Trustor Form

What is the Trustor

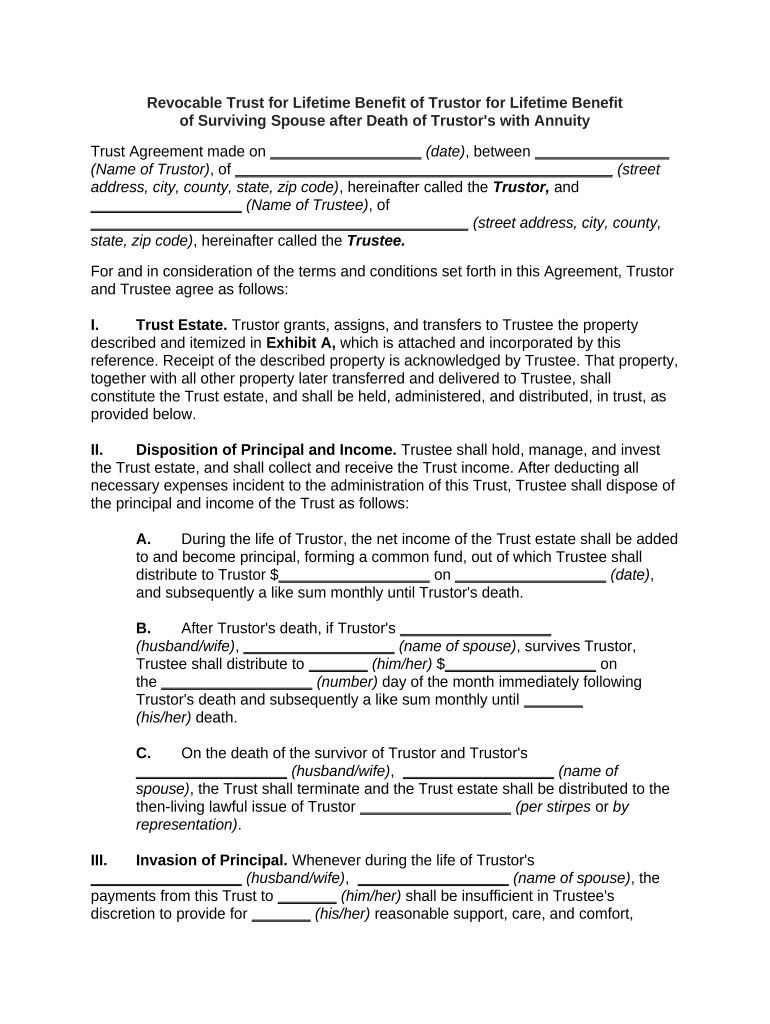

The trustor, also known as the grantor or settlor, is the individual who creates a trust. This person transfers assets into the trust and establishes the terms under which those assets will be managed and distributed. In the context of a revocable trust, the trustor retains control over the assets during their lifetime and can modify or revoke the trust as needed. Understanding the role of the trustor is essential for effective estate planning, as it determines how the trust operates and the benefits it provides to beneficiaries.

Key Elements of the Trustor

Several key elements define the role and responsibilities of a trustor. These include:

- Asset Transfer: The trustor transfers ownership of assets into the trust, which may include real estate, bank accounts, and investments.

- Trust Document: The trustor creates a legal document outlining the terms of the trust, including how assets will be managed and distributed.

- Beneficiaries: The trustor designates beneficiaries who will receive the trust assets upon the trustor's death or as specified in the trust document.

- Trustee Appointment: The trustor appoints a trustee to manage the trust assets according to the terms set forth in the trust document.

Steps to Complete the Trustor

Completing the trustor process involves several important steps:

- Determine Your Goals: Identify your objectives for creating the trust, such as asset protection, tax benefits, or ensuring care for dependents.

- Select Assets: Decide which assets to transfer into the trust and assess their value.

- Draft the Trust Document: Work with a legal professional to create a trust document that outlines the terms and conditions of the trust.

- Transfer Assets: Legally transfer ownership of the selected assets into the trust, ensuring all documentation is properly executed.

- Review and Update: Regularly review the trust and make updates as necessary to reflect changes in your circumstances or intentions.

Legal Use of the Trustor

The legal use of a trustor is governed by state laws and regulations. In the United States, a trustor can create various types of trusts, including revocable and irrevocable trusts. Each type has different implications for asset management and taxation. It is crucial for the trustor to ensure that the trust complies with applicable laws to avoid potential legal issues. Consulting with an estate planning attorney can help navigate these legal requirements and ensure that the trust is established correctly.

Examples of Using the Trustor

Trustors can utilize trusts in various scenarios, including:

- Estate Planning: A trustor may create a revocable trust to manage assets during their lifetime and simplify the transfer of those assets to heirs after death.

- Tax Benefits: Some trustors establish irrevocable trusts to remove assets from their taxable estate, potentially reducing estate taxes.

- Special Needs Planning: A trustor may set up a special needs trust to provide for a disabled beneficiary without jeopardizing their eligibility for government assistance.

Required Documents

Establishing a trust requires specific documents, including:

- Trust Agreement: The primary document that outlines the terms of the trust.

- Asset Deeds: Documentation to transfer ownership of real estate or other assets into the trust.

- Financial Statements: Records of the assets being placed in the trust, such as bank accounts and investment portfolios.

Quick guide on how to complete trustor

Complete Trustor effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the right form and keep it securely stored online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents quickly and without complications. Manage Trustor on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The optimal way to alter and eSign Trustor effortlessly

- Find Trustor and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or mask sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Trustor and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a trust trustor in the context of airSlate SignNow?

A trust trustor is an individual or entity that creates a trust and has the authority to manage its assets. In the context of airSlate SignNow, understanding the role of a trust trustor is essential for effective document management and eSigning related to trust agreements.

-

How does airSlate SignNow help trust trustors manage their documents?

airSlate SignNow offers trust trustors a streamlined platform to send, receive, and eSign important documents related to trusts. With customizable templates and secure storage, trust trustors can ensure their documents are managed efficiently and securely.

-

What features does airSlate SignNow provide for trust trustors?

For trust trustors, airSlate SignNow provides essential features like customizable document templates, secure eSigning, and real-time tracking. These features enhance the efficiency of managing trust-related documents, ensuring compliance and security.

-

Is airSlate SignNow a cost-effective solution for trust trustors?

Yes, airSlate SignNow is designed to offer a cost-effective solution for trust trustors by reducing administrative overhead and streamlining document workflows. This allows trust trustors to focus on effectively managing their trusts without incurring excessive costs.

-

What integrations does airSlate SignNow offer for trust trustors?

airSlate SignNow features integrations with various applications that trust trustors commonly use, including CRM systems, cloud storage solutions, and project management tools. These integrations help trust trustors maintain coherence in their workflows and data management.

-

How secure is document handling for trust trustors on airSlate SignNow?

Document security is paramount for trust trustors using airSlate SignNow. The platform employs advanced encryption and compliance measures to protect sensitive documents, ensuring that trust trustors can manage their materials securely.

-

Can trust trustors access airSlate SignNow on mobile devices?

Absolutely! airSlate SignNow is mobile-friendly, allowing trust trustors to access their documents and manage eSignatures from anywhere. This flexibility enables trust trustors to work efficiently, even while on the go.

Get more for Trustor

Find out other Trustor

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter