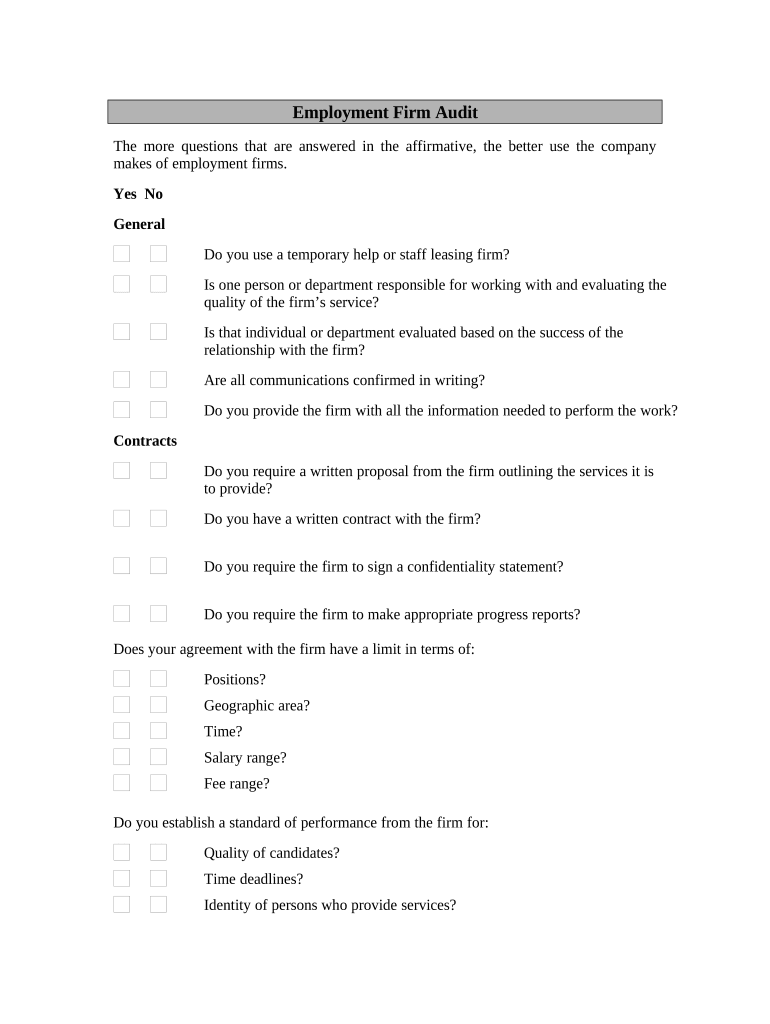

Employment Audit Form

What is the Employment Audit

An employment audit is a comprehensive review of a company's employment practices and policies. It assesses compliance with federal, state, and local labor laws, ensuring that the organization adheres to regulations regarding employee rights, workplace safety, and compensation. The audit typically examines various aspects, including hiring practices, employee classifications, wage and hour laws, and workplace policies. This process helps identify potential legal risks and areas for improvement, ultimately fostering a fair and compliant workplace environment.

How to use the Employment Audit

Utilizing the employment audit involves several key steps. First, gather all relevant documentation, including employee handbooks, job descriptions, and payroll records. Next, assess compliance by comparing current practices against legal requirements. This includes reviewing hiring practices to ensure non-discrimination and evaluating employee classifications to confirm proper status as exempt or non-exempt. After the assessment, compile findings into a report that outlines any discrepancies and recommendations for corrective actions. Regular audits help maintain compliance and improve overall workplace practices.

Key elements of the Employment Audit

Several critical elements comprise an effective employment audit. These include:

- Employee Classification: Reviewing how employees are classified to ensure compliance with wage and hour laws.

- Hiring Practices: Evaluating recruitment processes for fairness and adherence to anti-discrimination laws.

- Compensation Policies: Analyzing pay structures to ensure compliance with minimum wage and overtime regulations.

- Workplace Policies: Assessing employee handbooks and policies for clarity and legal compliance.

- Record Keeping: Ensuring proper documentation is maintained for all employment-related practices.

Steps to complete the Employment Audit

Completing an employment audit involves a systematic approach. Follow these steps:

- Preparation: Gather necessary documents, including employee files, policies, and payroll records.

- Assessment: Review each area of employment practices against relevant laws and regulations.

- Identify Issues: Document any compliance gaps or areas needing improvement.

- Recommendations: Develop actionable recommendations to address identified issues.

- Implementation: Work with management to implement necessary changes and updates.

- Follow-Up: Schedule regular audits to ensure ongoing compliance and improvement.

Legal use of the Employment Audit

The legal use of an employment audit is essential for mitigating risks associated with non-compliance. Conducting regular audits helps organizations identify potential legal issues before they escalate. It ensures adherence to laws such as the Fair Labor Standards Act (FLSA), the Equal Employment Opportunity Commission (EEOC) guidelines, and other relevant regulations. By proactively addressing compliance issues, businesses can protect themselves from costly litigation and penalties while promoting a fair workplace culture.

Required Documents

To conduct an employment audit effectively, several documents are essential. These include:

- Employee handbooks and policy manuals

- Job descriptions and employment contracts

- Payroll records and timekeeping systems

- Recruitment and hiring documentation

- Training materials and compliance training records

Having these documents readily available facilitates a thorough review and ensures a comprehensive audit process.

Quick guide on how to complete employment audit

Effortlessly Prepare Employment Audit on Any Device

Managing documents online has become increasingly popular among companies and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed papers, allowing you to obtain the correct version and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle Employment Audit on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign Employment Audit with Ease

- Locate Employment Audit and click on Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of your documents or obscure confidential information using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature with the Sign tool, which takes only seconds and carries the same legal weight as a traditional handwritten signature.

- Review all details and click on the Done button to save your changes.

- Select your preferred method of submitting your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Employment Audit and ensure exceptional communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an employment audit and why is it important?

An employment audit is a systematic review of an organization's employment practices to ensure compliance with labor laws and regulations. It is essential for identifying potential risks, reducing legal liability, and improving workplace policies. Conducting regular employment audits can enhance overall business efficiency and employee satisfaction.

-

How can airSlate SignNow facilitate my employment audit process?

airSlate SignNow simplifies the employment audit process by allowing businesses to send, sign, and manage essential documents electronically. With our eSignature solution, you can easily collect employee feedback and documents necessary for an effective employment audit. The platform's user-friendly features streamline documentation and help maintain compliance.

-

What features does airSlate SignNow offer for conducting an employment audit?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure online storage, all of which are advantageous for conducting an employment audit. These tools enable efficient document management and enhance collaboration among team members during the auditing process. With integrated tracking, you can keep tabs on document status and ensure completion.

-

Is airSlate SignNow cost-effective for small businesses performing employment audits?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses conducting employment audits. Our flexible pricing plans cater to different needs, making it easier for smaller organizations to stay compliant without breaking the bank. Investing in airSlate SignNow can save time and money during your employment audit.

-

Can airSlate SignNow integrate with other tools for employment audit preparation?

Absolutely! airSlate SignNow seamlessly integrates with various third-party applications, such as Google Drive, Salesforce, and more. This integration capability supports the efficiency of data management and document sharing, essential for a thorough employment audit. By connecting your existing tools, you can streamline the audit preparation process.

-

How secure is airSlate SignNow for sensitive employment audit documents?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and multiple authentication methods to protect sensitive documents during the employment audit process. You can trust that your data remains confidential and secure while complying with industry standards.

-

What support does airSlate SignNow offer during an employment audit?

airSlate SignNow provides comprehensive support through our dedicated customer service team, available to assist you during your employment audit. We offer resources such as tutorials, guides, and FAQs to help you maximize the platform's features. Our support team is here to ensure a smooth experience throughout the auditing process.

Get more for Employment Audit

- Warranty retailer return log xikar form

- 2019 leadership clinic application form

- General human resources truckee meadows community form

- Search page 1520 family history of cardiac disease form

- Kaiser permanente release of medical information services

- 1541 general requirements california department of form

- Price transparency and incomplete contracts in health care form

- Conditionsrestrictions form

Find out other Employment Audit

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe