Closing an Estate Form

What is the Closing An Estate

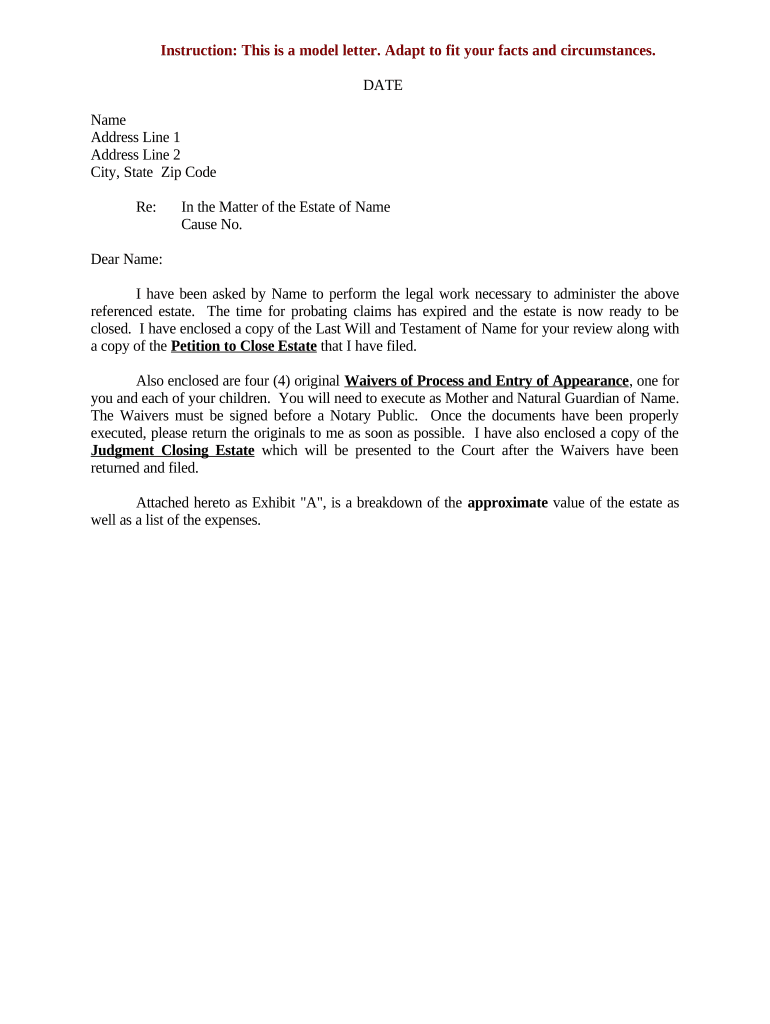

The closing of an estate refers to the legal process of settling the affairs of a deceased person's estate. This involves gathering and valuing the deceased's assets, paying any debts or taxes owed, and distributing the remaining assets to beneficiaries according to the will or state law. The process ensures that all financial obligations are met and that the estate is legally finalized. Understanding this process is crucial for executors and beneficiaries alike, as it can impact the distribution of assets and the overall timeline of estate settlement.

Steps to complete the Closing An Estate

Completing the closing of an estate involves several key steps. First, the executor must gather all relevant documents, including the will, death certificate, and any financial statements. Next, they need to identify and inventory all assets, which may include real estate, bank accounts, and personal property. Following this, the executor must pay any outstanding debts and taxes, which may require filing specific forms, such as the form 207 42 for reporting expenses. Once all debts are settled, the executor can distribute the remaining assets to the beneficiaries as outlined in the will. Finally, the executor must file a closing statement with the court to officially conclude the estate.

Legal use of the Closing An Estate

The legal use of closing an estate is governed by state laws, which dictate how assets are managed and distributed after a person's death. It is essential for executors to comply with these laws to avoid potential legal issues. This includes filing necessary documents with the probate court and adhering to timelines for asset distribution. Additionally, proper documentation, such as the closing estate statement, must be maintained to ensure transparency and accountability throughout the process. Failure to follow legal procedures can lead to disputes among beneficiaries or even legal penalties for the executor.

Required Documents

To successfully close an estate, several documents are typically required. Key documents include:

- The deceased's will, if one exists.

- A death certificate to verify the passing of the individual.

- Inventory of assets, detailing all property and financial accounts.

- Records of debts and liabilities that need to be settled.

- The form 207 42, which may be necessary for reporting specific expenses related to the estate.

- Final accounting statements, which summarize the financial activities of the estate.

Having these documents organized and readily available can streamline the closing process and help ensure compliance with legal requirements.

Examples of using the Closing An Estate

Practical examples of closing an estate can illustrate the process effectively. For instance, if an individual passes away leaving behind a house, bank accounts, and personal belongings, the executor must first assess the value of these assets. After settling any outstanding debts, such as funeral expenses or medical bills, the executor can then distribute the house to one beneficiary and the bank accounts to others, as specified in the will. Additionally, if there are estate expenses that need to be reported, the executor would utilize the form 207 42 to ensure accurate documentation of these costs. These examples highlight the importance of following a structured approach to closing an estate.

Filing Deadlines / Important Dates

Filing deadlines and important dates are critical to the estate closing process. Executors must be aware of state-specific timelines for submitting the will to probate, notifying beneficiaries, and filing tax returns. Typically, the will must be filed within a few weeks of the death, while tax returns may have specific deadlines based on the estate's fiscal year. Additionally, the executor should keep track of deadlines for submitting forms, such as the form 207 42, to ensure all expenses are reported correctly and on time. Missing these deadlines can lead to complications and potential legal ramifications.

Quick guide on how to complete closing an estate

Effortlessly Prepare Closing An Estate on Any Device

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to access the proper form and securely store it online. airSlate SignNow provides all the resources necessary for you to create, modify, and electronically sign your documents swiftly without any hassle. Manage Closing An Estate on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign Closing An Estate with Ease

- Locate Closing An Estate and click on Get Form to begin.

- Utilize the features we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information thoroughly and click on the Done button to save your changes.

- Select how you want to share your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Closing An Estate to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is form 207 42 and why is it important?

Form 207 42 is a crucial document used in various business transactions. Understanding how to complete and submit form 207 42 correctly can streamline processes and ensure compliance with regulations. airSlate SignNow provides tools that simplify the eSigning and document management of form 207 42.

-

How does airSlate SignNow integrate with form 207 42?

airSlate SignNow allows users to create, send, and eSign form 207 42 seamlessly. With its intuitive interface, you can easily incorporate form 207 42 into your workflow, making document management hassle-free. This integration enhances your productivity and reduces the turnaround time for approvals.

-

What are the pricing options for using airSlate SignNow with form 207 42?

airSlate SignNow offers competitive pricing plans tailored to fit different business needs. You can access essential features for handling form 207 42 without breaking the bank. Whether you're a small business or an enterprise, airSlate SignNow provides value that scales with your requirements.

-

Can I customize form 207 42 using airSlate SignNow?

Yes, airSlate SignNow allows you to customize form 207 42 to fit your specific needs. You can add your branding, configure fields, and include any necessary information to streamline your document workflow. Customization ensures that your form 207 42 meets all your requirements.

-

What are the benefits of using airSlate SignNow for form 207 42?

Using airSlate SignNow for form 207 42 offers numerous benefits, including enhanced security, reduced turnaround times, and improved collaboration. This cost-effective solution simplifies the eSigning process, making it easier to obtain necessary approvals. Additionally, users can track the status of form 207 42 in real-time.

-

Is it easy to eSign form 207 42 with airSlate SignNow?

Absolutely! airSlate SignNow makes it incredibly easy to eSign form 207 42 with just a few clicks. The user-friendly interface allows anyone to quickly eSign documents without any technical barriers, facilitating a smooth signing experience for all parties involved.

-

Does airSlate SignNow provide support for form 207 42?

Yes, airSlate SignNow offers dedicated support for users managing form 207 42. Our support team is knowledgeable and ready to assist you with any questions or challenges you may encounter. We ensure you have all the resources necessary for successful document management.

Get more for Closing An Estate

Find out other Closing An Estate

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast