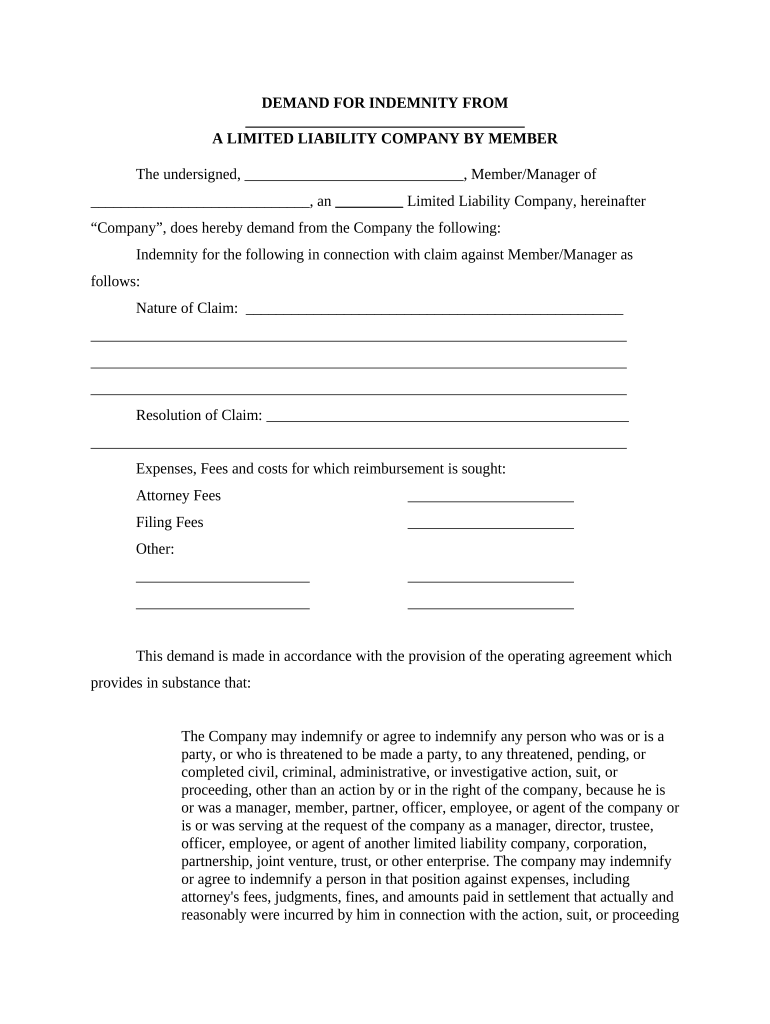

Limited Liability Company Form

What is the limited liability company?

A limited liability company (LLC) is a flexible business structure that combines the benefits of both corporations and partnerships. It offers personal liability protection to its members, meaning that personal assets are generally protected from business debts and claims. This structure is popular among small business owners due to its simplicity and tax advantages. An LLC can have one or more members, who can be individuals, corporations, or other LLCs, providing flexibility in ownership and management.

Key elements of the limited liability company

Several key elements define a limited liability company. These include:

- Limited liability protection: Members are not personally liable for the company's debts.

- Pass-through taxation: Profits and losses can be reported on members' personal tax returns, avoiding double taxation.

- Flexible management structure: Members can choose to manage the LLC themselves or appoint managers.

- Fewer formalities: LLCs have fewer ongoing formalities and compliance requirements compared to corporations.

Steps to complete the limited liability company

Completing the formation of a limited liability company involves several steps:

- Choose a name: The name must comply with state naming requirements and include "LLC" or "Limited Liability Company."

- Designate a registered agent: This individual or business will receive legal documents on behalf of the LLC.

- File Articles of Organization: Submit this document to the appropriate state agency, along with any required fees.

- Create an operating agreement: Although not always required, this document outlines the management structure and operating procedures.

- Obtain necessary licenses and permits: Depending on the business type and location, additional permits may be required.

Legal use of the limited liability company

The legal use of a limited liability company is governed by state laws, which vary across the United States. LLCs can engage in a wide range of business activities, but they must adhere to specific regulations, including maintaining proper records and filing annual reports. It is essential for LLCs to operate within the bounds of the law to maintain their limited liability status and protect their members from personal liability.

Eligibility criteria

To form a limited liability company, certain eligibility criteria must be met:

- At least one member is required, with no upper limit on the number of members.

- Members can be individuals, corporations, or other LLCs.

- The LLC must comply with state-specific regulations and naming conventions.

Required documents

To establish a limited liability company, several documents are typically required:

- Articles of Organization: The primary document filed with the state to create the LLC.

- Operating Agreement: A document that outlines the management structure and operational rules.

- Employer Identification Number (EIN): Required for tax purposes if the LLC has more than one member or employees.

Quick guide on how to complete limited liability company 497334560

Effortlessly prepare Limited Liability Company on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-conscious substitute to traditional printed and signed paperwork, allowing you to access the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents quickly and without delays. Manage Limited Liability Company from any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

The easiest way to edit and electronically sign Limited Liability Company with minimal effort

- Find Limited Liability Company and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet signature.

- Review the information and click on the Done button to preserve your modifications.

- Choose your preferred method for sharing your form, whether it be via email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, time-consuming form searches, or mistakes that necessitate printing new document versions. airSlate SignNow addresses all your document management needs within a few clicks from any device you choose. Edit and electronically sign Limited Liability Company to ensure excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an indemnity contract and why is it important?

An indemnity contract is a legal agreement where one party agrees to compensate another for certain damages or losses. This type of contract is crucial in protecting businesses from financial risks associated with unforeseen events. By utilizing an indemnity contract, businesses can safeguard their assets and ensure compliance with legal obligations.

-

How does airSlate SignNow facilitate the creation of an indemnity contract?

airSlate SignNow simplifies the process of creating an indemnity contract with its user-friendly interface and customizable templates. Users can easily input the necessary details, ensuring that the contract meets specific legal requirements. This streamlining saves time and minimizes the risk of errors in document preparation.

-

What features does airSlate SignNow offer for managing indemnity contracts?

airSlate SignNow provides features such as secure electronic signatures, document tracking, and collaboration tools specifically designed for managing indemnity contracts. These features enhance efficiency and transparency in the contract execution process. Additionally, the platform allows for easy archival and retrieval of contracts when needed.

-

Is airSlate SignNow cost-effective for creating indemnity contracts?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to create and manage indemnity contracts. With flexible pricing plans, companies can choose the option that best fits their needs, ranging from individual licenses to enterprise solutions. This affordability ensures that even small businesses can protect themselves with well-drafted indemnity contracts.

-

Can I integrate airSlate SignNow with other software for indemnity contracts?

Absolutely! airSlate SignNow offers integration capabilities with various software applications, enhancing the overall efficiency in managing indemnity contracts. Whether you're using CRM systems or project management tools, integration options are available to streamline your workflow and improve document management.

-

What benefits do users gain from using airSlate SignNow for indemnity contracts?

Users benefit from increased efficiency, reduced paperwork, and enhanced security when using airSlate SignNow for indemnity contracts. The electronic signature feature ensures quick and legally binding agreements, while the platform’s secure environment protects sensitive information. Overall, this leads to faster business operations and reduced risks.

-

How secure is airSlate SignNow for handling indemnity contracts?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption standards and complies with industry regulations to safeguard all documents, including indemnity contracts. Users can confidently handle sensitive agreements knowing their data is protected from unauthorized access.

Get more for Limited Liability Company

- Applicationresidential life ampamp housingvirginia commonwealth form

- Robert wikipedia form

- Facility request form lander university

- 20202021 v5 aggregate verification worksheet forms

- 2020 2021 v 5 aggregate verification worksheet dependent form

- Financial aid student loans and college scholarships edvisors form

- Aamu verification form

- Ssa priority list of acceptable evidence of identity documents form

Find out other Limited Liability Company

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer

- eSignature Colorado Charity LLC Operating Agreement Now

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed