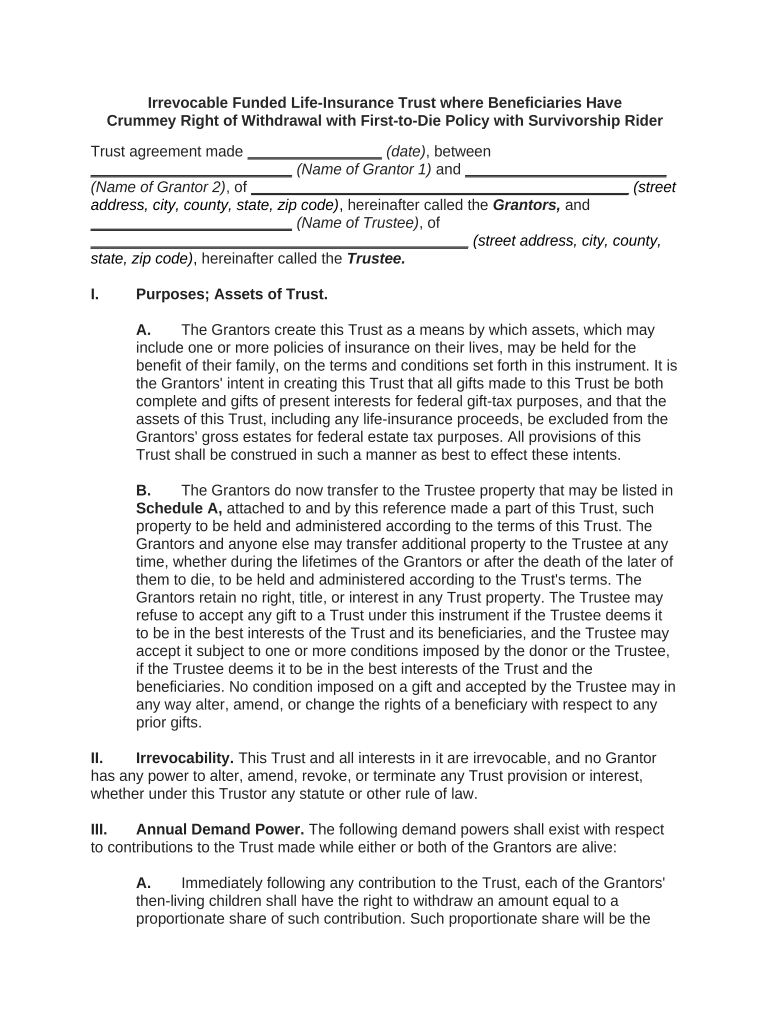

Irrevocable Insurance Trust Form

What is the irrevocable insurance trust?

An irrevocable insurance trust is a legal entity that holds a life insurance policy for the benefit of designated beneficiaries. Once established, the trust cannot be altered or revoked by the grantor, which provides significant advantages in estate planning. By transferring ownership of a life insurance policy into the trust, the death benefits can be excluded from the grantor's taxable estate, potentially reducing estate taxes. This type of trust ensures that the proceeds are managed according to the grantor's wishes, providing financial security for the beneficiaries without the complications of probate.

Steps to complete the irrevocable insurance trust

Completing irrevocable life insurance trust forms involves several key steps to ensure proper execution and compliance with legal requirements. First, gather all necessary information, including details about the grantor, beneficiaries, and the life insurance policy. Next, fill out the trust document accurately, specifying the terms and conditions under which the trust operates. It is crucial to sign the document in front of a notary public to validate its authenticity. After signing, transfer the ownership of the life insurance policy to the trust. Finally, keep copies of all documents for your records and inform the insurance company about the change in ownership.

Legal use of the irrevocable insurance trust

The irrevocable insurance trust is legally binding and must comply with state and federal laws. It is essential to ensure that the trust meets all legal requirements to be recognized by the courts and tax authorities. This includes properly executing the trust document, adhering to state-specific regulations, and maintaining accurate records of all transactions related to the trust. Additionally, the trust should be funded appropriately, with the life insurance policy transferred into the trust's name. Legal guidance may be beneficial to navigate complex regulations and ensure the trust serves its intended purpose effectively.

Key elements of the irrevocable insurance trust

Several key elements define an irrevocable insurance trust. These include the grantor, who establishes the trust; the trustee, responsible for managing the trust assets; and the beneficiaries, who receive the benefits upon the grantor's death. The trust document must outline the specific terms, including how the death benefits will be distributed, any conditions attached to the distributions, and the powers granted to the trustee. Additionally, the trust must be irrevocable, meaning that once established, the grantor cannot change or dissolve it without the consent of all beneficiaries.

Required documents

To establish an irrevocable insurance trust, specific documents are required. These typically include the trust agreement, which outlines the terms and conditions of the trust, and the life insurance policy itself. You may also need to provide identification documents for the grantor and trustee, as well as any relevant financial documents that demonstrate the trust's funding. It is advisable to consult with a legal professional to ensure all necessary documentation is complete and compliant with applicable laws.

Examples of using the irrevocable insurance trust

There are various scenarios where an irrevocable insurance trust can be beneficial. For instance, a parent may set up a trust to ensure that their children receive life insurance proceeds upon their passing, providing financial support for education or living expenses. Business owners might use the trust to protect their business assets from estate taxes, ensuring a smoother transition of ownership. Additionally, individuals with significant assets may establish the trust to minimize estate tax liabilities, preserving wealth for future generations while maintaining control over how the assets are distributed.

Quick guide on how to complete irrevocable insurance trust

Complete Irrevocable Insurance Trust seamlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can acquire the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Irrevocable Insurance Trust on any device using the airSlate SignNow applications for Android or iOS, and simplify any document-centric task today.

How to edit and eSign Irrevocable Insurance Trust effortlessly

- Find Irrevocable Insurance Trust and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Verify all information and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors requiring new copies to be printed. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Irrevocable Insurance Trust while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are irrevocable life insurance trust forms?

Irrevocable life insurance trust forms are legal documents that establish a trust which cannot be modified or revoked once created. These forms are used to transfer ownership of life insurance policies to benefit beneficiaries outside of estate taxes, ensuring the assets are protected for your heirs.

-

How can airSlate SignNow assist with irrevocable life insurance trust forms?

airSlate SignNow provides an easy-to-use platform for creating, managing, and eSigning irrevocable life insurance trust forms. Our solution streamlines the process, allowing you to quickly prepare these important documents and ensure they are securely signed by all involved parties.

-

What are the benefits of using airSlate SignNow for trust forms?

Using airSlate SignNow for your irrevocable life insurance trust forms offers numerous benefits, including increased efficiency, reduced paperwork, and improved compliance. Our platform also allows tracking of document status, ensuring you maintain control throughout the process.

-

Are there any costs associated with using airSlate SignNow for irrevocable life insurance trust forms?

The pricing for airSlate SignNow is designed to be cost-effective for businesses and individuals alike. We offer various subscription plans that cater to different needs, ensuring that you can find a solution that fits your budget while efficiently managing your irrevocable life insurance trust forms.

-

What features does airSlate SignNow offer for managing trust documents?

airSlate SignNow features an intuitive document editor, templates for irrevocable life insurance trust forms, and secure eSigning capabilities. Additionally, our platform includes integrations with popular applications, making it easier to manage and access your documents in one place.

-

Can I customize my irrevocable life insurance trust forms with airSlate SignNow?

Yes, airSlate SignNow allows you to customize your irrevocable life insurance trust forms by adding specific clauses or terms that suit your needs. Our document editor provides flexibility to ensure that your trust documents are tailored to your unique requirements.

-

Is it possible to integrate airSlate SignNow with other software for my trust forms?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software applications, allowing you to enhance your workflow when managing irrevocable life insurance trust forms. This means you can easily connect with your favorite tools for a more streamlined document management experience.

Get more for Irrevocable Insurance Trust

Find out other Irrevocable Insurance Trust

- Electronic signature Texas Time Off Policy Later

- Electronic signature Texas Time Off Policy Free

- eSignature Delaware Time Off Policy Online

- Help Me With Electronic signature Indiana Direct Deposit Enrollment Form

- Electronic signature Iowa Overtime Authorization Form Online

- Electronic signature Illinois Employee Appraisal Form Simple

- Electronic signature West Virginia Business Ethics and Conduct Disclosure Statement Free

- Electronic signature Alabama Disclosure Notice Simple

- Electronic signature Massachusetts Disclosure Notice Free

- Electronic signature Delaware Drug Testing Consent Agreement Easy

- Electronic signature North Dakota Disclosure Notice Simple

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter