Devise of Form

What is the devise of?

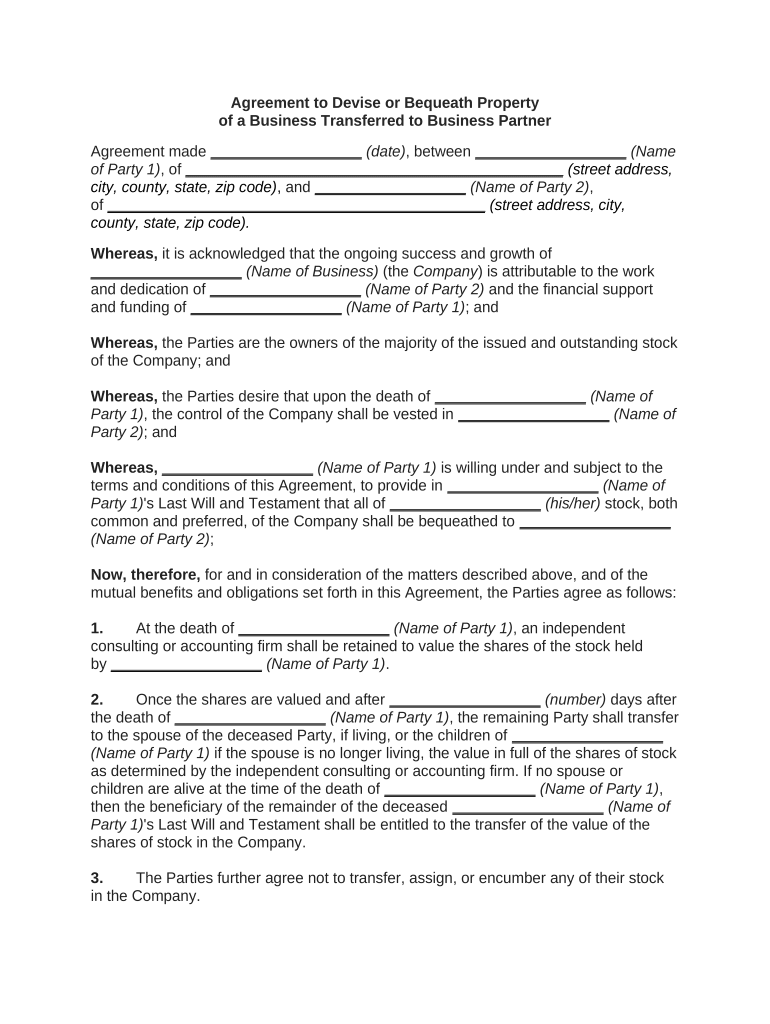

The devise of refers to the legal act of transferring property or assets through a will or similar document. This process allows individuals to specify how their property should be distributed upon their passing. In the context of estate planning, the devise is a crucial component, as it ensures that the testator's wishes are honored and that the intended beneficiaries receive their designated shares. The devise can encompass various types of property, including real estate, personal belongings, and financial assets.

How to use the devise of

Using the devise of involves several steps to ensure that the transfer of property is executed correctly. First, individuals should clearly outline their intentions regarding property distribution in a legally recognized document, such as a will. It is essential to identify the beneficiaries and specify the exact property being bequeathed. Consulting with an estate planning attorney can provide valuable insights into the legal requirements and help avoid potential disputes among heirs.

Key elements of the devise of

Several key elements are integral to the devise of. These include:

- Clear identification of property: The property must be specifically described to avoid ambiguity.

- Designation of beneficiaries: Individuals receiving the property should be clearly named to ensure proper distribution.

- Legal compliance: The devise must adhere to state laws regarding wills and estates to be considered valid.

- Signature and witnesses: Most states require the testator's signature and witnesses to validate the document.

Steps to complete the devise of

Completing the devise of involves a series of methodical steps:

- Determine the property to be devised.

- Identify and name the beneficiaries.

- Draft a will or other legal document outlining the devise.

- Ensure compliance with state laws, including signature and witness requirements.

- Store the document in a safe place and inform the beneficiaries of its existence.

Legal use of the devise of

The legal use of the devise of is governed by state laws, which dictate how property can be transferred upon death. It is essential to follow these laws to ensure that the devise is enforceable. This includes understanding the requirements for a valid will, the rights of heirs, and any tax implications that may arise from the transfer of property. Failure to comply with legal standards can result in disputes or invalidation of the devise.

State-specific rules for the devise of

Each state has its own rules regarding the devise of property, which can affect how wills are drafted and executed. These rules may include:

- Requirements for witnesses and notarization.

- Specific language that must be included in the will.

- Time limits for contesting a will.

- Tax implications for the beneficiaries.

It is advisable to consult with a legal professional familiar with the laws in your state to ensure compliance and to address any unique considerations that may apply.

Quick guide on how to complete devise of

Complete Devise Of effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, enabling you to locate the necessary form and securely archive it online. airSlate SignNow provides you with all the functionalities required to create, modify, and eSign your documents promptly without any holdups. Handle Devise Of on any platform with airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The simplest way to edit and eSign Devise Of without hassle

- Find Devise Of and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Devise Of and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What does it mean to devise bequeath in legal terms?

To 'devise bequeath' refers to the act of bequeathing property or assets through a will or legal document upon one's death. This term is often used in estate planning to ensure that an individual's wishes regarding their property are clearly communicated and executed. Understanding how to devise bequeath effectively can help streamline the distribution of assets.

-

How does airSlate SignNow support the process of devising bequeath?

airSlate SignNow simplifies the process of creating and signing legal documents, making it easier to draft wills and other estate planning documents where you might need to devise bequeath. With customizable templates and secure eSigning capabilities, our platform ensures that your documents are legally binding and easy to share with beneficiaries. This functionality can save time and reduce the complexity of estate management.

-

What is the pricing structure for airSlate SignNow?

airSlate SignNow offers various pricing tiers to cater to different business needs, with features ideal for those looking to devise bequeath legally binding documents. Our pricing is competitive and offers a range of features, ensuring that even small businesses can afford a robust eSigning solution. You can choose from monthly or annual subscriptions depending on your usage and needs.

-

What features does airSlate SignNow offer for document creation?

Our platform comes with a variety of features including customizable templates, document routing, and in-built compliance controls that are essential when you want to devise bequeath. With our drag-and-drop editor, users can easily create documents that meet their specific needs. This makes it a valuable tool for individuals and professionals alike who are handling estate planning.

-

Can I use airSlate SignNow for multiple users?

Yes, airSlate SignNow allows businesses to set up teams and manage multiple users efficiently. This feature is particularly useful for law firms or estate planning professionals who assist clients in devising bequeath. Teams can collaborate on documents, track changes, and ensure everyone is aligned, making the process seamless.

-

Does airSlate SignNow integrate with other software platforms?

Indeed, airSlate SignNow offers numerous integrations with popular software platforms, which can greatly enhance your ability to manage the devising bequeath process. Whether you're using CRM systems or cloud storage solutions, our platform allows for streamlined workflows, minimizing the need to switch between applications. This integration capability helps improve efficiency in document handling.

-

What are the benefits of using airSlate SignNow for estate planning?

Using airSlate SignNow for estate planning offers numerous benefits, especially when you need to devise bequeath legal documents. The platform ensures a fast and secure way to create, share, and sign documents, reducing turnaround time signNowly. Additionally, the eSigning feature eliminates the need for physical paperwork, making the process more eco-friendly and convenient.

Get more for Devise Of

- Verification mr form

- Ipps representative certification form

- Copics guide to medical professional liability insurance form

- Daiichi sankyoamerican regent iv iron patient assistance form

- International cancer immunotherapy conference september form

- Fillable online to l e d o z o o ampampamp a q u a r i u m fax form

- Clienttherapist agreement new hope counseling center form

- Baggage delay claim baggage amp personal effects seven corners form

Find out other Devise Of

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online