Complex Trust Form

What is the complex trust?

A complex trust is a specific type of trust that can accumulate income and make distributions to beneficiaries. Unlike simple trusts, which are required to distribute all income earned, complex trusts have more flexibility in managing their assets and income. This allows for strategic financial planning, especially in terms of tax implications and wealth management. Understanding the structure and function of a complex trust is crucial for individuals looking to optimize their estate planning and financial strategies.

Steps to complete the complex trust

Completing a complex trust involves several key steps to ensure compliance and effectiveness. Here are the essential steps:

- Determine the trust's purpose: Clearly define the goals of the trust, such as asset protection, tax planning, or providing for beneficiaries.

- Select a trustee: Choose a reliable individual or institution to manage the trust's assets and make decisions on behalf of the beneficiaries.

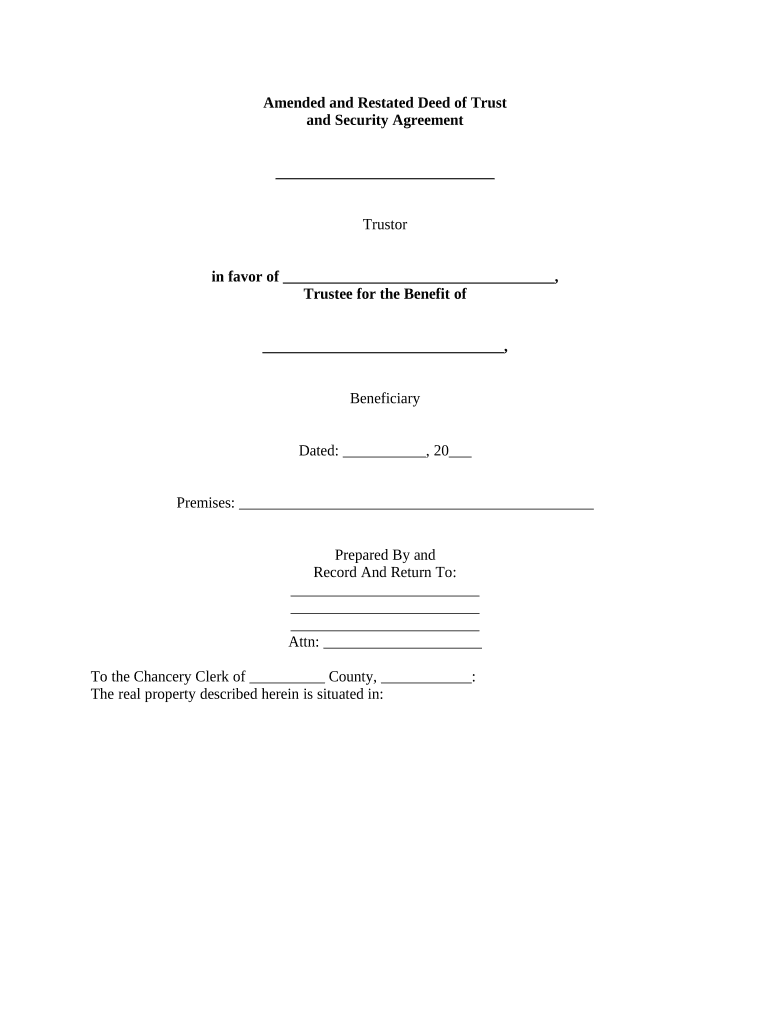

- Draft the trust document: Create a comprehensive document outlining the terms of the trust, including how income will be managed and distributed.

- Fund the trust: Transfer assets into the trust, which may include cash, real estate, or investments.

- Maintain records: Keep detailed records of all transactions and distributions for tax purposes and to ensure compliance with legal requirements.

Legal use of the complex trust

The legal framework surrounding complex trusts is essential for their validity and effectiveness. Complex trusts must comply with various federal and state laws, including tax regulations. They are subject to specific rules regarding income accumulation and distribution, which can significantly impact the tax obligations of both the trust and its beneficiaries. Understanding these legal requirements is vital to avoid penalties and ensure the trust operates within the law.

Key elements of the complex trust

Several key elements define a complex trust and differentiate it from other types of trusts. These include:

- Income accumulation: Unlike simple trusts, complex trusts can retain income rather than distribute it immediately.

- Discretionary distributions: The trustee has the authority to decide when and how much income or principal to distribute to beneficiaries.

- Tax implications: Complex trusts may be subject to different tax rates than individuals, affecting overall tax liability.

- Beneficiary rights: Beneficiaries may have specific rights outlined in the trust document regarding distributions and information access.

Required documents

To establish and maintain a complex trust, several documents are necessary. These typically include:

- Trust agreement: The foundational document that outlines the terms and conditions of the trust.

- Tax identification number: An Employer Identification Number (EIN) is required for tax reporting purposes.

- Asset documentation: Records of the assets being transferred into the trust, including appraisals and ownership documents.

- Trustee information: Documentation regarding the appointed trustee, including their acceptance of the role.

Examples of using the complex trust

Complex trusts can serve various purposes, and their applications can be diverse. Some common examples include:

- Wealth management: Families may use complex trusts to manage and protect family wealth across generations.

- Tax planning: Individuals may establish complex trusts to minimize tax liabilities through strategic income distribution.

- Special needs planning: Complex trusts can provide for beneficiaries with special needs without jeopardizing their eligibility for government assistance.

Quick guide on how to complete complex trust

Complete Complex Trust seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Manage Complex Trust on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Complex Trust with ease

- Locate Complex Trust and click Get Form to initiate.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or cover sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click on the Done button to save your modifications.

- Decide how you want to send your form, via email, text message (SMS), or an invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Complex Trust and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a complex trust and how does airSlate SignNow support it?

A complex trust is a type of trust that can accumulate income or make distributions to beneficiaries based on specific conditions. airSlate SignNow provides features that allow users to manage complex trust-related documents efficiently, ensuring compliance and clarity in the execution of trust agreements. Our platform simplifies the process of sending and signing documents related to complex trusts.

-

How does airSlate SignNow ensure the security of complex trust documents?

Security is a top priority for airSlate SignNow, especially for sensitive documents like those related to complex trusts. We utilize advanced encryption protocols and comply with industry standards to keep your documents secure. Additionally, our audit trails provide accountability and peace of mind when managing complex trust agreements.

-

Can I integrate airSlate SignNow with other software to manage complex trusts?

Yes, airSlate SignNow offers seamless integrations with a variety of software applications commonly used for managing complex trusts, including accounting and financial planning tools. This integration capability enhances workflow efficiency and allows users to streamline their document management processes. By connecting your trusted systems, managing complex trusts becomes even easier.

-

What pricing plans does airSlate SignNow offer for complex trust management?

airSlate SignNow offers flexible pricing plans that cater to various needs, including those managing complex trusts. Whether you are a small business or a larger enterprise, our plans provide cost-effective solutions that include all necessary features for document management and e-signatures. For detailed pricing information, visit our website or contact our sales team.

-

What features does airSlate SignNow provide for handling complex trust documents?

airSlate SignNow includes a variety of features specifically designed to ease the management of complex trust documents. Features such as custom templates, automated workflows, and collaboration tools help streamline communication and execution. Our solution emphasizes user-friendliness, allowing anyone to handle complex trust-related documents efficiently.

-

How can airSlate SignNow benefit the administration of complex trusts?

Using airSlate SignNow for the administration of complex trusts benefits users by providing a straightforward, digital approach to document handling. Our platform reduces paperwork and administrative burdens, enabling quicker decision-making and execution of trust agreements. By automating certain processes, managing complex trusts becomes less time-consuming and more reliable.

-

Is technical support available for airSlate SignNow users managing complex trusts?

Absolutely! airSlate SignNow offers robust technical support tailored for users managing complex trusts. Our dedicated support team is available via chat, email, and phone to assist with any inquiries, ensuring you have the guidance you need to navigate and utilize our platform effectively for complex trust management.

Get more for Complex Trust

Find out other Complex Trust

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT

- Help Me With eSignature Connecticut High Tech Presentation

- How To eSignature Georgia High Tech Document

- How Can I eSignature Rhode Island Finance & Tax Accounting Word

- How Can I eSignature Colorado Insurance Presentation

- Help Me With eSignature Georgia Insurance Form

- How Do I eSignature Kansas Insurance Word

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word