Job Expense Form

What is the Job Expense

The job expense refers to the costs associated with a specific job or project undertaken by an individual or business. These expenses can include materials, labor, travel, and other costs necessary for completing a job. Understanding job expenses is crucial for accurate financial reporting and budgeting. In many cases, these expenses can be deducted from taxable income, providing potential tax benefits for individuals and businesses alike.

Steps to complete the Job Expense

Completing a job expense form involves several key steps to ensure accuracy and compliance. First, gather all relevant receipts and documentation related to the expenses incurred. Next, categorize each expense according to its type, such as materials, labor, or travel. After categorization, enter the details into the job expense form, including dates, amounts, and descriptions of each expense. Finally, review the completed form for accuracy before submission to ensure all necessary information is included.

Legal use of the Job Expense

The legal use of job expenses is governed by tax laws and regulations. In the United States, the Internal Revenue Service (IRS) allows individuals and businesses to deduct certain job-related expenses from their taxable income, provided they meet specific criteria. It is essential to maintain accurate records and receipts to substantiate these deductions in case of an audit. Understanding the legal implications of job expenses can help individuals and businesses maximize their tax benefits while remaining compliant with the law.

Required Documents

To successfully complete a job expense form, several documents may be required. These typically include receipts for all expenses, invoices from service providers, and any relevant contracts or agreements related to the job. Additionally, individuals may need to provide proof of payment, such as bank statements or credit card statements, to validate the expenses claimed. Keeping organized records of these documents will facilitate the completion of the job expense form and ensure compliance with tax regulations.

Examples of using the Job Expense

Job expenses can apply to various scenarios across different professions. For instance, a freelance graphic designer may include costs for software subscriptions, design materials, and travel expenses for client meetings. Similarly, a contractor might document expenses for tools, labor, and transportation related to a construction project. By accurately tracking and reporting these expenses, individuals can gain insights into their business operations and potentially reduce their tax liabilities.

IRS Guidelines

The IRS provides specific guidelines regarding the deductibility of job expenses. According to IRS rules, expenses must be ordinary and necessary for the trade or business to qualify for deductions. Additionally, individuals must maintain adequate records to substantiate their claims. Familiarizing oneself with IRS guidelines can help ensure compliance and maximize potential deductions related to job expenses.

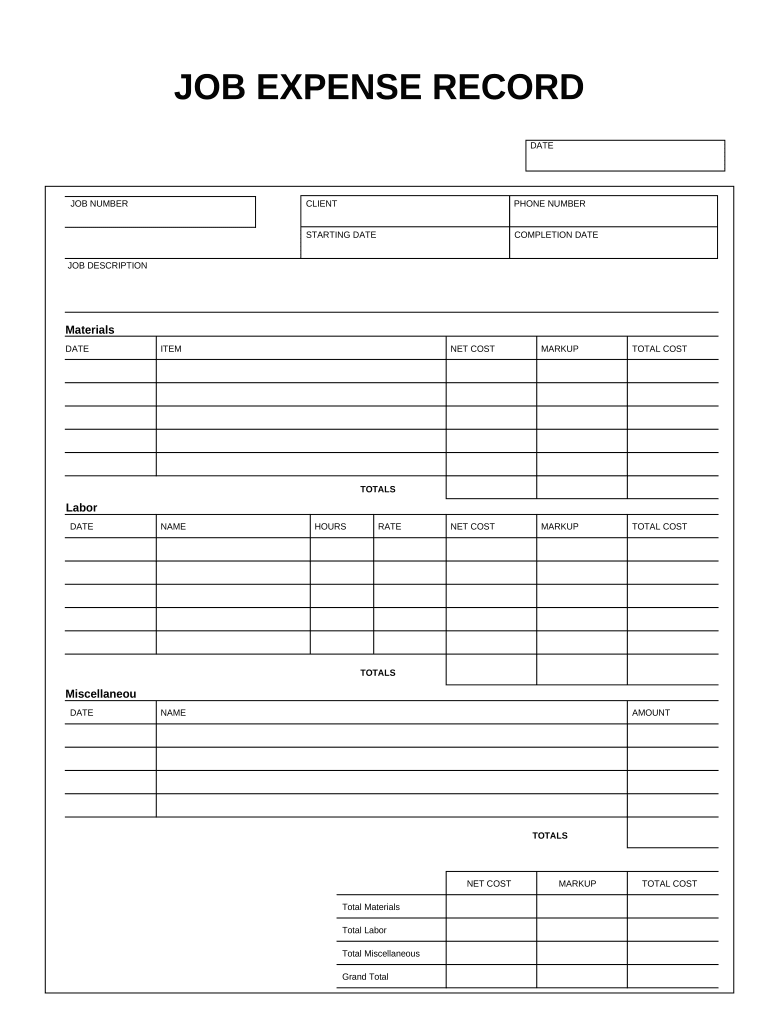

Quick guide on how to complete job expense

Effortlessly Prepare Job Expense on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the required form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without hassles. Handle Job Expense on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

Efficiently Alter and eSign Job Expense with Ease

- Locate Job Expense and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize key sections of the documents or obscure sensitive details with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select how you wish to send your form, be it via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you prefer. Adjust and eSign Job Expense and ensure outstanding communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a job record and how does airSlate SignNow help manage it?

A job record is a document that contains detailed information about an individual's employment history. With airSlate SignNow, businesses can easily create, send, and eSign job records, ensuring that all necessary information is accurately captured and securely stored.

-

How can I ensure my job records are secure with airSlate SignNow?

AirSlate SignNow employs advanced encryption and security measures to protect your job records. Our platform ensures that all documents are transmitted securely, and eSignatures are legally binding, providing peace of mind when handling sensitive information.

-

What are the pricing options for using airSlate SignNow for job records?

AirSlate SignNow offers various pricing plans tailored to fit different business needs. You can choose from several tiers depending on the features you require, including those specifically designed for managing job records effectively and affordably.

-

Can I integrate airSlate SignNow with other tools for managing job records?

Yes, airSlate SignNow seamlessly integrates with numerous applications and tools, allowing you to enhance your workflow when managing job records. Integrations with platforms like CRM systems and HR software help streamline processes and boost productivity.

-

What features does airSlate SignNow provide for tracking job record statuses?

AirSlate SignNow includes features that allow you to track the status of your job records in real-time. Notifications and reminders help you monitor when documents are sent, viewed, and signed, ensuring timely communication and follow-up.

-

Is it easy to create job records using airSlate SignNow?

Absolutely! AirSlate SignNow offers an intuitive interface that makes creating job records quick and easy. With customizable templates and drag-and-drop functionality, you can generate professional job records in just a few clicks.

-

How does airSlate SignNow help in compliance related to job records?

AirSlate SignNow helps businesses maintain compliance by ensuring that all job records are generated and signed according to legal standards. Our platform allows for customizable workflows that can adapt to your specific compliance needs.

Get more for Job Expense

- Form gm 509b fill online printable fillable blankpdffiller

- Form 2202a central registry third party

- Form gm 509b

- New hampshire central registry name search form

- Physician update form

- Disability premiums are paid 100 by the employee on a post tax basis form

- Nevada dhcfp serious occurence report form

- Fillable online ncleg kysa player reg forms 2012ldst

Find out other Job Expense

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple