Sample Letter Irs Form

What is the Sample Letter to IRS

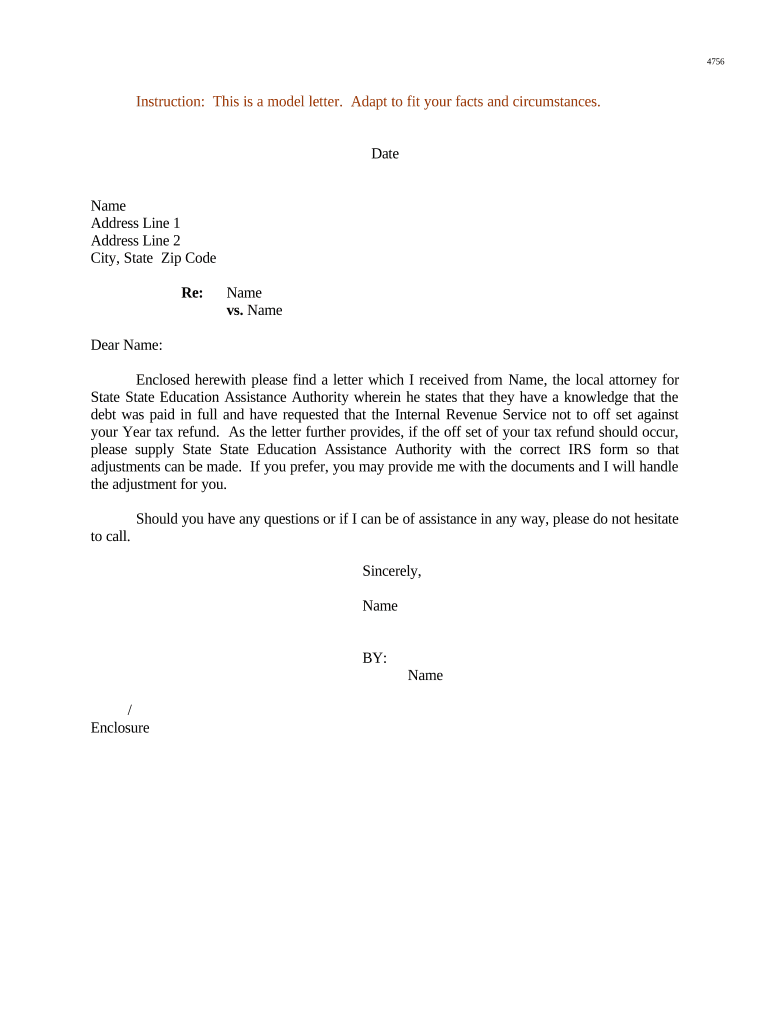

The sample letter to the IRS, particularly regarding CP504 notices, serves as a formal communication tool for taxpayers. This letter is typically used when responding to a notice from the IRS that indicates a potential tax liability or issues related to unpaid taxes. The CP504 notice specifically informs taxpayers that the IRS intends to levy their assets due to unpaid taxes. A well-structured letter can clarify the taxpayer's situation, provide necessary documentation, and potentially resolve misunderstandings with the IRS.

Key Elements of the Sample Letter to IRS

When drafting a letter to the IRS regarding a CP504 notice, it is essential to include specific key elements to ensure clarity and effectiveness. These elements include:

- Taxpayer Information: Include your full name, address, and Social Security number or Employer Identification Number.

- IRS Notice Details: Reference the CP504 notice number and the date it was issued.

- Reason for Writing: Clearly state the purpose of your letter, whether it is to dispute the notice, request a payment plan, or provide additional information.

- Supporting Documentation: Attach any relevant documents that support your case, such as proof of payment or financial hardship documentation.

- Contact Information: Provide your phone number and email address for any follow-up communications.

Steps to Complete the Sample Letter to IRS

Completing a sample letter to the IRS involves several straightforward steps to ensure it is effective and comprehensive:

- Gather Information: Collect all relevant tax documents, including the CP504 notice and any supporting financial records.

- Draft the Letter: Use clear and concise language to explain your situation. Follow the key elements outlined previously.

- Review for Accuracy: Double-check all information, ensuring that names, numbers, and dates are correct.

- Sign the Letter: Include your signature at the end of the letter to authenticate it.

- Send the Letter: Choose a submission method, whether by mail or electronically, ensuring you retain a copy for your records.

IRS Guidelines for Correspondence

The IRS has specific guidelines for correspondence that taxpayers should follow to ensure their letters are processed efficiently. These guidelines include:

- Use Official Language: Maintain a professional tone and avoid slang or informal language.

- Be Concise: Keep your letter brief and to the point, focusing on the key issues without unnecessary details.

- Follow Formatting Standards: Use standard business letter formatting, including proper salutations and closings.

- Provide Clear Requests: Clearly state what action you would like the IRS to take in response to your letter.

Digital vs. Paper Version of the Letter

When deciding between a digital or paper version of the letter to the IRS, consider the following aspects:

- Digital Submission: Submitting electronically can expedite the process, as it allows for quicker delivery and confirmation of receipt.

- Paper Submission: Mailing a paper letter provides a physical record of your correspondence, which can be beneficial for tracking purposes.

- Compliance with Regulations: Ensure that whichever method you choose complies with IRS regulations regarding electronic communications.

Required Documents for Submission

To support your letter to the IRS, it is crucial to include all required documents. These may include:

- Copy of CP504 Notice: Always include a copy of the notice you are responding to.

- Proof of Payment: If applicable, provide documentation showing any payments made towards the tax owed.

- Financial Statements: If you are requesting a payment plan or demonstrating hardship, include recent financial statements.

- Identification Documents: Attach copies of identification, such as a driver's license or Social Security card, if necessary.

Quick guide on how to complete sample letter irs

Effortlessly Prepare Sample Letter Irs on Any Device

Web-based document management has become increasingly favored by both organizations and individuals. It serves as an excellent environmentally friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents promptly without any holdups. Manage Sample Letter Irs on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to Modify and eSign Sample Letter Irs with Ease

- Obtain Sample Letter Irs and click on Get Form to begin.

- Make use of the tools we offer to complete your document.

- Highlight important sections of the documents or conceal sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal authority as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or a shareable link, or download it to your computer.

Eliminate worries about lost or misplaced documents, frustrating form navigation, or errors that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Sample Letter Irs and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sample hardship letter to IRS?

A sample hardship letter to IRS is a template that individuals can use to draft their own letters requesting financial relief from the IRS. It typically outlines the taxpayer's financial situation and explains why they are unable to pay their tax obligations. By using a well-structured sample hardship letter to IRS, you can effectively communicate your circumstances to the IRS.

-

How can I use airSlate SignNow to create a sample hardship letter to IRS?

With airSlate SignNow, you can easily draft and customize a sample hardship letter to IRS using our user-friendly document editor. You can access pre-built templates, fill in your specific details, and sign the document electronically. This streamlines the process and ensures your letter meets all necessary requirements.

-

What features does airSlate SignNow offer for creating letters?

airSlate SignNow offers features such as customizable templates, eSignature options, and document sharing capabilities. These features make it easy to create and send a sample hardship letter to IRS or any other important documents. The platform enhances productivity and simplifies document management.

-

Is airSlate SignNow cost-effective for drafting hardship letters?

Yes, airSlate SignNow is designed to be an affordable solution for businesses and individuals alike. Our pricing plans are competitive, allowing you to draft a sample hardship letter to IRS without breaking the bank. We offer various packages tailored to meet different document management needs.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow supports integrations with various applications including CRM tools, cloud storage services, and productivity software. This means you can seamlessly create a sample hardship letter to IRS from your existing workflow and enhance your overall efficiency.

-

How does eSigning work in airSlate SignNow?

eSigning in airSlate SignNow is straightforward and secure. Once you've prepared your sample hardship letter to IRS, you can invite recipients to sign electronically. Our platform ensures that all signatures are legally binding and compliant with regulations, making it a reliable choice for your document needs.

-

What are the benefits of using airSlate SignNow for letter creation?

Using airSlate SignNow for letter creation offers numerous benefits such as time savings, reduced paperwork, and increased accessibility. When drafting a sample hardship letter to IRS, you can quickly edit, sign, and send documents from anywhere, enhancing your workflow efficiency dramatically.

Get more for Sample Letter Irs

- Injunction protection sexual form

- Final injunction protection against violence form

- Petition for dissolution of marriage with minor child florida 2011 form

- Fl petition form

- Florida supreme court approved family law form 12901b2 2011

- Florida family law rules of procedure 12910 2000 form

- Georgia instructions standard form

- Model opgaaf gegevens voor de loonheffingen vanaf lh 008 2z11fol form

Find out other Sample Letter Irs

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online