Sample Letter Loan Application Form

Understanding the Letter Payment History

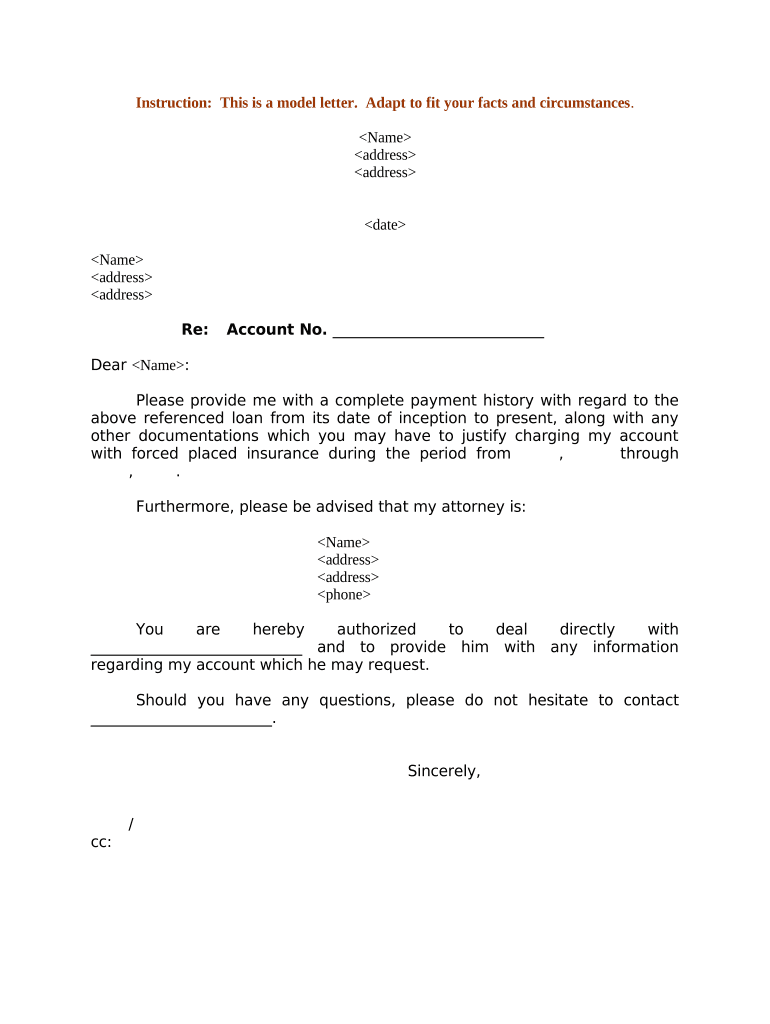

A letter payment history is a formal document that outlines the details of payments made to a creditor or lender over a specific period. This letter serves as a record of transactions, including dates, amounts, and any outstanding balances. It is essential for individuals or businesses seeking to verify their payment records for loan applications, credit assessments, or financial planning. Having an accurate payment history can significantly impact your ability to secure future financing or loans.

Key Elements of a Letter Payment History

When drafting a letter requesting payment history, it is important to include specific elements to ensure clarity and completeness. These elements typically include:

- Recipient Information: Include the name and address of the creditor or lender.

- Your Information: Provide your name, address, and account number.

- Request Details: Clearly state that you are requesting your payment history.

- Timeframe: Specify the period for which you need the payment history.

- Signature: Sign the letter to authenticate your request.

Steps to Complete the Letter Payment History Request

To effectively request your payment history, follow these steps:

- Gather your account information, including your account number and any previous correspondence with the lender.

- Draft your letter, ensuring it includes all key elements mentioned above.

- Review the letter for accuracy and completeness.

- Send the letter via your preferred method, whether by mail or electronically, depending on the lender's policies.

- Keep a copy of the letter for your records.

Legal Use of the Letter Payment History

A letter payment history can serve as a legal document in various situations, such as disputes regarding payment amounts or when applying for a loan. It is vital to ensure that the information provided is accurate and complies with relevant laws and regulations. In the United States, the Fair Credit Reporting Act (FCRA) provides guidelines on how payment histories should be maintained and reported, ensuring that consumers have access to accurate information.

Who Issues the Letter Payment History

The letter payment history is typically issued by the creditor or lender to whom payments have been made. This could include banks, credit unions, or other financial institutions. It is important to contact the specific institution directly to request this document, as procedures may vary between organizations.

Required Documents for Requesting Payment History

When requesting a letter payment history, you may need to provide certain documents to verify your identity and account ownership. Commonly required documents include:

- A government-issued photo ID.

- Your account statement or any previous correspondence with the lender.

- Proof of address, such as a utility bill or lease agreement.

Quick guide on how to complete sample letter loan application

Effortlessly Prepare Sample Letter Loan Application on Any Device

The management of online documents has gained signNow traction among companies and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the appropriate forms and securely store them online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage Sample Letter Loan Application on any device with the airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

The Easiest Way to Modify and eSign Sample Letter Loan Application Effortlessly

- Obtain Sample Letter Loan Application and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight important sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow simplifies your document management needs in just a few clicks from your preferred device. Edit and eSign Sample Letter Loan Application and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sample letter justifying PPP loan application?

A sample letter justifying a PPP loan application is a template that helps businesses articulate the reasons for applying for the Paycheck Protection Program. This letter typically highlights the applicant's need for financial support and elaborates on how the funds will be used to sustain payroll and operational expenses.

-

How can airSlate SignNow help me with my PPP loan application?

airSlate SignNow provides a seamless way to prepare and sign documents, including a sample letter justifying PPP loan application. Our intuitive platform allows you to quickly create and send your letter for eSignature, helping you expedite the application process.

-

Is there a cost involved in using airSlate SignNow for creating my letter?

airSlate SignNow offers various pricing plans that are designed to be cost-effective for businesses of all sizes. You can create and send a sample letter justifying PPP loan application for a minimal fee, ensuring you get the professional tools necessary at an affordable price.

-

What features does airSlate SignNow offer for document management?

With airSlate SignNow, you have access to features such as customizable templates, eSignature capabilities, document tracking, and secure cloud storage. These tools make it easy to manage your sample letter justifying PPP loan application alongside other important documents.

-

Can I save and reuse my sample letter for future applications?

Absolutely! airSlate SignNow allows you to save your sample letter justifying PPP loan application as a reusable template. This feature simplifies future applications or correspondence, ensuring you can quickly adapt the content as needed.

-

What integrations does airSlate SignNow support?

airSlate SignNow integrates seamlessly with a variety of popular business applications, such as Google Drive, Salesforce, and Dropbox. This allows for easy access to your documents, including your sample letter justifying PPP loan application, enhancing workflow efficiency.

-

How secure is my data with airSlate SignNow?

Security is a top priority at airSlate SignNow, which employs industry-standard encryption and authentication protocols. Your sample letter justifying PPP loan application and all other documents are protected to give you peace of mind as you conduct business.

Get more for Sample Letter Loan Application

Find out other Sample Letter Loan Application

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement