Llc Ownership Shares Form

What is the LLC Ownership Shares

LLC ownership shares represent the ownership interest of members in a Limited Liability Company (LLC). Each member's share indicates their stake in the company, which can affect their rights to profits, losses, and decision-making. Unlike traditional corporations, LLCs do not issue stock; instead, ownership is typically divided based on the members' contributions or as outlined in the operating agreement. Understanding how these shares work is crucial for managing an LLC effectively.

Key Elements of the LLC Ownership Shares

Several key elements define LLC ownership shares:

- Membership Interest: This refers to the member's percentage of ownership in the LLC, which can impact profit distribution and voting rights.

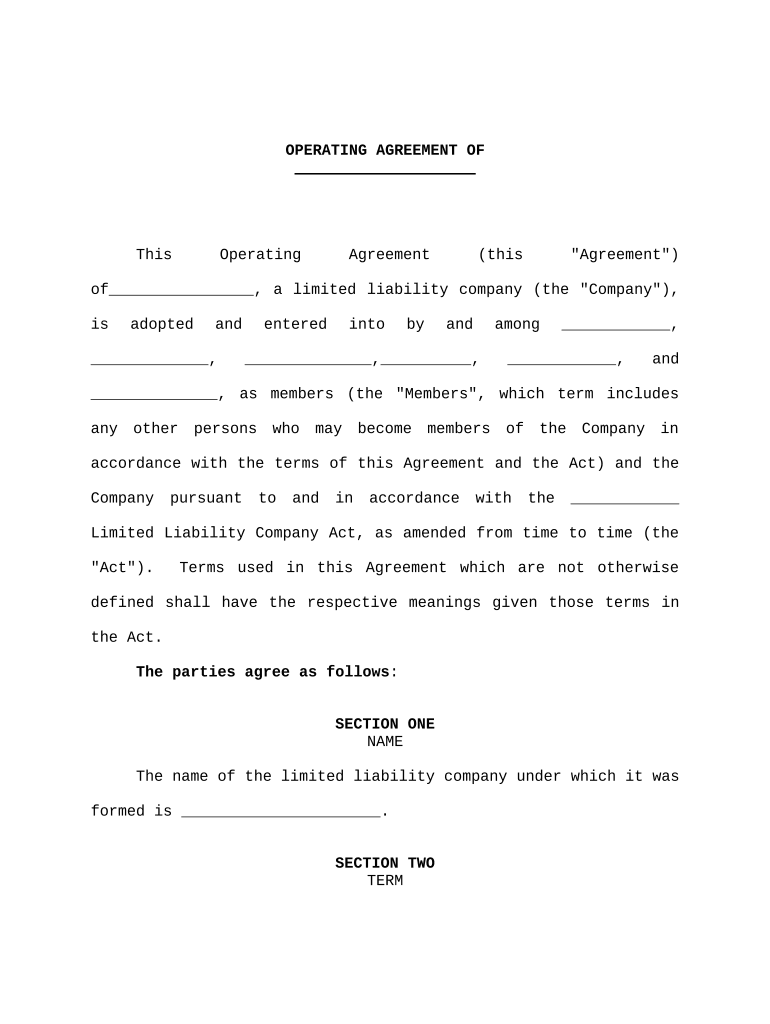

- Operating Agreement: This document outlines the management structure and the rights and responsibilities of each member, including how ownership shares are allocated.

- Capital Contributions: Members typically invest capital or assets into the LLC, which can determine their ownership percentage and influence on decision-making.

- Transferability: Ownership shares in an LLC may have restrictions on transfer, which should be detailed in the operating agreement to maintain control among members.

Steps to Complete the LLC Ownership Shares

Completing the LLC ownership shares involves several steps to ensure proper documentation and compliance:

- Draft the Operating Agreement: Clearly outline the ownership structure, including the percentage of shares each member holds.

- Record Capital Contributions: Document each member's contributions to establish their ownership percentages.

- Issue Membership Certificates: Although not legally required, issuing certificates can provide a formal acknowledgment of ownership.

- Maintain Accurate Records: Keep detailed records of ownership shares and any changes to membership to ensure compliance with state regulations.

Legal Use of the LLC Ownership Shares

The legal use of LLC ownership shares is governed by state laws and the operating agreement. Members must adhere to the terms outlined in these documents, which serve as the foundation for ownership rights and responsibilities. Properly managing ownership shares ensures compliance with legal requirements and helps prevent disputes among members. Additionally, understanding the implications of ownership shares can aid in tax planning and liability protection.

State-Specific Rules for the LLC Ownership Shares

Each state has its own regulations regarding LLC ownership shares, which can affect how they are structured and managed. It is essential to familiarize yourself with the specific laws in your state, as they may dictate:

- How ownership shares are defined and allocated

- The requirements for amending the operating agreement

- Procedures for transferring ownership shares

- Tax implications associated with ownership shares

Examples of Using the LLC Ownership Shares

Understanding practical applications of LLC ownership shares can provide valuable insights:

- A member may contribute cash to the LLC, receiving a corresponding percentage of ownership shares based on their investment.

- When a new member joins, existing members may need to adjust their ownership shares to accommodate the new member's stake.

- In the event of a member leaving the LLC, the remaining members may need to buy out their ownership shares, which requires careful valuation and agreement.

Quick guide on how to complete llc ownership shares

Effortlessly Prepare Llc Ownership Shares on Any Device

Managing documents online has gained popularity with businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, as you can access the right format and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents rapidly without delays. Handle Llc Ownership Shares on any device using airSlate SignNow's Android or iOS apps and enhance any document-related activity today.

How to Edit and eSign Llc Ownership Shares with Ease

- Find Llc Ownership Shares and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Llc Ownership Shares and ensure seamless communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are LLC ownership shares?

LLC ownership shares represent the investment or stake that members have in a Limited Liability Company (LLC). These shares determine how profits and losses are distributed among members and can vary based on the operating agreement. Understanding LLC ownership shares is crucial for effective management and decision-making within the business.

-

How do airSlate SignNow features support LLC ownership shares management?

airSlate SignNow offers features that simplify the documentation and management of LLC ownership shares. Users can easily create, send, and eSign custom agreements related to ownership shares, ensuring accurate record-keeping. This not only speeds up the process but also enhances transparency among members.

-

What is the cost of using airSlate SignNow for managing LLC ownership shares?

The pricing for airSlate SignNow is competitive and offers a range of plans tailored for different business needs. By investing in our service, businesses can manage LLC ownership shares more efficiently and reduce administrative costs. We also provide a free trial to explore the platform's features.

-

Can I integrate airSlate SignNow with other tools for LLC ownership shares documentation?

Yes, airSlate SignNow seamlessly integrates with various applications to enhance your workflow for LLC ownership shares. You can connect it with tools like CRMs, cloud storage services, and team collaboration software. This integration ensures a cohesive experience while managing your ownership shares.

-

How can airSlate SignNow help in protecting LLC ownership shares?

airSlate SignNow includes security features that protect sensitive documents related to LLC ownership shares. With encrypted eSignatures and secure cloud storage, your ownership agreements are safeguarded from unauthorized access. This ensures that your members' rights and investments are well-protected.

-

What benefits does airSlate SignNow offer for LLC ownership shares transactions?

Using airSlate SignNow for LLC ownership shares transactions brings many benefits, such as speed, cost-effectiveness, and ease of use. eSigning eliminates the need for tedious paperwork and physical meetings, facilitating faster agreement processes. These efficiencies allow business members to focus on growth and strategy rather than administration.

-

Are there any templates available for LLC ownership shares agreements in airSlate SignNow?

Yes, airSlate SignNow provides a variety of customizable templates specifically designed for LLC ownership shares agreements. These templates help you create legally-binding documents quickly and accurately, ensuring compliance with applicable laws. Using templates can signNowly streamline the documentation process for your LLC.

Get more for Llc Ownership Shares

Find out other Llc Ownership Shares

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament