Cut0165 1s Form

What is the Cut0165 1s Form

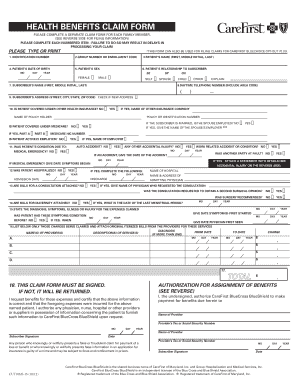

The Cut0165 1s Form is a specific document used primarily for tax purposes in the United States. It serves as a means for individuals or businesses to report certain types of income or financial information to the Internal Revenue Service (IRS). Understanding the purpose of this form is crucial for compliance with federal tax regulations. Properly completing and submitting the Cut0165 1s Form ensures that taxpayers meet their obligations and can avoid potential penalties.

How to use the Cut0165 1s Form

Using the Cut0165 1s Form involves several steps that require attention to detail. First, gather all necessary financial documents, such as income statements and expense records. Next, carefully fill out the form, ensuring that all information is accurate and complete. It is important to review the form for any errors before submission. Once completed, the form can be submitted electronically or via mail, depending on the specific requirements set by the IRS.

Steps to complete the Cut0165 1s Form

Completing the Cut0165 1s Form involves a systematic approach:

- Collect all relevant financial documents needed for accurate reporting.

- Begin filling out the form, starting with personal or business identification information.

- Input all income details, including wages, dividends, and other sources of income.

- Document any deductions or credits that apply to your situation.

- Review the completed form for accuracy and completeness.

- Submit the form according to the IRS guidelines, either electronically or by mail.

Legal use of the Cut0165 1s Form

The legal use of the Cut0165 1s Form is governed by IRS regulations. This form must be completed accurately to ensure compliance with tax laws. Failure to use the form correctly can result in legal consequences, including potential audits or penalties. It is essential for taxpayers to understand their rights and responsibilities when using this form, ensuring that all information provided is truthful and complete.

Key elements of the Cut0165 1s Form

Several key elements are critical to the Cut0165 1s Form:

- Identification Information: This includes the taxpayer's name, address, and Social Security number or Employer Identification Number.

- Income Reporting: Accurate reporting of all sources of income is necessary for compliance.

- Deductions and Credits: Identifying applicable deductions can reduce taxable income.

- Signature: The form must be signed and dated to validate the information provided.

Form Submission Methods

The Cut0165 1s Form can be submitted through various methods, depending on the preferences of the taxpayer and IRS guidelines. Options include:

- Online Submission: Taxpayers may use IRS-approved e-filing systems for quick and secure submission.

- Mail: The form can be printed and sent via postal service to the appropriate IRS address.

- In-Person: Some taxpayers may choose to deliver the form directly to an IRS office, ensuring it is received on time.

Quick guide on how to complete cut0165 1s form

Effortlessly Complete Cut0165 1s Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents promptly without delays. Manage Cut0165 1s Form from any device using the airSlate SignNow apps available for Android or iOS, and streamline any document-related processes today.

The Easiest Method to Modify and Electronically Sign Cut0165 1s Form Stress-Free

- Locate Cut0165 1s Form and click on Get Form to begin.

- Utilize the tools we provide to finish your document.

- Highlight pertinent sections of the documents or obscure sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Cut0165 1s Form to ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the cut0165 1s form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Cut0165 1s Form used for?

The Cut0165 1s Form is designed for organizations to streamline document workflows and ensure compliance. It simplifies the process of collecting signatures and managing documents, making it easier for businesses to operate efficiently.

-

How can I send a Cut0165 1s Form for eSignature?

You can easily send a Cut0165 1s Form for eSignature by uploading the document to airSlate SignNow, adding relevant signers, and customizing the message. The process is quick and user-friendly, ensuring that your documents are signed promptly.

-

What are the key features of the Cut0165 1s Form in airSlate SignNow?

The Cut0165 1s Form in airSlate SignNow offers features such as customizable templates, multi-signature support, and tracking of document status. These functionalities empower users to manage their documents seamlessly and maintain professionalism.

-

Is airSlate SignNow cost-effective for businesses using the Cut0165 1s Form?

Yes, airSlate SignNow provides a cost-effective solution for businesses utilizing the Cut0165 1s Form. With competitive pricing plans and robust features, companies can save time and reduce costs associated with traditional document management.

-

Can I integrate the Cut0165 1s Form with other applications?

Absolutely! airSlate SignNow allows for seamless integration with a variety of popular applications, including CRM systems and cloud storage services. This enhances productivity by enabling users to manage the Cut0165 1s Form alongside their other tools.

-

What benefits does the Cut0165 1s Form offer for my business?

Utilizing the Cut0165 1s Form offers numerous benefits, including enhanced efficiency in document processing and reduced turnaround times for signatures. This leads to improved workflow and allows your business to focus on core activities.

-

Is it easy to track the status of the Cut0165 1s Form?

Yes, airSlate SignNow provides real-time tracking of the Cut0165 1s Form, allowing you to monitor when the document has been viewed, signed, or completed. This level of visibility ensures you stay informed throughout the signing process.

Get more for Cut0165 1s Form

Find out other Cut0165 1s Form

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe

- Can I Sign West Virginia Personal loan contract template

- How Do I Sign Hawaii Real estate sales contract template

- Sign Kentucky New hire forms Myself

- Sign Alabama New hire packet Online

- How Can I Sign California Verification of employment form

- Sign Indiana Home rental application Online

- Sign Idaho Rental application Free

- Sign South Carolina Rental lease application Online

- Sign Arizona Standard rental application Now

- Sign Indiana Real estate document Free

- How To Sign Wisconsin Real estate document

- Sign Montana Real estate investment proposal template Later

- How Do I Sign Washington Real estate investment proposal template

- Can I Sign Washington Real estate investment proposal template

- Sign Wisconsin Real estate investment proposal template Simple

- Can I Sign Kentucky Performance Contract

- How Do I Sign Florida Investment Contract