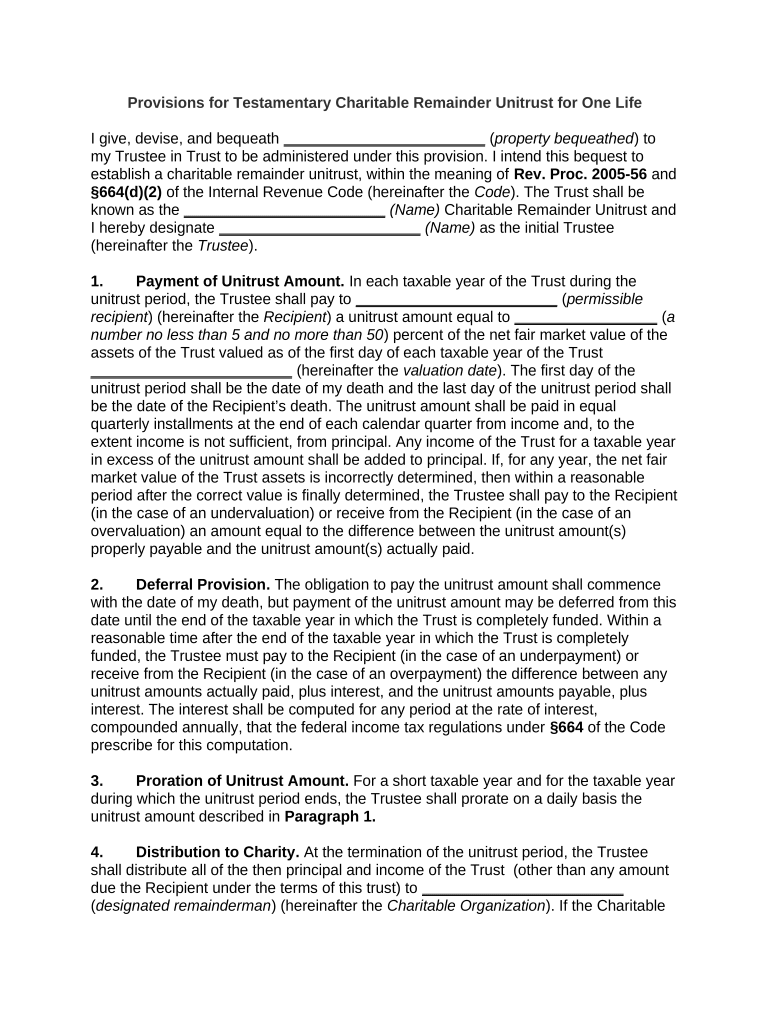

Charitable Remainder Unitrust Form

What is the Charitable Remainder Unitrust

The charitable remainder unitrust is a type of trust that allows individuals to donate assets while retaining the right to receive income from those assets for a specified period. After this period, the remaining assets are transferred to a designated charity. This arrangement not only provides a charitable contribution but also offers potential tax benefits to the donor. The unitrust pays a fixed percentage of the trust's value to the income beneficiaries, which can be adjusted annually based on the trust's performance.

How to use the Charitable Remainder Unitrust

To effectively use a charitable remainder unitrust, individuals should first determine their financial goals and the charitable organizations they wish to support. Once these decisions are made, they can establish the trust by working with legal and financial advisors to draft the trust document. This document will outline the terms of the trust, including the income percentage and the charity that will receive the remainder. After the trust is funded, the income beneficiaries will receive distributions based on the trust's value, while the charity will benefit from the remainder after the trust term ends.

Steps to complete the Charitable Remainder Unitrust

Completing a charitable remainder unitrust involves several key steps:

- Consult with a financial advisor to assess your situation and objectives.

- Select the charity or charities you wish to support.

- Determine the income percentage that will be distributed to beneficiaries.

- Draft the trust agreement with legal assistance to ensure compliance with state and federal laws.

- Fund the trust with appropriate assets, such as cash, stocks, or real estate.

- File any necessary documentation with the IRS to establish tax-exempt status.

Key elements of the Charitable Remainder Unitrust

Several key elements define a charitable remainder unitrust:

- Income Beneficiaries: Individuals designated to receive income from the trust during its term.

- Charitable Beneficiary: The charity that will receive the remaining assets after the trust term ends.

- Fixed Percentage: The predetermined percentage of the trust's value paid to income beneficiaries, which must be at least five percent.

- Trust Term: The duration for which the income beneficiaries will receive payments, which can be a specific number of years or the lifetime of the beneficiaries.

Legal use of the Charitable Remainder Unitrust

The legal use of a charitable remainder unitrust is governed by specific regulations that ensure compliance with IRS guidelines. To be valid, the trust must meet certain criteria, including the requirement that the income beneficiaries receive a fixed percentage of the trust's value. Additionally, the trust must be irrevocable, meaning that once it is established, the terms cannot be changed. It is essential to follow the legal framework to ensure that the trust is recognized as a legitimate charitable entity, allowing for the associated tax benefits.

IRS Guidelines

The IRS provides guidelines for charitable remainder unitrusts to ensure they comply with tax laws. These guidelines outline the requirements for establishing the trust, including the minimum payout percentage and the necessity for the trust to be irrevocable. Additionally, the IRS requires that the trust's charitable beneficiary receive at least a portion of the trust's assets, ensuring that the charitable intent is met. Individuals should consult the IRS regulations or a tax professional to ensure compliance and maximize potential tax benefits.

Quick guide on how to complete charitable remainder unitrust 497333616

Prepare Charitable Remainder Unitrust effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the correct template and securely store it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents promptly without delays. Manage Charitable Remainder Unitrust on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Charitable Remainder Unitrust with ease

- Locate Charitable Remainder Unitrust and click on Get Form to proceed.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Leave behind the issues of lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Edit and eSign Charitable Remainder Unitrust and guarantee exceptional communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a remainder unitrust and how is it used?

A remainder unitrust is a type of charitable trust that allows donors to contribute assets while retaining income over a specified period. This setup provides tax advantages and thus serves as a valuable financial planning tool. By using airSlate SignNow, you can efficiently manage the documentation needed for establishing a remainder unitrust.

-

How does airSlate SignNow facilitate the creation of a remainder unitrust?

airSlate SignNow simplifies the process of creating a remainder unitrust by allowing users to eSign documents securely and efficiently. The platform enables you to store and access your legal documents remotely, ensuring that all paperwork required for the trust is handled with clarity and compliance.

-

What are the benefits of using airSlate SignNow for managing a remainder unitrust?

Using airSlate SignNow for a remainder unitrust offers signNow benefits, including cost-effectiveness and enhanced ease of use. The platform streamlines the signing process, reducing the time spent on paperwork and allowing for quicker setup and management of your trust.

-

Is there a pricing model available for airSlate SignNow when handling a remainder unitrust?

Yes, airSlate SignNow provides flexible pricing models tailored to meet the needs of businesses managing a remainder unitrust. Whether you require occasional document signing or a more comprehensive package, you'll find options that fit your budget and usage demands.

-

Can I integrate airSlate SignNow with other financial software for my remainder unitrust?

Absolutely! airSlate SignNow offers various integrations with popular financial software solutions. This means you can seamlessly connect your tools to better manage the financial aspects of your remainder unitrust, ensuring a streamlined workflow.

-

What features does airSlate SignNow offer specifically for charitable remainder unitrusts?

airSlate SignNow includes features such as secure eSigning, template management, and document tracking which are essential for charitable remainder unitrusts. These tools empower users to execute agreements in a secure environment, while also providing oversight throughout the process.

-

How can I ensure compliance when establishing a remainder unitrust using airSlate SignNow?

airSlate SignNow helps ensure compliance by providing templates and document management tools that adhere to legal requirements for a remainder unitrust. The platform's user-friendly interface also facilitates clear communication and record-keeping, which is critical for maintaining compliance.

Get more for Charitable Remainder Unitrust

- Patient info emergcy contact form

- Ivy tech community college of indiana health information

- Related medical conditionsfood allergy research form

- Podiatrists professional liability insurance bailey special risks form

- Nationwide annuity beneficiary claim form

- Global initiatives hematologyorg american society of form

- Medmarc application form

- Sace application form 392945198

Find out other Charitable Remainder Unitrust

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT