Disbursements Form

What is the disbursements receipts?

Disbursements receipts are essential documents that record the transfer of funds from one party to another, typically within a business context. They serve as proof of payment and detail the nature of the transaction, including the amount, date, and purpose. These receipts are vital for maintaining accurate financial records and ensuring transparency in financial dealings. They can be used for various purposes, such as expense tracking, auditing, and tax reporting.

Steps to complete the disbursements receipts

Completing disbursements receipts involves several straightforward steps to ensure accuracy and compliance. Begin by gathering all necessary information related to the transaction, including the payee's details, payment amount, and the date of disbursement. Next, fill out the receipt form, ensuring that all fields are completed accurately. Include a brief description of the payment purpose for clarity. After completing the form, review it for any errors before signing and dating the document. Finally, distribute copies to all relevant parties, ensuring that both the payer and payee retain a copy for their records.

Legal use of the disbursements receipts

Disbursements receipts hold legal significance as they provide documented proof of financial transactions. In the United States, these receipts are crucial for compliance with tax laws and regulations. They can be used as evidence in legal disputes regarding payments or financial transactions. To ensure their legal validity, it is essential to maintain accurate records and adhere to any applicable state or federal regulations governing financial documentation.

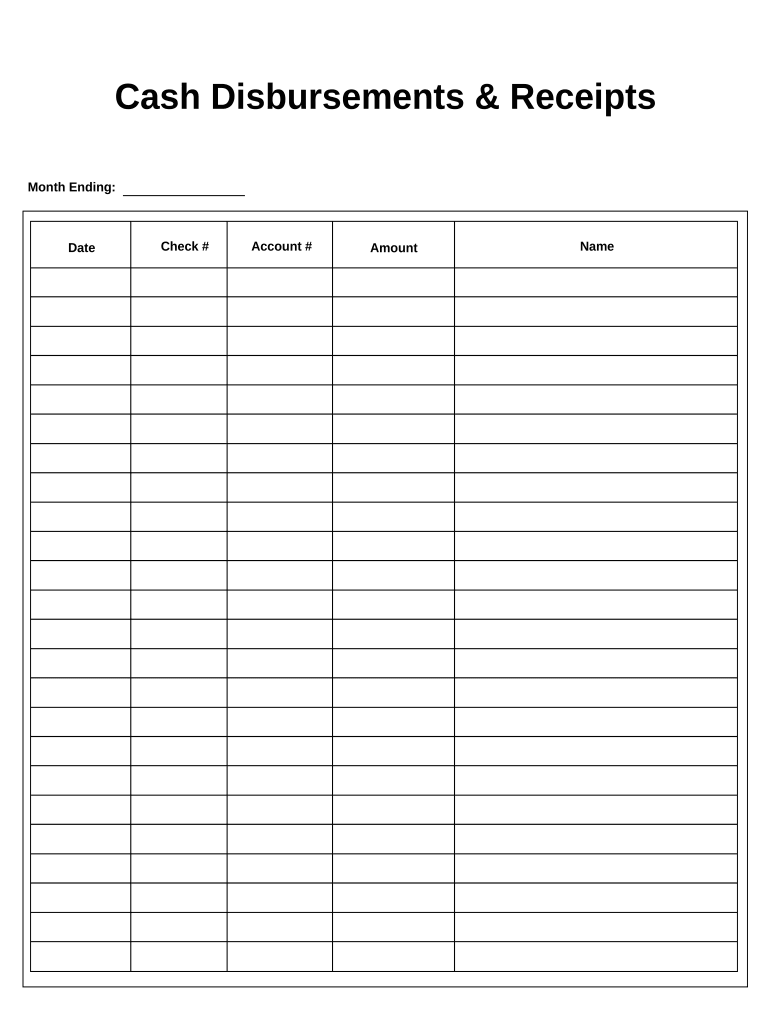

Key elements of the disbursements receipts

Several key elements must be included in disbursements receipts to ensure their effectiveness and legality. These elements typically include:

- Date: The date on which the payment was made.

- Payee Information: The name and contact details of the individual or entity receiving the payment.

- Payment Amount: The total sum disbursed.

- Purpose of Payment: A brief description explaining the reason for the disbursement.

- Signature: The signature of the person authorizing the payment, confirming its legitimacy.

Examples of using the disbursements receipts

Disbursements receipts can be utilized in various scenarios, illustrating their versatility in financial transactions. Common examples include:

- Business expenses, such as reimbursements for travel or supplies.

- Payments made to contractors or freelancers for services rendered.

- Refunds issued to customers for returned products.

- Charitable donations made by businesses to nonprofit organizations.

Filing deadlines / Important dates

While disbursements receipts themselves do not typically have specific filing deadlines, they play a crucial role in the broader context of financial reporting and tax compliance. Businesses should maintain these receipts throughout the fiscal year to support their financial statements and tax returns. It is advisable to review any relevant deadlines for tax filings to ensure that all supporting documentation, including disbursements receipts, is organized and available when needed.

Quick guide on how to complete disbursements 497334388

Prepare Disbursements easily on any device

Digital document management has gained traction among businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct format and securely preserve it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents quickly without hassles. Handle Disbursements on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to alter and electronically sign Disbursements with ease

- Obtain Disbursements and click on Get Form to begin.

- Utilize the resources we provide to fill out your form.

- Mark important sections of the documents or obscure sensitive data with tools that airSlate SignNow offers specifically for that function.

- Create your signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to store your changes.

- Choose how you prefer to send your form, by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Disbursements and ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are disbursements receipts in airSlate SignNow?

Disbursements receipts in airSlate SignNow serve as official documents that acknowledge the transfer of funds or assets. These receipts help businesses maintain accurate records of disbursements for accounting and tax purposes, ensuring transparency in financial transactions.

-

How does airSlate SignNow help in generating disbursements receipts?

airSlate SignNow simplifies the process of creating disbursements receipts by providing customizable templates. Users can fill in necessary details quickly and leverage eSignature capabilities to ensure that receipts are signed and legally binding in minutes.

-

What pricing plans does airSlate SignNow offer for managing disbursements receipts?

airSlate SignNow offers several pricing plans tailored for various business sizes. Each plan includes features for generating disbursements receipts, with options for additional functionalities like advanced integrations and team collaboration tools, ensuring you find the right fit for your budget.

-

Can I integrate disbursements receipts with my accounting software?

Yes, airSlate SignNow integrates seamlessly with various accounting software, allowing businesses to streamline their financial processes. By integrating disbursements receipts directly with your accounting system, you can manage your finances more efficiently and reduce manual data entry.

-

What are the benefits of using airSlate SignNow for disbursements receipts?

Using airSlate SignNow for disbursements receipts enhances efficiency by automating the document signing process, reducing turnaround time signNowly. Additionally, the platform ensures that all receipts are stored securely, making retrieval easy for audits or future references.

-

Is airSlate SignNow secure for handling disbursements receipts?

Absolutely! airSlate SignNow prioritizes the security of its users' data. All disbursements receipts are protected with industry-standard encryption, ensuring that sensitive financial information is secure throughout the signing and storage processes.

-

What types of businesses can benefit from disbursements receipts in airSlate SignNow?

Any business that needs to track expenditures or payments can benefit from disbursements receipts in airSlate SignNow. From freelancers to large corporations, the ability to create and manage these receipts enhances financial clarity and accountability across all industries.

Get more for Disbursements

Find out other Disbursements

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now