reflects the testator's intentions. First, the testator should draft a will that includes the provisions for the testamentary trust. This document must clearly outline the trust's purpose, the assets to be included, and the beneficiaries. Next, it is essential to appoint a trustee, who will be responsible for managing the trust according to the terms specified in the will. Once the will is finalized, it should be signed and witnessed according to state laws to ensure its validity. Finally, the testator should store the will in a safe place and inform the trustee of its location.

Legal Use of the Testamentary Trust For

The legal use of a testamentary trust is governed by state laws, which dictate how these trusts must be created and administered. It is important for the testator to comply with these regulations to ensure that the trust is enforceable. The trust must be clearly defined in the will, and the trustee must act in accordance with the fiduciary duties imposed by law. This includes managing the trust assets prudently and distributing them according to the testator's wishes. Additionally, the testamentary trust must adhere to any relevant tax obligations, ensuring that the charitable purpose remains intact and compliant with IRS guidelines.

Key Elements of the Testamentary Trust For

Several key elements are essential for a testamentary trust to function effectively. These include the trust's purpose, which should align with the testator's charitable goals; the designation of beneficiaries, who will receive the trust assets; and the appointment of a trustee, who will manage the trust. Additionally, the trust should specify the terms of distribution, including any conditions that must be met before beneficiaries can access the assets. It is also crucial to outline how the trust will be funded, detailing which assets will be transferred into the trust upon the testator's death.

Examples of Using the Testamentary Trust For

Testamentary trusts can be utilized in various scenarios to achieve specific charitable purposes. For instance, a testator may establish a trust to provide for the education of their grandchildren, ensuring that funds are available for tuition and related expenses. Alternatively, a testamentary trust can be set up to support a charitable organization, allowing the testator to leave a lasting impact on a cause they care about. In both cases, the trust serves as a vehicle to manage and distribute assets according to the testator's wishes, ensuring that their legacy aligns with their values and philanthropic goals.

Quick guide on how to complete testamentary trust for

Complete Testamentary Trust For effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed papers, enabling you to obtain the correct form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Testamentary Trust For across any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

How to modify and eSign Testamentary Trust For with ease

- Find Testamentary Trust For and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow.

- Generate your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you'd like to share your form, whether via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced papers, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Testamentary Trust For and ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the significance of a charitable purpose in document signing?

A charitable purpose is essential when drafting documents related to non-profit organizations. airSlate SignNow allows users to eSign important papers that support their charitable initiatives. This ensures that your charitable purpose is documented effectively and legally when establishing agreements and partnerships.

-

How does airSlate SignNow support organizations with charitable purposes?

airSlate SignNow provides tools that help organizations focus on their charitable purpose by streamlining the signing process. This includes features like customizable templates specifically designed for non-profits, allowing for rapid document turnaround. By minimizing administrative tasks, you can dedicate more resources to your charitable initiatives.

-

What pricing options are available for non-profits with a charitable purpose?

We offer special pricing for non-profit organizations that revolve around a charitable purpose. These plans are designed to be budget-friendly, enabling your organization to utilize the platform without sacrificing funds needed for charitable activities. signNow out to our sales team to learn more about these discounted options.

-

Can airSlate SignNow integrate with other tools for charitable organizations?

Yes, airSlate SignNow seamlessly integrates with various platforms that are valuable for organizations with a charitable purpose. These integrations allow for smooth workflows between your eSigning tasks and other tools, such as donor management systems, fundraising platforms, and CRM software. This ensures your charitable objectives are met efficiently.

-

What features does airSlate SignNow offer to enhance a charitable purpose?

airSlate SignNow offers features like bulk sending, reminders, and audit trails which are particularly useful for organizations with a charitable purpose. These features help ensure that all documents are signed promptly and securely. Moreover, you can track the status of your documents to maintain transparency for supporters and stakeholders.

-

Is it secure to eSign documents related to charitable purposes?

Absolutely. Security is paramount in handling documents tied to a charitable purpose. airSlate SignNow utilizes advanced encryption and compliance measures to protect sensitive information, ensuring that your charitable documents are secure during the signing process and beyond.

-

How can airSlate SignNow streamline the donation process for charitable organizations?

By utilizing airSlate SignNow, charitable organizations can signNowly streamline their donation processes. eSignatures simplify agreements between donors and recipients, ensuring that all necessary documents are quickly executed. This efficiency allows non-profits to focus more on their mission rather than paperwork.

Get more for Testamentary Trust For

- Texas music industry directory colleges and universities in form

- Necropsy and sample submission form for office use only mdh

- Premier spine care patient registration information

- Emergency medicine physician assistant residency form

- Bylawssts society of thoracic surgeons form

- This application consists of 3 pages which must be completed form

- Southcoast health mychart access information

- Proof of loss form payment authorization instructions

Find out other Testamentary Trust For

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template