Personnel Payroll Associate Checklist Form

What is the Personnel Payroll Associate Checklist

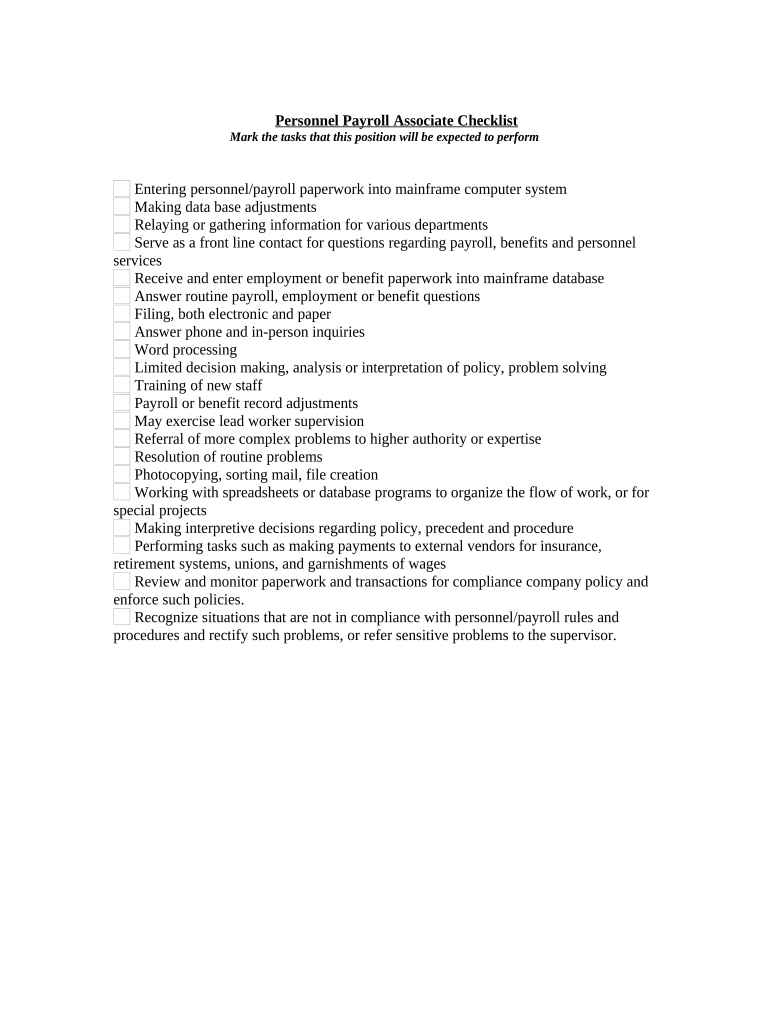

The Personnel Payroll Associate Checklist is a structured document designed to assist payroll professionals in ensuring that all necessary steps are completed accurately and efficiently during the payroll process. This checklist serves as a comprehensive guide, outlining essential tasks that must be performed each pay period to maintain compliance with federal and state regulations. It includes items such as verifying employee hours, calculating wages, and ensuring proper deductions for taxes and benefits.

Key elements of the Personnel Payroll Associate Checklist

Several key elements make up the Personnel Payroll Associate Checklist, which is crucial for effective payroll management. These elements typically include:

- Employee information verification: Ensuring that all employee records are up to date and accurate.

- Timekeeping accuracy: Confirming that all hours worked are correctly recorded and approved.

- Wage calculations: Accurately calculating gross pay, deductions, and net pay.

- Compliance checks: Verifying adherence to federal, state, and local payroll regulations.

- Reporting requirements: Preparing necessary payroll reports for internal and external stakeholders.

Steps to complete the Personnel Payroll Associate Checklist

Completing the Personnel Payroll Associate Checklist involves a series of systematic steps that ensure all payroll tasks are addressed. Here are the typical steps:

- Gather all relevant employee data, including hours worked and any changes in employment status.

- Review timekeeping records for accuracy and approval from supervisors.

- Calculate gross pay based on hourly rates or salaries, including overtime if applicable.

- Apply necessary deductions for taxes, benefits, and other withholdings.

- Prepare payroll reports and ensure they are distributed to the necessary parties.

- Submit payroll data for processing, whether through electronic means or traditional methods.

Legal use of the Personnel Payroll Associate Checklist

The legal use of the Personnel Payroll Associate Checklist is vital for ensuring compliance with various labor laws and regulations. This checklist helps payroll professionals adhere to guidelines set forth by the Fair Labor Standards Act (FLSA), Internal Revenue Service (IRS), and state labor departments. By following the checklist, businesses can mitigate risks associated with payroll errors and potential legal penalties.

Required Documents

To effectively utilize the Personnel Payroll Associate Checklist, certain documents are required. These documents typically include:

- Employee timecards or timesheets: Records of hours worked by employees.

- Payroll records: Documentation of previous payrolls for reference.

- Tax forms: Such as W-4s for withholding allowances and I-9s for employment eligibility.

- Benefit enrollment forms: Information regarding employee benefits that affect payroll deductions.

Examples of using the Personnel Payroll Associate Checklist

Utilizing the Personnel Payroll Associate Checklist can vary based on the size and structure of a business. For example:

- A small business may use the checklist to process payroll manually, ensuring each step is completed before submitting payroll.

- A larger corporation might integrate the checklist into their payroll software, allowing for automated checks and balances.

- Non-profit organizations may adapt the checklist to accommodate unique funding and reporting requirements.

Quick guide on how to complete personnel payroll associate checklist

Complete Personnel Payroll Associate Checklist effortlessly on any device

Online document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without any delays. Handle Personnel Payroll Associate Checklist on any platform using airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to alter and eSign Personnel Payroll Associate Checklist with ease

- Obtain Personnel Payroll Associate Checklist and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that function.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your alterations.

- Choose how you would like to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in a few clicks from a device of your choice. Edit and eSign Personnel Payroll Associate Checklist and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a payroll checklist template?

A payroll checklist template is a structured tool that assists businesses in managing their payroll process. It ensures that all necessary steps are followed, documents are completed, and deadlines are met to maintain compliance. Utilizing a payroll checklist template can streamline payroll operations and reduce the risk of errors.

-

How can a payroll checklist template benefit my business?

Implementing a payroll checklist template can signNowly enhance efficiency. It helps ensure timely payments to employees and compliance with tax regulations, ultimately reducing administrative burdens. By standardizing the payroll process with a checklist template, you can save time and resources, allowing you to focus on core business activities.

-

Does airSlate SignNow offer customizable payroll checklist templates?

Yes, airSlate SignNow provides customizable payroll checklist templates that cater to your specific business needs. You can easily modify templates to include your essential payroll steps, ensuring that they align with your internal processes. This flexibility makes it easier to maintain accuracy and compliance.

-

What features should I look for in a payroll checklist template?

When selecting a payroll checklist template, look for features such as step-by-step guidance, integration with existing software, and the ability to assign tasks to team members. A good template should also allow for electronic signatures and secure document storage, making processes more streamlined and efficient.

-

Is the payroll checklist template offered by airSlate SignNow cost-effective?

Absolutely! The payroll checklist template provided by airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. By optimizing your payroll process with this template, you can lower administrative costs and minimize the risk of costly errors, making it a wise investment for any organization.

-

What integrations does airSlate SignNow offer for its payroll checklist template?

airSlate SignNow seamlessly integrates with various accounting and HR software, such as QuickBooks and ADP, enhancing the utility of your payroll checklist template. These integrations allow for a smoother workflow, enabling data sharing and better overall payroll management. This connectivity helps ensure accurate records and a streamlined process.

-

Can I use the payroll checklist template on mobile devices?

Yes, the payroll checklist template from airSlate SignNow is fully optimized for mobile devices. This mobile accessibility allows users to complete and manage payroll tasks on-the-go, increasing flexibility and productivity. You can review and sign documents anytime, anywhere, making payroll management more convenient.

Get more for Personnel Payroll Associate Checklist

- Ohio crash report manual 5461266 form

- Pasrr evaluation summary please use the fillable form or

- Blank pasrr form for ohio

- Ambulance inspection form

- Nurse aide amp nontechnical services worker registry form

- Physicians data sheet quiz form

- Repackagerappdoc form

- Nurse aide temporary emergency waiver okgov form

Find out other Personnel Payroll Associate Checklist

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA