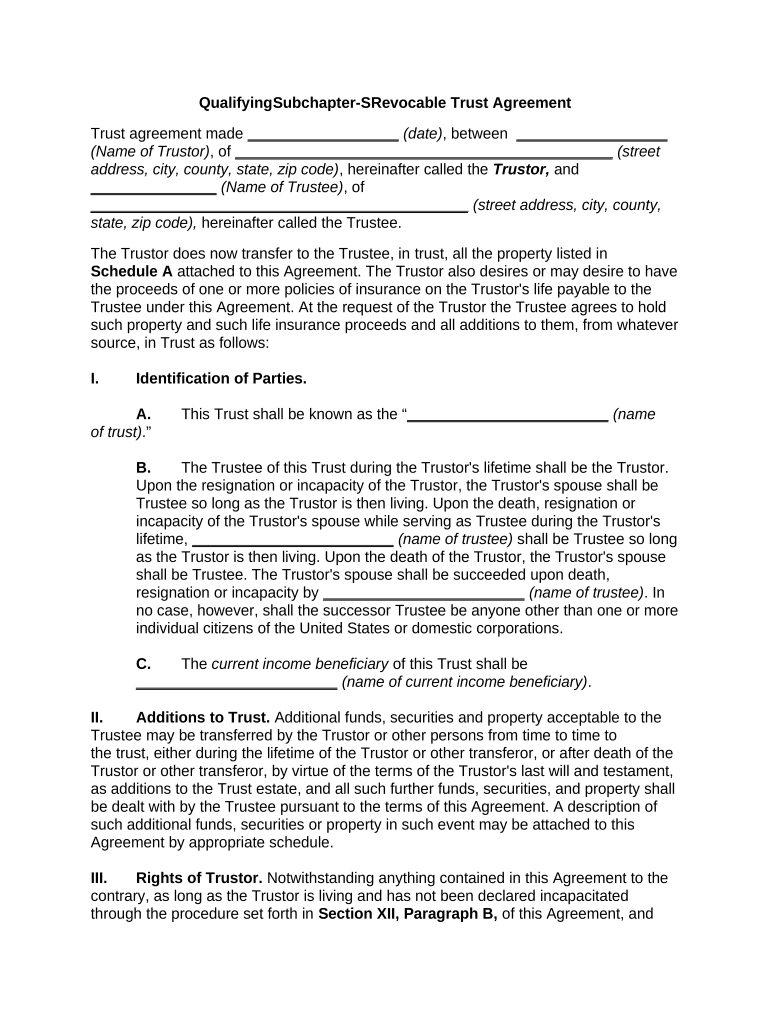

Subchapter S Form

What is the Subchapter S?

The Subchapter S is a tax designation under the Internal Revenue Code that allows certain corporations to be taxed as pass-through entities. This means that the income, deductions, and credits of the corporation pass through to the shareholders, who report them on their personal tax returns. This structure helps avoid the double taxation typically associated with traditional corporations. To qualify as a Subchapter S corporation, the business must meet specific requirements, including having a limited number of shareholders and being a domestic corporation.

How to use the Subchapter S

Using the Subchapter S designation involves several steps. First, a corporation must elect to be treated as a Subchapter S corporation by filing Form 2553 with the IRS. This form must be submitted within a specific timeframe, typically within two months and 15 days of the beginning of the tax year. Once approved, the corporation must adhere to ongoing compliance requirements, such as maintaining eligibility criteria and filing annual tax returns. Understanding these requirements is crucial for maximizing the benefits of the Subchapter S status.

Steps to complete the Subchapter S

Completing the Subchapter S process requires careful attention to detail. Here are the essential steps:

- Determine eligibility by ensuring the corporation meets the requirements for Subchapter S status.

- File Form 2553 with the IRS, ensuring it is completed accurately and submitted on time.

- Obtain approval from the IRS, which typically takes a few weeks.

- Maintain compliance with ongoing requirements, such as shareholder limits and annual filing obligations.

Legal use of the Subchapter S

The legal use of the Subchapter S designation is governed by specific IRS regulations. To maintain compliance, businesses must adhere to the eligibility requirements, including having no more than one hundred shareholders and ensuring that all shareholders are individuals, certain trusts, or estates. Additionally, the corporation must not have more than one class of stock. Failure to comply with these regulations can result in the loss of Subchapter S status, leading to potential tax implications.

Eligibility Criteria

To qualify for Subchapter S status, a corporation must meet several criteria, including:

- Be a domestic corporation.

- Have no more than one hundred shareholders.

- Have only allowable shareholders, which include individuals, certain trusts, and estates.

- Not have more than one class of stock.

Understanding these criteria is essential for businesses considering this tax designation, as non-compliance can lead to significant tax consequences.

Required Documents

When applying for Subchapter S status, specific documents are necessary to ensure compliance with IRS regulations. The primary document is Form 2553, which must be completed and submitted to the IRS. Additionally, corporations may need to provide supporting documentation, such as a list of shareholders and proof of eligibility criteria. Keeping thorough records is vital for maintaining compliance and facilitating any future audits.

Quick guide on how to complete subchapter s

Complete Subchapter S effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers a superb environmentally friendly alternative to conventional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Subchapter S on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Subchapter S with ease

- Locate Subchapter S and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Subchapter S and ensure seamless communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a qualifying trust?

A qualifying trust is a legal arrangement that meets specific criteria to qualify for tax benefits. Understanding the nuances of a qualifying trust can help in making informed financial decisions. It typically involves specific assets and beneficiaries defined by legal requirements.

-

How can airSlate SignNow help with managing a qualifying trust?

airSlate SignNow facilitates the efficient management of documents related to a qualifying trust. With its easy-to-use eSigning features, you can securely sign, send, and store essential trust documents. This streamlines the process and ensures compliance with legal standards.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to cater to different business needs, including those managing a qualifying trust. You can choose from monthly or annual subscriptions, with each plan providing access to essential features. Benefit from a cost-effective solution tailored to your document eSigning requirements.

-

What features does airSlate SignNow offer for legal documents?

airSlate SignNow provides advanced features such as document templates, automated workflows, and multi-party eSigning. For a qualifying trust, these features allow for organized management of legal documentation. Additionally, robust security measures ensure that all documents are protected.

-

How can I integrate airSlate SignNow with my existing software?

airSlate SignNow offers seamless integrations with popular applications such as Google Workspace, Salesforce, and more. By integrating with your existing software, you can enhance the workflow related to a qualifying trust effortlessly. This connectivity ensures all your processes remain efficient and streamlined.

-

Is airSlate SignNow secure for handling sensitive trust documents?

Yes, airSlate SignNow takes security seriously, offering encryption and compliance with various regulations. This ensures that your qualifying trust documents are handled with the utmost care and confidentiality. Trust in a platform that prioritizes your data security while enabling efficient document management.

-

What are the benefits of using airSlate SignNow for a qualifying trust?

Using airSlate SignNow for a qualifying trust simplifies the document signing and management process. The platform provides enhanced efficiency, reduces turnaround times, and ensures legal compliance. Ultimately, this allows for better focus on managing trust-related responsibilities.

Get more for Subchapter S

Find out other Subchapter S

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement