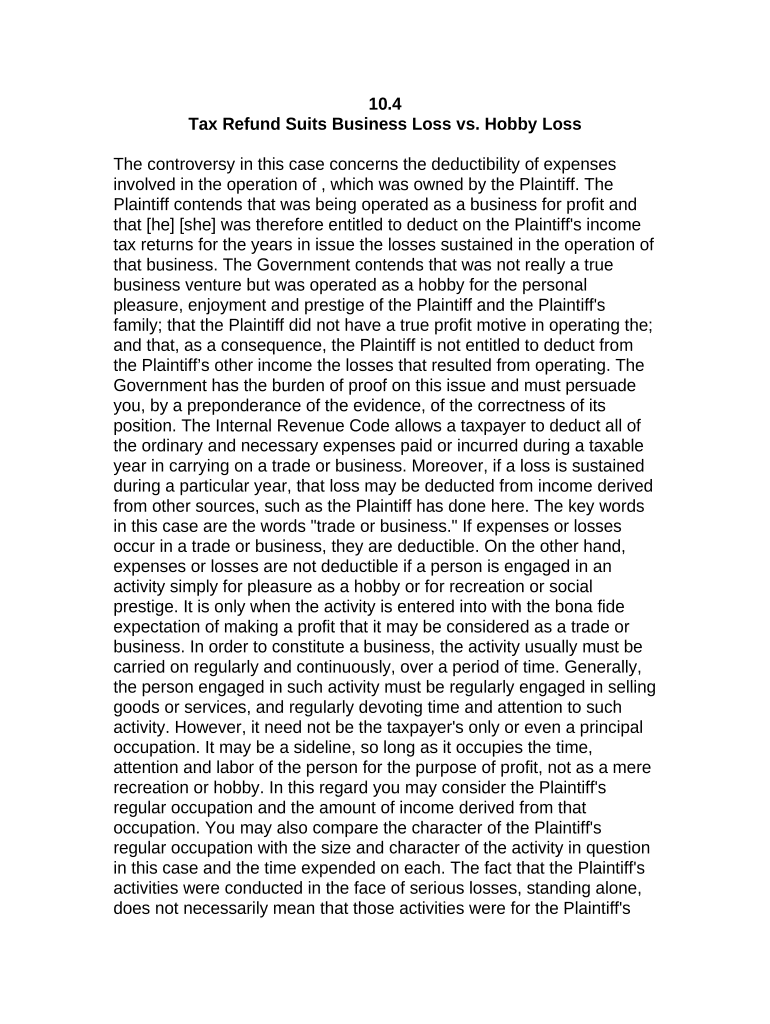

Jury Instruction 10 10 4 Business Loss Vs Hobby Loss Form

What makes the jury instruction 10104 business loss vs hobby loss form legally valid?

Because the society takes a step away from office working conditions, the completion of documents more and more happens electronically. The jury instruction 10104 business loss vs hobby loss form isn’t an exception. Dealing with it using digital tools is different from doing so in the physical world.

An eDocument can be regarded as legally binding given that certain needs are satisfied. They are especially crucial when it comes to signatures and stipulations related to them. Entering your initials or full name alone will not ensure that the organization requesting the sample or a court would consider it executed. You need a reliable solution, like airSlate SignNow that provides a signer with a digital certificate. Furthermore, airSlate SignNow keeps compliance with ESIGN, UETA, and eIDAS - key legal frameworks for eSignatures.

How to protect your jury instruction 10104 business loss vs hobby loss form when filling out it online?

Compliance with eSignature laws is only a fraction of what airSlate SignNow can offer to make document execution legal and secure. Furthermore, it gives a lot of opportunities for smooth completion security smart. Let's quickly run through them so that you can stay assured that your jury instruction 10104 business loss vs hobby loss form remains protected as you fill it out.

- SOC 2 Type II and PCI DSS certification: legal frameworks that are established to protect online user data and payment information.

- FERPA, CCPA, HIPAA, and GDPR: leading privacy standards in the USA and Europe.

- Two-factor authentication: adds an extra layer of protection and validates other parties identities via additional means, such as an SMS or phone call.

- Audit Trail: serves to capture and record identity authentication, time and date stamp, and IP.

- 256-bit encryption: sends the data securely to the servers.

Filling out the jury instruction 10104 business loss vs hobby loss form with airSlate SignNow will give greater confidence that the output document will be legally binding and safeguarded.

Quick guide on how to complete jury instruction 10104 business loss vs hobby loss

Complete jury instruction 10104 business loss vs hobby loss form seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily access the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage jury instruction 10104 business loss vs hobby loss form on any device using airSlate SignNow's Android or iOS applications and streamline any document-based procedure today.

The easiest way to alter and eSign jury instruction 10104 business loss vs hobby loss form effortlessly

- Find jury instruction 10104 business loss vs hobby loss form and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which only takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, via email, SMS, or invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow satisfies all your document management needs in just a few clicks from any device you prefer. Modify and eSign jury instruction 10104 business loss vs hobby loss form and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Video instructions and help with filling out and completing Jury Instruction 10 10 4 Business Loss Vs Hobby Loss Form

Instructions and help about Jury Instruction 10 10 4 Business Loss Vs Hobby Loss

Related searches to Jury Instruction 10 10 4 Business Loss Vs Hobby Loss

Create this form in 5 minutes!

People also ask

-

What is the Jury Instruction 10 10 4 Business Loss Vs Hobby Loss?

Jury Instruction 10 10 4 Business Loss Vs Hobby Loss is a legal guideline that differentiates between legitimate business losses and those resulting from hobbies. Understanding this distinction is crucial for business owners when filing taxes or seeking business losses. Our platform provides easy access to legal documents that can assist you in preparing properly under this instruction.

-

How can airSlate SignNow help with the Jury Instruction 10 10 4 Business Loss Vs Hobby Loss documentation?

airSlate SignNow simplifies the process of signing and sending legal documents related to Jury Instruction 10 10 4 Business Loss Vs Hobby Loss. Our platform allows you to create, customize, and eSign documents quickly, ensuring compliance with legal standards. With our user-friendly interface, managing your documentation becomes hassle-free.

-

Is airSlate SignNow an affordable solution for small businesses dealing with Jury Instruction 10 10 4 Business Loss Vs Hobby Loss?

Yes, airSlate SignNow offers cost-effective pricing plans tailored for small businesses. Our service provides signNow savings as it eliminates the need for costly in-person meetings and paperwork. You can easily manage your legal documents related to Jury Instruction 10 10 4 Business Loss Vs Hobby Loss without breaking the bank.

-

What features does airSlate SignNow provide for users needing assistance with Jury Instruction 10 10 4 Business Loss Vs Hobby Loss?

airSlate SignNow comes equipped with multiple features designed to streamline legal document management, including templates, collaborative tools, and eSignature integration. These features ensure you can efficiently create and manage documents associated with Jury Instruction 10 10 4 Business Loss Vs Hobby Loss. Our platform also supports compliance with legal requirements for added peace of mind.

-

Can I integrate airSlate SignNow with other software for handling Jury Instruction 10 10 4 Business Loss Vs Hobby Loss?

Absolutely! airSlate SignNow offers seamless integrations with various popular software applications, such as CRMs and document management systems. This allows for a streamlined workflow when handling documentation related to Jury Instruction 10 10 4 Business Loss Vs Hobby Loss. Connecting your tools enhances efficiency and simplifies the document management process.

-

What are the benefits of using airSlate SignNow for Jury Instruction 10 10 4 Business Loss Vs Hobby Loss?

Utilizing airSlate SignNow for Jury Instruction 10 10 4 Business Loss Vs Hobby Loss documentation offers numerous benefits, including time savings, improved accuracy, and enhanced security. Our platform allows you to sign documents electronically, reducing turnaround times and the risk of errors. Moreover, data protection features ensure your sensitive information remains secure.

-

Are there any tutorials on how to use airSlate SignNow for Jury Instruction 10 10 4 Business Loss Vs Hobby Loss?

Yes, airSlate SignNow provides a range of tutorials and resources to guide you through using our platform effectively for Jury Instruction 10 10 4 Business Loss Vs Hobby Loss documentation. These resources include step-by-step guides, video tutorials, and comprehensive FAQs. Our support team is also available to assist you with any specific questions you may have.

Get more for Jury Instruction 10 10 4 Business Loss Vs Hobby Loss

- Ecmo specialist training manual 4th edition pdf download form

- Solicitation letter tagalog 467980016 form

- Ss 4245 form

- Chapter 16 section 4 japanese aggression worksheet answers form

- Mpmsu enrollment login form

- International money transfer form 444863936

- Chapter 8 active reading worksheets cell reproduction answer key form

- Procurement services gpg bsupplierb profile change bgautengb bb form

Find out other Jury Instruction 10 10 4 Business Loss Vs Hobby Loss

- Help Me With eSign New Mexico Sports PPT

- How Can I eSign New Mexico Sports PPT

- Can I eSign New Mexico Sports PPT

- Can I eSign New Mexico Sports PPT

- Help Me With eSign New Mexico Sports PPT

- How To eSign New Mexico Sports PPT

- How Can I eSign New Mexico Sports PPT

- How Do I eSign New Mexico Sports PPT

- Help Me With eSign New Mexico Sports PPT

- How Can I eSign New Mexico Sports PPT

- Can I eSign New Mexico Sports PPT

- Can I eSign New Mexico Sports PPT

- How To eSign New Mexico Sports PPT

- How Do I eSign New Mexico Sports PPT

- How To eSign New Mexico Sports PPT

- How Do I eSign New Mexico Sports PPT

- Help Me With eSign New Mexico Sports PPT

- Help Me With eSign New Mexico Sports PPT

- How Can I eSign New Mexico Sports PPT

- Can I eSign New Mexico Sports PPT