Priority Bankruptcy Form

What is the Priority Bankruptcy

Priority bankruptcy refers to a specific classification of debts that must be paid before other types of debts in the event of bankruptcy. This classification is crucial in determining how assets are distributed among creditors. Common examples of priority debts include certain tax obligations, child support, and alimony. Understanding what constitutes priority bankruptcy is essential for individuals and businesses facing financial difficulties, as it can significantly impact the outcome of bankruptcy proceedings.

How to use the Priority Bankruptcy

Using priority bankruptcy involves identifying and categorizing debts according to their priority status. When filing for bankruptcy, it is important to list all debts accurately, distinguishing between priority and non-priority debts. This categorization helps ensure that priority debts are addressed first during the bankruptcy process. Individuals should consult with a bankruptcy attorney or financial advisor to navigate this process effectively and understand the implications of their choices.

Steps to complete the Priority Bankruptcy

Completing a priority bankruptcy involves several key steps:

- Gather financial documents, including income statements, tax returns, and a list of all debts.

- Consult with a bankruptcy attorney to evaluate your financial situation and determine if bankruptcy is the right option.

- Complete the necessary bankruptcy forms, ensuring that priority debts are clearly identified.

- File the bankruptcy petition with the appropriate court, along with all required documentation.

- Attend the creditors' meeting, where you will answer questions about your financial situation.

- Follow any court orders regarding repayment of priority debts.

Legal use of the Priority Bankruptcy

The legal framework surrounding priority bankruptcy is defined by federal bankruptcy laws, which outline the treatment of priority debts. These laws ensure that certain debts are prioritized in bankruptcy proceedings, protecting the rights of creditors. For individuals and businesses, understanding these legal stipulations is vital to ensure compliance and to maximize the benefits of bankruptcy protection. Engaging with legal counsel can provide clarity on how these laws apply to specific situations.

Required Documents

When filing for priority bankruptcy, several documents are required to support your case. These typically include:

- Bankruptcy petition and schedules detailing all debts and assets.

- Proof of income, such as pay stubs or tax returns.

- Documentation of priority debts, including court orders for child support or alimony.

- List of creditors and the amounts owed.

Having these documents prepared in advance can streamline the filing process and help avoid delays.

Filing Deadlines / Important Dates

Filing for priority bankruptcy involves adhering to specific deadlines and important dates. These can include:

- The date by which the bankruptcy petition must be filed.

- Deadlines for submitting required documents to the court.

- Dates for attending the creditors' meeting and any court hearings.

Missing these deadlines can result in complications, so it is essential to keep track of all relevant dates throughout the bankruptcy process.

Quick guide on how to complete priority bankruptcy

Complete Priority Bankruptcy with ease on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the right forms and securely store them online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents swiftly without any hassles. Manage Priority Bankruptcy on any device using airSlate SignNow's Android or iOS applications and simplify any document-related workflow today.

The easiest way to modify and electronically sign Priority Bankruptcy effortlessly

- Find Priority Bankruptcy and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tiring form searches, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Priority Bankruptcy and ensure effective communication at any phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

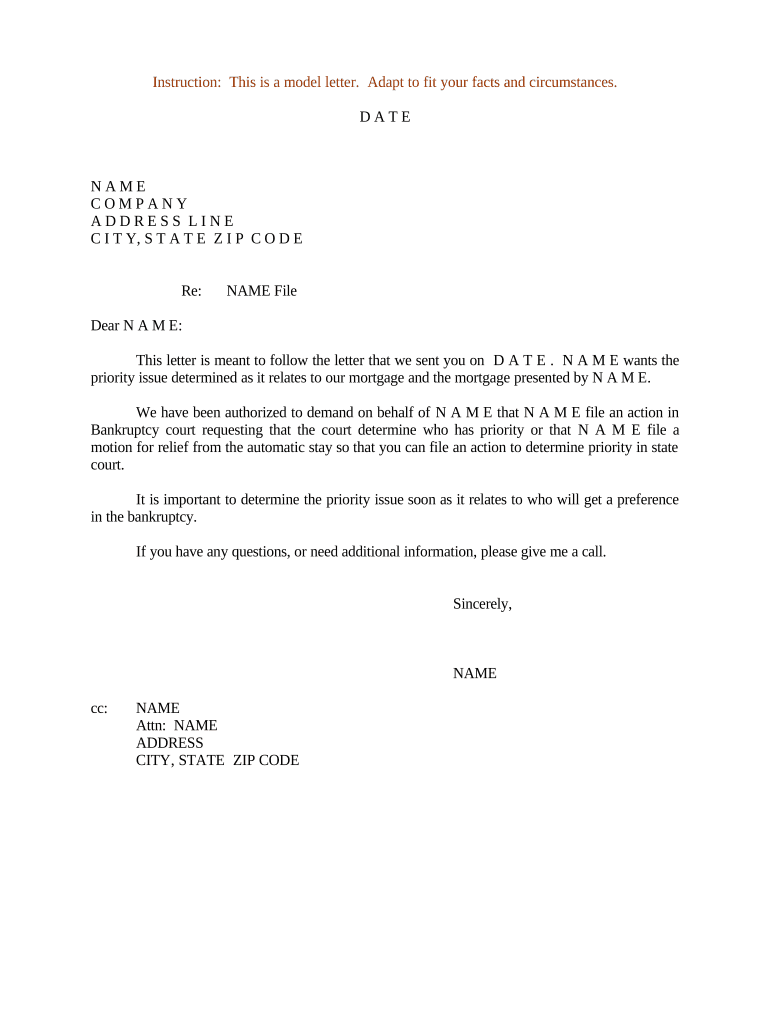

What is a letter bankruptcy sample?

A letter bankruptcy sample is a template that individuals can use to formally communicate their bankruptcy situation to creditors or other interested parties. This sample typically outlines the person's financial difficulties and intentions regarding debt repayment.

-

How can airSlate SignNow help with creating a letter bankruptcy sample?

With airSlate SignNow, users can easily create a customized letter bankruptcy sample by utilizing our document templates. This feature allows for efficient editing and personalization to meet individual requirements.

-

Is there a cost associated with using letter bankruptcy sample templates on airSlate SignNow?

AirSlate SignNow offers competitive pricing plans that include access to various document templates, including the letter bankruptcy sample. Users can choose a plan that fits their budget and needs to optimize document management.

-

What features does airSlate SignNow provide for signing a letter bankruptcy sample?

AirSlate SignNow provides features such as electronic signatures, document sharing, and real-time collaboration for signing a letter bankruptcy sample. These features simplify the signing process, making it secure and efficient.

-

Are there integrations available for the letter bankruptcy sample on airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with several third-party applications and services, allowing users to incorporate their letter bankruptcy sample into existing workflows. This enhances productivity and ensures a smooth document handling experience.

-

Can I track the status of my letter bankruptcy sample on airSlate SignNow?

Absolutely! AirSlate SignNow offers tracking features that allow users to monitor the status of their letter bankruptcy sample in real time. This helps ensure that all parties involved are updated throughout the signing process.

-

What are the benefits of using airSlate SignNow for my letter bankruptcy sample?

Using airSlate SignNow for your letter bankruptcy sample streamlines the documentation process, reduces time spent on paperwork, and enhances security through encryption. Additionally, it offers an intuitive interface that makes document management easy, even for those unfamiliar with digital solutions.

Get more for Priority Bankruptcy

- Client information sheet behavior care specialists

- Mental health first aid northern lakes community mental form

- Submission forms external 2019 penn vet

- Tammy hillmarkel equine insurance specialist form

- Facility claim form

- In case of an emergency the school staff will contact 911 form

- Chris allyn fritsch med atc pt ccrp form

- Fillable online cibmtr form 2804 r50 cibmtr research id

Find out other Priority Bankruptcy

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT

- How To Electronic signature Utah Government Document

- How To Electronic signature Washington Government PDF