Right Inheritance Form

Understanding the Right Inheritance

The right inheritance refers to the legal entitlement of individuals to inherit assets from a deceased person. In the context of waiving rights, it is essential to understand that individuals can choose to relinquish their claim to an inheritance. This decision may arise from various personal or financial reasons, such as resolving family disputes or simplifying estate management. When waiving the right to inheritance, it is crucial to document this decision properly to ensure it is legally recognized and binding.

Steps to Complete the Waiving Right Process

Completing the process of waiving the right to inheritance involves several key steps to ensure legal validity. First, the individual must clearly express their intention to waive their rights in writing. This document should include essential details such as the names of the parties involved, a description of the inheritance being waived, and the date of the waiver. Next, both parties should sign the document in the presence of a notary public to add a layer of authenticity. Finally, it is advisable to keep a copy of the signed document for personal records and to provide it to relevant parties, such as the estate executor.

Legal Use of the Waiving Right

Waiving the right to inheritance is a legally recognized action in the United States, provided it meets specific legal requirements. The waiver must be voluntary, meaning the individual should not be coerced or pressured into making this decision. Additionally, the waiver should comply with state laws governing inheritance and estate matters. It is also important to consider any tax implications that may arise from waiving an inheritance, as these can vary by state and individual circumstances.

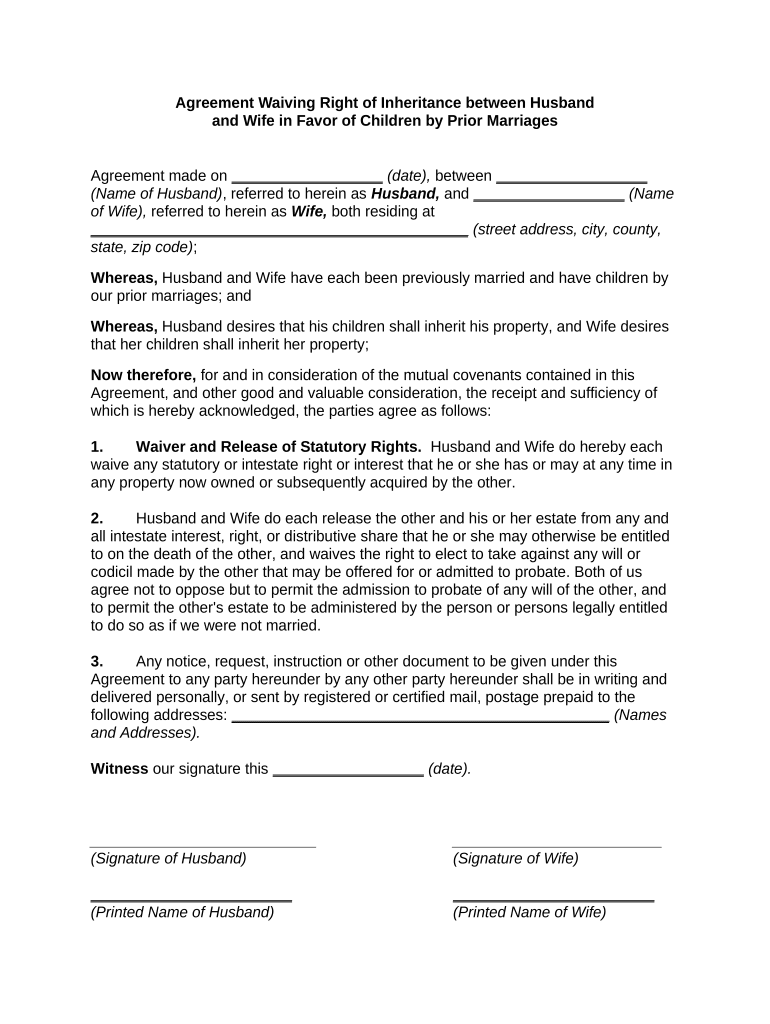

Key Elements of the Waiving Right Agreement

A well-structured waiving right agreement should include several key elements to ensure clarity and enforceability. These elements typically include:

- Identification of Parties: Clearly state the names and relationships of the individuals involved.

- Description of the Inheritance: Specify the assets or rights being waived.

- Intent to Waive: Include a clear statement indicating the intention to waive the inheritance rights.

- Signatures: Both parties must sign the document, ideally in the presence of a notary.

- Date: Record the date when the waiver is executed.

State-Specific Rules for Waiving Inheritance Rights

Each state in the U.S. has its own laws governing inheritance and the waiving of rights. It is important to consult state statutes or a legal professional to understand the specific requirements and implications of waiving inheritance rights in your jurisdiction. Some states may require additional documentation or have specific forms that need to be completed. Understanding these nuances can help ensure that the waiver is valid and recognized by courts or estate administrators.

Examples of Waiving Inheritance Rights

There are various scenarios in which individuals may choose to waive their inheritance rights. For instance, siblings may agree to waive their rights to an estate in favor of one sibling who has been the primary caregiver for their aging parents. Alternatively, a spouse may decide to waive their rights to an inheritance to simplify estate planning or to avoid potential conflicts with other family members. Documenting these agreements properly ensures that all parties are clear on the terms and helps prevent disputes in the future.

Quick guide on how to complete right inheritance

Complete Right Inheritance effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Right Inheritance on any platform using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

The simplest way to modify and eSign Right Inheritance with ease

- Find Right Inheritance and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize relevant parts of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Verify the details and click the Done button to save your changes.

- Select your preferred method to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Never worry about missing or lost documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your needs in document management within a few clicks from any device you prefer. Modify and eSign Right Inheritance and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it help with inheritance husband transactions?

airSlate SignNow is a user-friendly eSignature platform that simplifies the process of sending and signing documents. For inheritance husband-related transactions, it provides a seamless way to manage legal documents securely, ensuring that agreements are legally binding and easily accessible for all parties involved.

-

How much does airSlate SignNow cost for managing inheritance husband documentation?

airSlate SignNow offers competitive pricing plans that cater to various needs, including individual and business users. For inheritance husband documentation, you can choose a plan that fits your volume of documents while benefiting from unlimited templates and eSignatures at an affordable rate.

-

What features should I look for in an eSignature tool for inheritance husband agreements?

When selecting an eSignature tool for inheritance husband agreements, key features to consider include secure document storage, customizable templates, and the ability to track document status. airSlate SignNow provides all these functionalities to ensure your legal documents are efficiently managed and secure.

-

Can airSlate SignNow integrate with other tools for managing inheritance husband paperwork?

Yes, airSlate SignNow integrates seamlessly with various tools such as Google Drive, Salesforce, and Microsoft Office, streamlining the management of inheritance husband paperwork. These integrations enhance productivity by allowing users to access and process documents from their preferred platforms.

-

Is airSlate SignNow legally compliant for inheritance husband documentation?

Absolutely. airSlate SignNow complies with various eSignature laws, including the ESIGN Act and UETA, ensuring that all documents, such as those related to inheritance husband matters, are legally binding. This compliance guarantees that your signatures hold the same legal weight as traditional handwritten ones.

-

What benefits does airSlate SignNow offer for inheritance husband processes?

Using airSlate SignNow for inheritance husband processes provides signNow benefits, including faster turnaround times for document signing and reduced paperwork hassles. The platform's easy-to-use interface allows multiple parties to sign documents without unnecessary delays, ensuring a smooth inheritance process.

-

How can airSlate SignNow enhance communication for inheritance husband agreements?

airSlate SignNow enhances communication for inheritance husband agreements by offering real-time notifications and reminders for all parties involved. This ensures that everyone stays updated on the status of the documents and can promptly address any queries, facilitating a smoother transaction process.

Get more for Right Inheritance

- Arizona notary manual form

- Form based code grass valley california

- Application special permit filming form

- City of anaheim parking variance traffic engineering anaheim form

- Pre investigative background questionnaire city of bakersfield form

- Hm 188 form

- Neighborhood partnership bprogramb strategic plan city of hayward form

- Ssa 16 application for social security disability insurance form

Find out other Right Inheritance

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile