Kappa Delta Recommendation Form

Understanding the Kappa Delta Recommendation

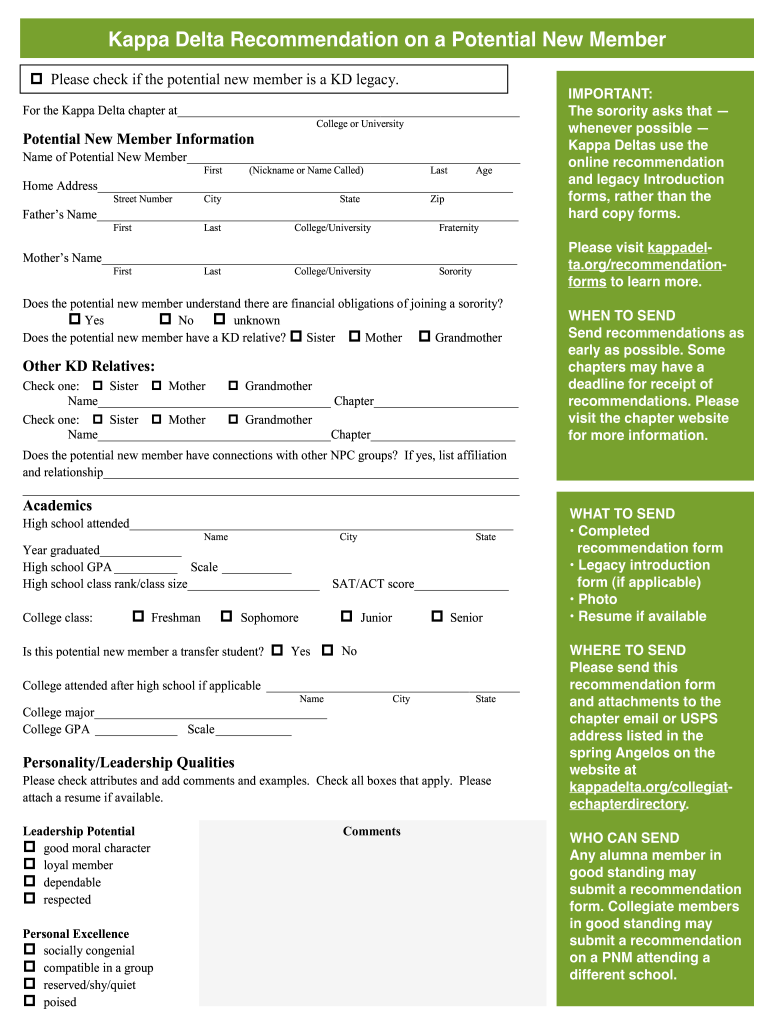

The Kappa Delta recommendation is a formal endorsement provided by current members of the Kappa Delta sorority. This document plays a crucial role in the recruitment process, as it highlights the qualifications and character of potential new members. It serves to inform the selection committee about the candidate's suitability for membership based on various criteria, including academic performance, leadership skills, and community involvement. The recommendation is typically submitted electronically through the Kappa Delta member portal, ensuring a streamlined and efficient process.

Steps to Complete the Kappa Delta Recommendation

Completing the Kappa Delta recommendation involves several key steps to ensure that the document meets the necessary standards. First, the recommending member should gather relevant information about the candidate, such as their academic achievements, extracurricular activities, and personal qualities. Next, the member should log into the Kappa Delta member portal to access the recommendation form. After filling out the required fields, it's important to review the information for accuracy and completeness. Finally, the member should submit the recommendation electronically, ensuring that it is received by the appropriate committee in a timely manner.

Legal Use of the Kappa Delta Recommendation

The Kappa Delta recommendation must adhere to specific legal standards to be considered valid and binding. This includes compliance with eSignature laws such as the ESIGN Act and UETA, which govern the use of electronic signatures in the United States. By using the Kappa Delta member portal, members can ensure that their recommendations are securely signed and stored, maintaining the integrity of the document. Additionally, it is essential to follow any applicable state-specific regulations regarding the submission and processing of recommendations.

Key Elements of the Kappa Delta Recommendation

When preparing a Kappa Delta recommendation, certain key elements should be included to enhance its effectiveness. These elements typically consist of the candidate's full name, contact information, and a detailed account of their qualifications. Personal anecdotes that illustrate the candidate's character and contributions to their community can also be beneficial. Furthermore, the recommendation should conclude with a strong endorsement, clearly stating the recommending member's support for the candidate's application to join Kappa Delta.

How to Obtain the Kappa Delta Recommendation

To obtain a Kappa Delta recommendation, potential new members should first reach out to current members of the sorority. This can be done through personal connections or by utilizing the Kappa Delta member portal to identify eligible recommenders. Once a member agrees to provide a recommendation, the candidate should ensure that they provide all necessary information to assist the member in completing the form. It is advisable to make this request well in advance of recruitment events to allow sufficient time for the recommendation to be prepared and submitted.

Examples of Using the Kappa Delta Recommendation

Examples of using the Kappa Delta recommendation include scenarios where candidates are applying for membership during formal recruitment periods. In these instances, the recommendation serves as a vital tool for the selection committee to evaluate applicants. Additionally, recommendations can be beneficial for candidates seeking to demonstrate their commitment to the values of Kappa Delta, such as leadership, scholarship, and service. By providing a well-crafted recommendation, current members can significantly impact a candidate's chances of being invited to join the sorority.

Quick guide on how to complete recommendation on a potential new member kappa delta kappadelta

Uncover how to effortlessly navigate the Kappa Delta Recommendation implementation with this simple guide

Submitting and verifying documents online is becoming progressively favored and the preferred choice for a diverse range of clients. It provides numerous advantages over conventional printed forms, including convenience, time savings, enhanced precision, and safety.

With resources like airSlate SignNow, you can locate, adjust, sign, and enhance and transmit your Kappa Delta Recommendation without getting bogged down in endless printing and scanning. Follow this brief tutorial to initiate and complete your document.

Follow these instructions to obtain and complete Kappa Delta Recommendation

- Begin by clicking the Get Form button to access your document in our editor.

- Follow the green label on the left that highlights essential fields so you don’t miss them.

- Utilize our expert tools to comment, modify, sign, secure, and enhance your document.

- Protect your file or convert it into a fillable form using the appropriate tab features.

- Review the document and look for mistakes or inconsistencies.

- Hit DONE to complete editing.

- Rename your document or keep it unchanged.

- Select the storage option you prefer for your document, send it via USPS, or click the Download Now button to save your file.

If Kappa Delta Recommendation isn't what you were looking for, you can browse our extensive library of pre-uploaded templates that you can complete with minimal effort. Try our solution today!

Create this form in 5 minutes or less

FAQs

-

How do I fill out the SS-4 form for a new Delaware C-Corp to get an EIN?

You indicate this is a Delaware C Corp so check corporation and you will file Form 1120.Check that you are starting a new corporation.Date business started is the date you actually started the business. Typically you would look on the paperwork from Delaware and put the date of incorporation.December is the standard closing month for most corporations. Unless you have a signNow business reason to pick a different month use Dec.If you plan to pay yourself wages put one. If you don't know put zero.Unless you are fairly sure you will owe payroll taxes the first year check that you will not have payroll or check that your liability will be less than $1,000. Anything else and the IRS will expect you to file quarterly payroll tax returns.Indicate the type of SaaS services you will offer.

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

I don't want to miss out on the new Google. Which sources on new tech companies would you recommend for a potential investor?

Where’re a few ways to gain your own pipe-line of projects and find among these projects “the new Google”:Tech media resourcesThis is one of the important ways to find out what is going on in the world of startups and the hardest way to find really great startups because tech media resources create a really big amount of information and it is hard to find perspective startups. But you can apply your analytical skills to analyse this data and find something important and useful. Below you can find world famous tech media resources:TechCrunch (and CrunchBase)The Next WebWiredVentureBeatProduct HuntCB InsightsAnd some local resources (for example in Russia - vc.ru, rb.ru, spark.ru, firrma.ru)VC’s blogsFrankly speaking sometimes media creating «hype» around really seek industries. For this reason I recommend to read what VCs write in their blogs. You can find helpful advices here and more detailed information about market trends and hottest startups. The best VC’s blogs in my version are:http://a16z.com/https://bothsidesofthetable.com/http://avc.com/http://tomtunguz.com/http://www.thisisgoingtobebig.com/https://blog.asmartbear.com/http://andrewchen.co/Management consulting and IB analytical reports of industriesYou can find a brilliant startup but you should also understand the industry in which startup is going to operate. Maybe where are no demand for this product or this market will disappear in the following years (why not?). Consultants and investment bankers have a great experience working with market leaders and understand key trends in most industries. And you can use it for free!World leaders in this sphere are:Big3 (BCG, McKinsey, Bain&Co)Big4 (EY, Deloitte, PwC, KPMG)Bulge bracket (like Morgan Stanley and Deutsche Bank)Rating agencies (like Fitch and S&P)You can find reports on their sites but I recommend to sign up for newsletters from these companies and read all reports to stay tuned.Your own expertise and expertise of industry leadersI highly recommend to find opportunities to invest in your professional sphere. If you have been working in the automotive industry for years you should use your own expertise and network to approve and find the next “big thing” in your sphere.And of course: Network and visit all kinds of VC events (conferences, meet ups, demo days, etc.) Small advice to enjoy information you will consume: use feedly to create unique feed of VC news and blogposts in order not to miss anything. FOLLOW ME at Quora and Facebook to get more information about VC:)

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

Create this form in 5 minutes!

How to create an eSignature for the recommendation on a potential new member kappa delta kappadelta

How to make an eSignature for your Recommendation On A Potential New Member Kappa Delta Kappadelta online

How to generate an eSignature for your Recommendation On A Potential New Member Kappa Delta Kappadelta in Chrome

How to generate an eSignature for signing the Recommendation On A Potential New Member Kappa Delta Kappadelta in Gmail

How to create an electronic signature for the Recommendation On A Potential New Member Kappa Delta Kappadelta right from your smart phone

How to generate an electronic signature for the Recommendation On A Potential New Member Kappa Delta Kappadelta on iOS devices

How to create an electronic signature for the Recommendation On A Potential New Member Kappa Delta Kappadelta on Android

People also ask

-

What is the kappa delta member portal?

The kappa delta member portal is an online platform designed for members of the Kappa Delta sorority. It provides easy access to important resources, event information, and communication tools for members. This portal enhances connection and engagement within the Kappa Delta community.

-

How can I access the kappa delta member portal?

To access the kappa delta member portal, you need a valid member login. Simply visit the official Kappa Delta website and click on the member portal link. Enter your credentials to gain access to personalized resources and member-only content.

-

Is there a cost to use the kappa delta member portal?

The kappa delta member portal is typically included as a benefit of your membership. If you're an active member, you won't incur extra charges for using the portal. It's a cost-effective way to stay connected and informed about Kappa Delta events and resources.

-

What features does the kappa delta member portal offer?

The kappa delta member portal offers various features, including access to event calendars, member directories, and important documents. You can also communicate easily with other members through the portal. These features streamline engagement and enhance the overall member experience.

-

How does the kappa delta member portal benefit members?

The kappa delta member portal benefits members by providing a centralized location for all essential sorority information. It helps members stay connected with each other, share ideas, and participate in events. This platform cultivates a sense of community and belonging among Kappa Delta members.

-

Can I integrate other tools with the kappa delta member portal?

Yes, the kappa delta member portal can be integrated with various tools to enhance its functionality. For instance, it may sync with event management software or communication apps to ensure seamless interaction. Integration helps optimize your experience and simplifies task management.

-

What if I forget my password for the kappa delta member portal?

If you forget your password for the kappa delta member portal, you can easily reset it by following the 'Forgot Password' link on the login page. You will need to provide your email address associated with your account to receive reset instructions. This ensures you can quickly regain access to your member resources.

Get more for Kappa Delta Recommendation

Find out other Kappa Delta Recommendation

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself

- eSign Hawaii Doctors Claim Later

- eSign Idaho Construction Arbitration Agreement Easy

- eSign Iowa Construction Quitclaim Deed Now

- How Do I eSign Iowa Construction Quitclaim Deed

- eSign Louisiana Doctors Letter Of Intent Fast

- eSign Maine Doctors Promissory Note Template Easy