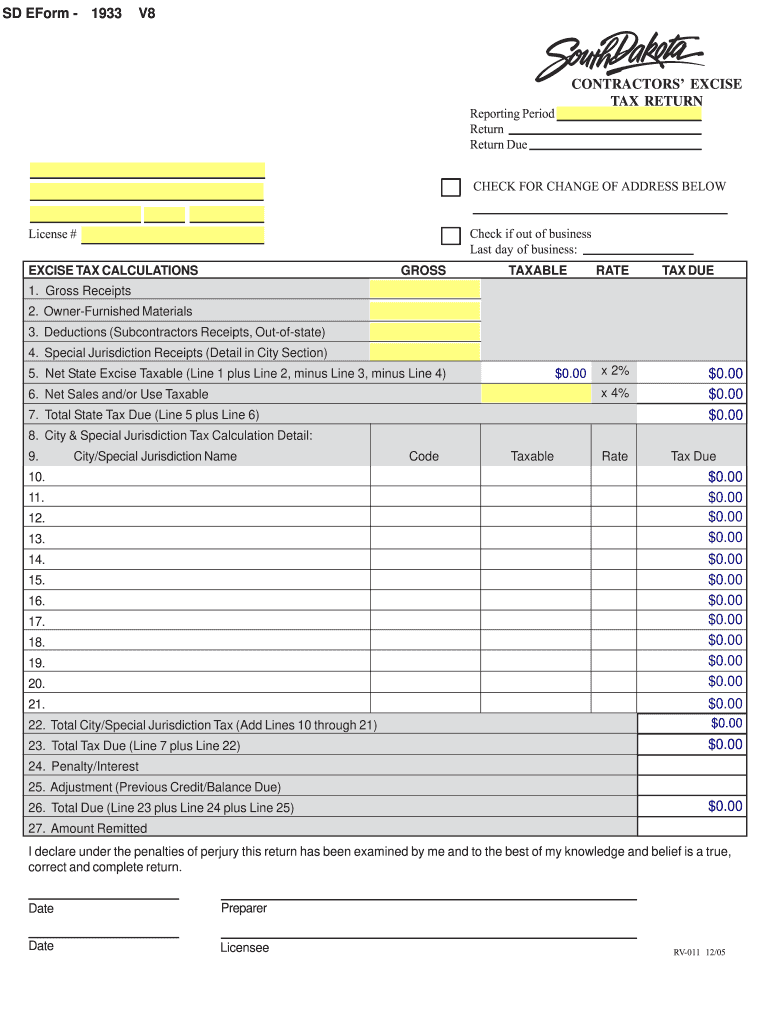

Contractors39 BExcise Tax Returnb State of South Dakota State Sd Form

Understanding the South Dakota Income Tax

The South Dakota income tax is unique as the state does not impose a personal income tax on its residents. This means that individuals living and working in South Dakota are not required to pay state income tax, which can be a significant financial advantage. However, businesses operating in South Dakota may be subject to different tax obligations, including sales tax and various business taxes. Understanding the implications of this tax structure is essential for both residents and business owners.

Filing Deadlines and Important Dates

Even though South Dakota does not have a personal income tax, businesses must adhere to specific filing deadlines for other taxes, such as sales tax and corporate income tax. Typically, sales tax returns are due on the 20th of the month following the reporting period. Corporations must file their annual returns by the last day of the month following the end of their fiscal year. Staying informed about these deadlines is crucial to avoid penalties.

Required Documents for Tax Filing

When filing taxes in South Dakota, it is important to have the necessary documentation ready. For businesses, this may include financial statements, sales records, and previous tax returns. While individuals do not need to prepare personal income tax documents, they should keep records of any other applicable taxes, such as property tax or sales tax on purchases. Proper documentation ensures compliance and facilitates smoother filing processes.

Form Submission Methods

Businesses in South Dakota can submit their tax forms through various methods. The most common options include online submissions via the South Dakota Department of Revenue website, mailing paper forms, or delivering them in person. Online filing is often the most efficient method, allowing for quicker processing times and immediate confirmation of submission. Understanding the available methods can help businesses choose the best option for their needs.

Penalties for Non-Compliance

Failure to comply with South Dakota tax regulations can result in significant penalties. Businesses that do not file their required tax returns on time may face late fees and interest on unpaid taxes. Additionally, repeated non-compliance can lead to more severe consequences, including legal action. It is essential for businesses to stay informed about their tax obligations and ensure timely submissions to avoid these penalties.

Eligibility Criteria for Business Taxes

While South Dakota does not impose a personal income tax, businesses must meet specific eligibility criteria for various taxes. For instance, sales tax applies to most retail sales, and businesses must register with the state to collect and remit this tax. Understanding these criteria is vital for compliance and helps businesses avoid potential issues with tax authorities.

Quick guide on how to complete contractors39 bexcise tax returnb state of south dakota state sd

Complete Contractors39 BExcise Tax Returnb State Of South Dakota State Sd effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed materials, as you can easily locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to design, modify, and eSign your documents promptly without any holdups. Handle Contractors39 BExcise Tax Returnb State Of South Dakota State Sd on any device with airSlate SignNow's Android or iOS applications and streamline any document-oriented process today.

The easiest method to alter and eSign Contractors39 BExcise Tax Returnb State Of South Dakota State Sd without hassle

- Locate Contractors39 BExcise Tax Returnb State Of South Dakota State Sd and then click Get Form to begin.

- Employ the tools we offer to complete your form.

- Emphasize notable sections of the documents or redact sensitive details using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature with the Sign tool, which takes moments and carries the same legal validity as a traditional handwritten signature.

- Verify the details and then click on the Done button to save your modifications.

- Choose your preferred method of submitting your form, whether by email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, cumbersome form navigation, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Contractors39 BExcise Tax Returnb State Of South Dakota State Sd while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How do I find out how much taxes I owe to the state of South Carolina?

Not a lengthy answer just read information : Tax Help Blog | Tax Problem Resolution | IRS Tax Debt Relief Information

-

How will enforcement of South Dakota V. Wayfair, that is collecting and remitting sales tax to states in which the business does not have a nexus or any business presence, work practically for small retail businesses?

I am just looking at the draft proposal from the Texas Comptroller (I have absolutely, positively no say in these matters) Highlights:Safe harbor Nexus: The Comptroller will not impose permit and collection responsibilities on out of state sellers whose total revenue from Texas sales in the preceding twelve calendar months is less than $500,000.The first twelve-month period for determining whether an out of state seller’s total revenue from Texas sales exceeds the safe harbor threshold amount: July 1, 2018 through June 30, 2019. The permitting and Texas sales tax collections would not begin until October 1, 2019.No retroactive application of the new law to out of state sellers that have no physical presence in Texas.The state legislature will be meeting in January 2019 to start their new session and hopefully there will be more guidance for Texas sales taxes after that.This is from the Comptroller’s guidance letter issued on June 27, 2018, “Gains from the ruling are likely to be lower than previous estimates of taxes uncollected by remote sellers. In the past year, for example, some remote sellers have volunteered to collect in anticipation of the Wayfair decision or for other reasons. Wayfair, the named plaintiff in this case, already collects Texas sales and use taxes. Also, in order to avoid imposing an undue burden on interstate commerce, the state will likely relieve some out-of-state sellers from collection responsibilities. More specific estimates will be available as the implementation and legislative process continues.”

-

Which areas are considered part of Yonkers when applying for a job in NY state? I noticed there's a separate tax form to fill out where you check off if you presently live in Yonkers or not. Are Tuckahoe and/or Crestwood included?

Crestwood IS a neighborhood in the city of Yonkers. Tuckahoe is NOT. Tuckahoe is a village in the town of Eastchester. Tuckahoe Road however is a street in Yonkers. It does not run through any other municipality. Another way for you to tell if you live in the city of Yonkers is if Mayor Mike Spano is your mayor. If he is, you are a resident of Yonkers.

-

How does one run for president in the united states, is there some kind of form to fill out or can you just have a huge fan base who would vote for you?

If you’re seeking the nomination of a major party, you have to go through the process of getting enough delegates to the party’s national convention to win the nomination. This explains that process:If you’re not running as a Democrat or Republican, you’ll need to get on the ballot in the various states. Each state has its own rules for getting on the ballot — in a few states, all you have to do is have a slate of presidential electors. In others, you need to collect hundreds or thousands of signatures of registered voters.

Create this form in 5 minutes!

How to create an eSignature for the contractors39 bexcise tax returnb state of south dakota state sd

How to create an eSignature for your Contractors39 Bexcise Tax Returnb State Of South Dakota State Sd online

How to create an electronic signature for your Contractors39 Bexcise Tax Returnb State Of South Dakota State Sd in Google Chrome

How to make an eSignature for putting it on the Contractors39 Bexcise Tax Returnb State Of South Dakota State Sd in Gmail

How to make an eSignature for the Contractors39 Bexcise Tax Returnb State Of South Dakota State Sd straight from your smart phone

How to make an eSignature for the Contractors39 Bexcise Tax Returnb State Of South Dakota State Sd on iOS

How to make an electronic signature for the Contractors39 Bexcise Tax Returnb State Of South Dakota State Sd on Android OS

People also ask

-

What is South Dakota income tax?

South Dakota is unique as it does not impose a personal income tax on its residents. This means businesses and individuals can benefit from a tax-friendly environment when using services like airSlate SignNow to manage documents and signatures without the burden of South Dakota income tax.

-

How does airSlate SignNow assist with managing South Dakota income tax documents?

With airSlate SignNow, businesses can easily create, send, and eSign critical documents related to South Dakota income tax filings. Our platform simplifies document management, allowing users to focus on tax strategy without the hassle of paperwork delays.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to suit different business needs. With our competitive pricing, including a cost-effective solution for both small and large enterprises, you can efficiently handle your South Dakota income tax documents at an affordable rate.

-

What features does airSlate SignNow provide for businesses dealing with South Dakota income tax?

Our platform includes features such as customizable templates, bulk sending, and secure cloud storage which are essential for businesses handling South Dakota income tax documents. These features save time and ensure compliance with local tax regulations.

-

Can I integrate airSlate SignNow with my accounting software for South Dakota income tax management?

Yes, airSlate SignNow seamlessly integrates with various accounting and tax software to streamline the management of your South Dakota income tax documents. This integration helps provide a comprehensive solution for tracking and submitting tax-related information.

-

How does airSlate SignNow ensure security for sensitive South Dakota income tax documents?

At airSlate SignNow, we prioritize the security of your documents, including those related to South Dakota income tax. Our platform uses advanced encryption and complies with industry standards to protect your sensitive data throughout the eSigning process.

-

What are the benefits of using airSlate SignNow for South Dakota income tax filing?

Using airSlate SignNow to manage your South Dakota income tax filings enhances efficiency and reduces paperwork. Our user-friendly interface and electronic signature capabilities ensure you can quickly complete necessary tax documents while maintaining compliance.

Get more for Contractors39 BExcise Tax Returnb State Of South Dakota State Sd

- Minutes for organizational meeting minnesota minnesota form

- Sample transmittal letter to secretary of states office to file articles of incorporation minnesota minnesota form

- Hearing notice form

- Js 44 civil cover sheet federal district court minnesota form

- Guardian ad litem 497312759 form

- Mn lead based paint form

- Mn lead based paint disclosure form

- Mn lease agreement template form

Find out other Contractors39 BExcise Tax Returnb State Of South Dakota State Sd

- Sign Oklahoma Insurance Limited Power Of Attorney Now

- Sign Idaho Legal Separation Agreement Online

- Sign Illinois Legal IOU Later

- Sign Illinois Legal Cease And Desist Letter Fast

- Sign Indiana Legal Cease And Desist Letter Easy

- Can I Sign Kansas Legal LLC Operating Agreement

- Sign Kansas Legal Cease And Desist Letter Now

- Sign Pennsylvania Insurance Business Plan Template Safe

- Sign Pennsylvania Insurance Contract Safe

- How Do I Sign Louisiana Legal Cease And Desist Letter

- How Can I Sign Kentucky Legal Quitclaim Deed

- Sign Kentucky Legal Cease And Desist Letter Fast

- Sign Maryland Legal Quitclaim Deed Now

- Can I Sign Maine Legal NDA

- How To Sign Maine Legal Warranty Deed

- Sign Maine Legal Last Will And Testament Fast

- How To Sign Maine Legal Quitclaim Deed

- Sign Mississippi Legal Business Plan Template Easy

- How Do I Sign Minnesota Legal Residential Lease Agreement

- Sign South Carolina Insurance Lease Agreement Template Computer