Limited Liability Llc Form

What is the Limited Liability LLC

A limited liability company (LLC) is a popular business structure in the United States that combines the flexibility of a partnership with the liability protection of a corporation. Owners of an LLC, known as members, enjoy limited liability, meaning their personal assets are generally protected from business debts and claims. This structure is advantageous for small business owners, as it offers a straightforward way to manage taxes while providing a shield against personal liability.

How to Obtain the Limited Liability LLC

To establish a limited liability company, you must follow specific steps that may vary by state. Generally, the process includes:

- Selecting a unique name for your LLC that complies with state regulations.

- Filing Articles of Organization with the appropriate state agency, often the Secretary of State.

- Paying the required filing fee, which varies by state.

- Creating an Operating Agreement that outlines the management structure and operating procedures.

- Obtaining any necessary licenses or permits specific to your business type and location.

Steps to Complete the Limited Liability LLC

Completing the formation of a limited liability company involves several key actions:

- Choose a business name that adheres to state naming rules.

- Designate a registered agent who will receive legal documents on behalf of the LLC.

- File the Articles of Organization, ensuring all required information is accurate and complete.

- Draft an Operating Agreement, even if not required by your state, to clarify roles and responsibilities.

- Apply for an Employer Identification Number (EIN) from the IRS, which is necessary for tax purposes.

Legal Use of the Limited Liability LLC

The limited liability company is legally recognized in all fifty states, providing a framework for business operations that protects members from personal liability. To maintain this protection, it is crucial for an LLC to adhere to state laws, including filing annual reports and maintaining proper records. Additionally, members should avoid commingling personal and business finances to ensure the legal protections of the LLC remain intact.

IRS Guidelines

The Internal Revenue Service (IRS) treats LLCs as pass-through entities for tax purposes, meaning profits and losses are reported on the members' personal tax returns. LLCs can choose to be taxed as a corporation if it benefits the members. It is essential for LLCs to comply with IRS guidelines, including filing the appropriate tax forms and paying any applicable taxes to avoid penalties.

Required Documents

When forming a limited liability company, several key documents are necessary:

- Articles of Organization: This document officially establishes the LLC with the state.

- Operating Agreement: While not always required, this document outlines the management structure and operational guidelines of the LLC.

- Employer Identification Number (EIN): Required for tax purposes and to open a business bank account.

- State-specific licenses and permits: Depending on the nature of the business, additional documentation may be required.

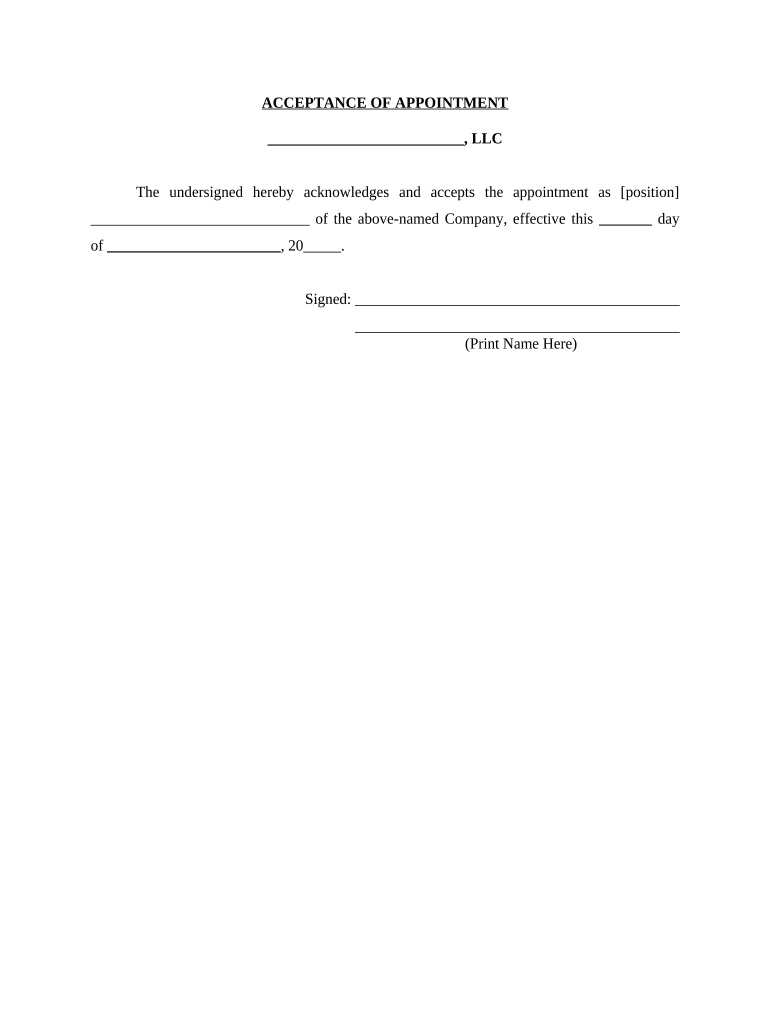

Quick guide on how to complete limited liability llc 497334562

Prepare Limited Liability Llc effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly, without delays. Manage Limited Liability Llc on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Limited Liability Llc without any hassle

- Locate Limited Liability Llc and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or cover sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious searches for forms, or mistakes requiring the printing of new document copies. airSlate SignNow meets your document management needs with just a few clicks from your selected device. Alter and eSign Limited Liability Llc to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a limited liability LLC and how does it work?

A limited liability LLC, or limited liability company, is a business structure that combines the liability protections of a corporation with the tax benefits of a partnership. In a limited liability LLC, owners, known as members, are not personally liable for the company's debts or liabilities, which helps protect their personal assets. This structure allows for flexibility in management and taxation, making it a popular choice for small businesses.

-

What are the main benefits of forming a limited liability LLC?

The main benefits of forming a limited liability LLC include personal liability protection, tax flexibility, and enhanced credibility. Members of a limited liability LLC are usually shielded from personal liability, meaning their personal assets are generally safe from creditors. Additionally, limited liability LLCs can choose how they are taxed, which can lead to potential savings.

-

How can airSlate SignNow assist with forming a limited liability LLC?

airSlate SignNow can streamline the process of forming a limited liability LLC by allowing you to eSign and send necessary documents quickly and securely. Our platform ensures that all paperwork is handled efficiently, reducing the time it takes to establish your LLC. We also offer templates and guidance to help you navigate the legal forms specific to your state.

-

What are the costs associated with a limited liability LLC?

The costs associated with a limited liability LLC can vary based on the state in which you form your business. Typically, you will incur filing fees, which can range from $50 to $500, as well as potential annual fees or taxes. With airSlate SignNow, you can save on administrative costs associated with paperwork by utilizing our cost-effective eSignature solutions.

-

Can a limited liability LLC have multiple owners?

Yes, a limited liability LLC can have multiple owners, referred to as members. The number of members can range from a single individual to hundreds in larger organizations. The flexibility to include multiple owners is one of the appealing aspects of forming a limited liability LLC, allowing for collaborative business efforts while maintaining personal liability protection.

-

Is it easy to dissolve a limited liability LLC?

Yes, dissolving a limited liability LLC is generally straightforward but it requires following specific state procedures. Members must typically agree to dissolve the company and then file the necessary dissolution form with the state. Additionally, airSlate SignNow can help facilitate this process by providing digital solutions for document management during the dissolution phase.

-

What features does airSlate SignNow offer for managing a limited liability LLC?

airSlate SignNow offers features such as secure eSigning, customizable templates, and collaboration tools that are essential for managing a limited liability LLC. Our platform allows members to easily share, edit, and eSign important documents, ensuring that all necessary agreements are executed swiftly and efficiently. This minimizes administrative burdens, allowing you to focus on growing your LLC.

Get more for Limited Liability Llc

Find out other Limited Liability Llc

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy