Sample Letter Tax Form

What is the Sample Letter Tax?

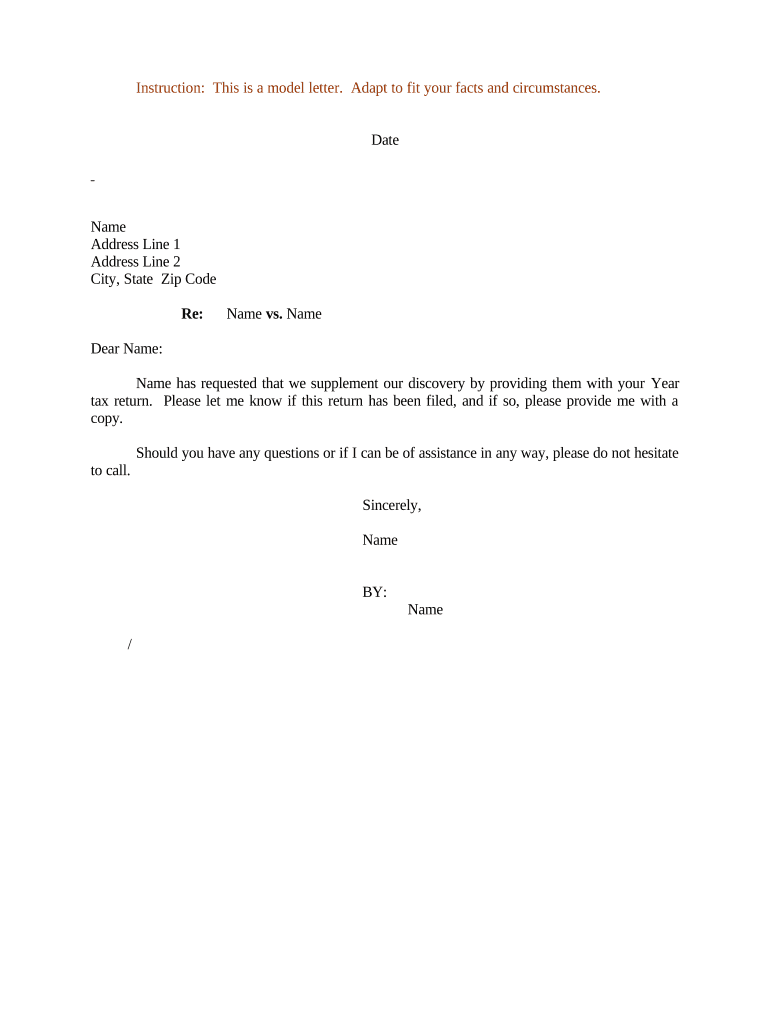

The sample letter tax return serves as a formal document that individuals or businesses can use to communicate with the Internal Revenue Service (IRS) regarding their tax filings. This letter typically includes essential information such as the taxpayer's identification details, the tax year in question, and any specific requests or clarifications related to the tax return. Understanding the purpose of this letter is crucial for ensuring compliance and addressing any issues that may arise during the tax filing process.

Key Elements of the Sample Letter Tax

When drafting a sample letter tax return, several key elements must be included to ensure clarity and compliance. These elements typically consist of:

- Taxpayer Information: Full name, address, and Social Security Number or Employer Identification Number.

- IRS Address: The specific address of the IRS office to which the letter is being sent.

- Subject Line: A clear subject line indicating the purpose of the letter, such as "Request for Tax Return Status."

- Body of the Letter: A concise explanation of the reason for writing, including any relevant details and requests.

- Signature: The taxpayer's signature, along with the date of the letter.

Steps to Complete the Sample Letter Tax

Completing a sample letter tax return involves several straightforward steps to ensure that all necessary information is accurately conveyed. Here are the steps to follow:

- Gather all relevant tax documents and information, including previous tax returns and correspondence with the IRS.

- Clearly outline the purpose of the letter, specifying any requests or clarifications needed.

- Draft the letter, ensuring that it includes all key elements mentioned earlier.

- Review the letter for accuracy and completeness, checking for any spelling or grammatical errors.

- Sign and date the letter before sending it to the appropriate IRS address.

IRS Guidelines

When preparing a sample letter tax return, it is essential to adhere to IRS guidelines to avoid potential issues. The IRS provides specific instructions regarding the format and content of correspondence. Key guidelines include:

- Use clear and concise language to convey your message.

- Ensure that all personal information is accurate and up to date.

- Follow any specific instructions provided by the IRS in previous correspondence.

- Keep a copy of the letter for your records, along with any supporting documents.

Legal Use of the Sample Letter Tax

The sample letter tax return is a legally recognized document when it adheres to the required standards set by the IRS. It can serve various purposes, such as:

- Requesting an extension for filing a tax return.

- Inquiring about the status of a tax refund.

- Providing additional information or documentation requested by the IRS.

- Addressing discrepancies or issues related to prior tax filings.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for ensuring compliance with tax regulations. The IRS typically sets specific deadlines for submitting tax returns and any related correspondence. Key dates to remember include:

- April 15: Deadline for individual tax returns.

- October 15: Deadline for filing extensions.

- Various deadlines for estimated tax payments, depending on the taxpayer's situation.

Quick guide on how to complete sample letter tax 497333971

Streamline Sample Letter Tax effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and without delays. Manage Sample Letter Tax on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related task today.

The easiest way to edit and electronically sign Sample Letter Tax without hassle

- Locate Sample Letter Tax and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Sample Letter Tax and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sample letter tax return and how can it be used?

A sample letter tax return is a template or example letter that individuals or businesses can use to communicate with the tax office regarding their tax returns. It simplifies the process of submitting documents and ensures that all necessary information is included, making it easier for the tax office to process the return.

-

How does airSlate SignNow facilitate the creation of a sample letter tax return?

airSlate SignNow streamlines the process of creating a sample letter tax return by allowing users to customize templates quickly and efficiently. With our user-friendly interface, users can fill out required fields and add eSignatures, ensuring that their letters are both professional and legally binding.

-

What are the pricing plans for using airSlate SignNow for a sample letter tax return?

airSlate SignNow offers various pricing plans to fit different needs, starting from a basic plan suitable for individual users to more comprehensive plans for businesses. Each plan gives users access to templates, including sample letters for tax returns, eSigning capabilities, and additional cloud storage options.

-

Are there any features in airSlate SignNow that help with tax return submissions?

Yes, airSlate SignNow includes features that are specifically useful for tax return submissions, such as document analytics, unlimited eSignatures, and real-time tracking. These tools help users ensure that their sample letter tax return and related documents are submitted promptly and accurately.

-

How can integrating airSlate SignNow benefit my tax return process?

Integrating airSlate SignNow can greatly enhance your tax return process by reducing the time spent on paperwork. With seamless integrations to popular accounting software and cloud storage services, you can easily access your sample letter tax return and other pertinent documents in one place.

-

Is airSlate SignNow secure for sending sensitive tax documents?

Absolutely. airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect sensitive information like your sample letter tax return. This ensures that all transactions and document submissions are safe and compliant with industry standards.

-

Can I access a library of sample letter tax return templates within airSlate SignNow?

Yes, airSlate SignNow provides users access to a library of sample letter tax return templates. This allows you to quickly find a relevant example, edit it to fit your specifics, and send it off without starting from scratch.

Get more for Sample Letter Tax

Find out other Sample Letter Tax

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF