Borrowers Certification Form

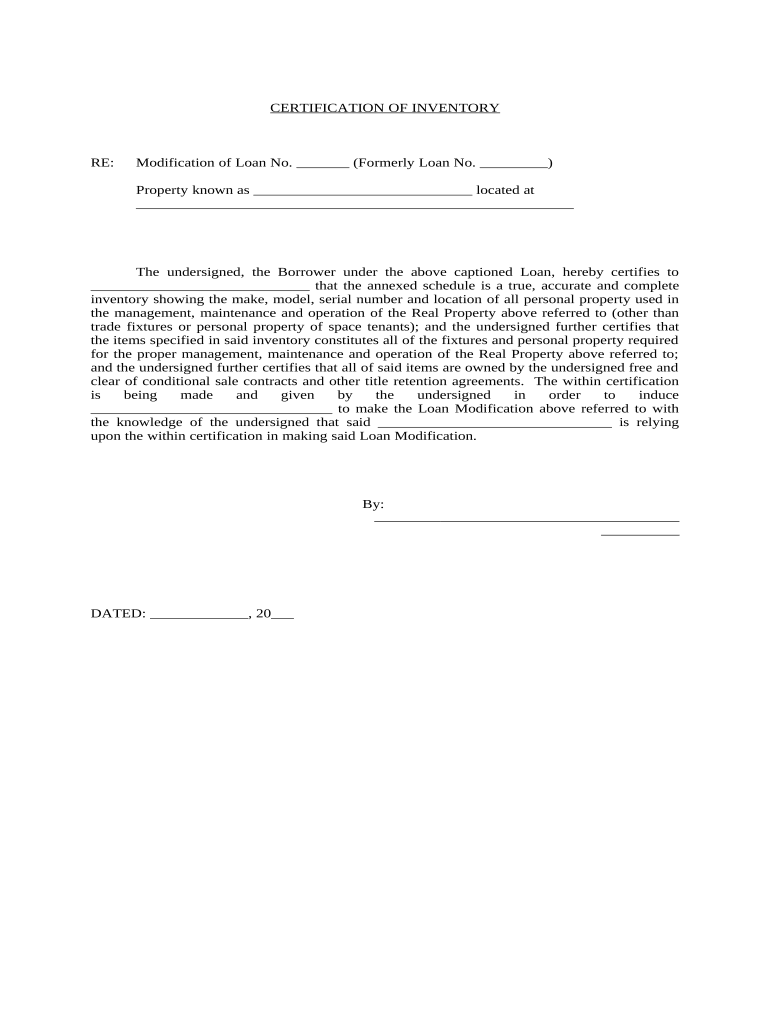

What is the Borrowers Certification Form

The borrowers certification form is a crucial document used primarily in the lending process. It serves to verify the borrower's financial status and intentions regarding the loan. This form typically includes information about the borrower's income, debts, and other financial obligations. By providing accurate details, borrowers help lenders assess their creditworthiness and ability to repay the loan. Understanding this form is essential for anyone seeking financing, as it plays a significant role in the approval process.

Steps to Complete the Borrowers Certification Form

Completing the borrowers certification form involves several key steps to ensure accuracy and compliance. Here is a straightforward process to follow:

- Gather necessary financial documents, including pay stubs, tax returns, and bank statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Provide details about your income, including any additional sources beyond your primary employment.

- List all current debts, including credit cards, loans, and other financial obligations.

- Review the completed form for accuracy and completeness before submission.

Legal Use of the Borrowers Certification Form

The borrowers certification form is legally binding when filled out correctly and signed by the borrower. To ensure its validity, it is essential to comply with relevant laws and regulations, such as the Electronic Signatures in Global and National Commerce (ESIGN) Act. This act allows electronic signatures to hold the same legal weight as handwritten ones, provided that certain criteria are met. Using a reputable eSigning platform can help maintain compliance and enhance the document's legal standing.

Key Elements of the Borrowers Certification Form

Several key elements must be included in the borrowers certification form to ensure it serves its purpose effectively. These elements typically consist of:

- Borrower Information: Personal details, including name, address, and contact information.

- Financial Information: Detailed accounts of income sources, monthly expenses, and existing debts.

- Certification Statement: A declaration affirming the accuracy of the provided information.

- Signature Section: A space for the borrower to sign and date the form, confirming their agreement.

How to Obtain the Borrowers Certification Form

The borrowers certification form can be obtained through various channels. Most lenders provide this form as part of their loan application package. Additionally, it may be available on financial institution websites or through legal document services. It is essential to ensure that you are using the most current version of the form to avoid any issues during the loan application process.

Examples of Using the Borrowers Certification Form

There are several scenarios in which the borrowers certification form is utilized. Common examples include:

- Applying for a mortgage to purchase a home.

- Seeking a personal loan for debt consolidation or major purchases.

- Requesting financing for a vehicle purchase.

- Obtaining a business loan to support startup costs or expansion.

Quick guide on how to complete borrowers certification form

Complete Borrowers Certification Form effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an excellent eco-friendly substitute to conventional printed and signed documents, as you can easily find the appropriate form and securely keep it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly without delays. Manage Borrowers Certification Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-oriented task today.

How to modify and eSign Borrowers Certification Form easily

- Find Borrowers Certification Form and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal significance as a traditional handwritten signature.

- Verify the details and click the Done button to preserve your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or disorganized files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Adjust and eSign Borrowers Certification Form to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a borrowers certification?

A borrowers certification is a formal document that verifies the financial status and creditworthiness of an individual seeking a loan. It typically includes important information about the borrower's income, debts, and overall financial health. Understanding this document is crucial for lenders to assess risk and make informed lending decisions.

-

How does airSlate SignNow help with borrowers certification?

airSlate SignNow streamlines the process of obtaining and signing borrowers certification documents electronically. Our platform allows users to create, send, and eSign these certifications quickly and securely. This not only speeds up the application process but also ensures that all documents are compliant and properly formatted.

-

What are the pricing options for eSigning borrowers certification with airSlate SignNow?

airSlate SignNow offers a variety of pricing plans designed to meet the needs of businesses of all sizes. Whether you're a solo entrepreneur or part of a larger organization, our competitive pricing ensures a cost-effective solution for managing borrowers certification. Contact our sales team to find the best plan that fits your requirements.

-

What features does airSlate SignNow offer for borrowers certification?

Our platform includes a robust set of features designed specifically for managing borrowers certification, such as customizable templates, audit trails, and secure cloud storage. With airSlate SignNow, users can also track the status of documents in real-time, ensuring that all necessary steps are completed efficiently. This feature set simplifies the certification process and helps maintain compliance.

-

Can I integrate airSlate SignNow with other applications for borrowers certification?

Yes, airSlate SignNow offers seamless integrations with many popular applications to enhance your workflow for borrowers certification. Whether you need to connect with CRM systems, payment processors, or file storage solutions, our platform supports a range of integrations that make document management easier. Check our integration toolkit for a comprehensive list of options.

-

How secure is the borrowers certification process with airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption standards for both data at rest and in transit, ensuring that your borrowers certification documents remain protected at all times. Additionally, our platform complies with industry regulations to safeguard sensitive information and maintain user trust.

-

What are the benefits of using airSlate SignNow for borrowers certification?

Using airSlate SignNow for borrowers certification offers multiple benefits, including reduced turnaround time for document signing and enhanced accuracy in data collection. Our user-friendly interface simplifies the borrowing process, allowing you to focus more on your business rather than paperwork. Ultimately, this can lead to improved customer satisfaction and higher conversion rates.

Get more for Borrowers Certification Form

- Imm 5444 e application for a permanent resident card form

- Imm 5690e document checklist permanent residence form

- Imm 5741e return of processing fee right of permanent form

- Imm return form

- Section 7 expenses information and report

- Note 41b form

- Child support affidavit form

- Canada authorization id form

Find out other Borrowers Certification Form

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement

- Electronic signature Georgia Courts Rental Application Fast

- How Can I Electronic signature Hawaii Courts Purchase Order Template

- How To Electronic signature Indiana Courts Cease And Desist Letter

- How Can I Electronic signature New Jersey Sports Purchase Order Template

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast