Flood Insurance Authorization Form

What is the Flood Insurance Authorization

The Flood Insurance Authorization form is a crucial document that allows property owners to authorize their insurance provider to access and manage their flood insurance policy. This form is particularly important for those living in flood-prone areas, as it ensures that they have the necessary coverage in place to protect their property from potential flood damage. By completing this form, individuals can facilitate communication between themselves and their insurance company, streamlining the process of obtaining and maintaining flood insurance.

Steps to complete the Flood Insurance Authorization

Completing the Flood Insurance Authorization involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary personal information, including your name, address, and policy details. Next, fill out the form carefully, ensuring that all fields are completed. It is essential to review the form for any errors or omissions before submission. Once completed, you can sign the form electronically or manually, depending on your preference. Finally, submit the form to your insurance provider using the preferred method, whether online or via mail.

Legal use of the Flood Insurance Authorization

The legal use of the Flood Insurance Authorization form is governed by various regulations that ensure the document is valid and enforceable. In the United States, electronic signatures are recognized under the ESIGN Act and UETA, which means that signing the form electronically is legally binding as long as specific criteria are met. It is important to ensure that the form is filled out accurately and submitted according to your insurance provider's guidelines to maintain its legal standing.

Key elements of the Flood Insurance Authorization

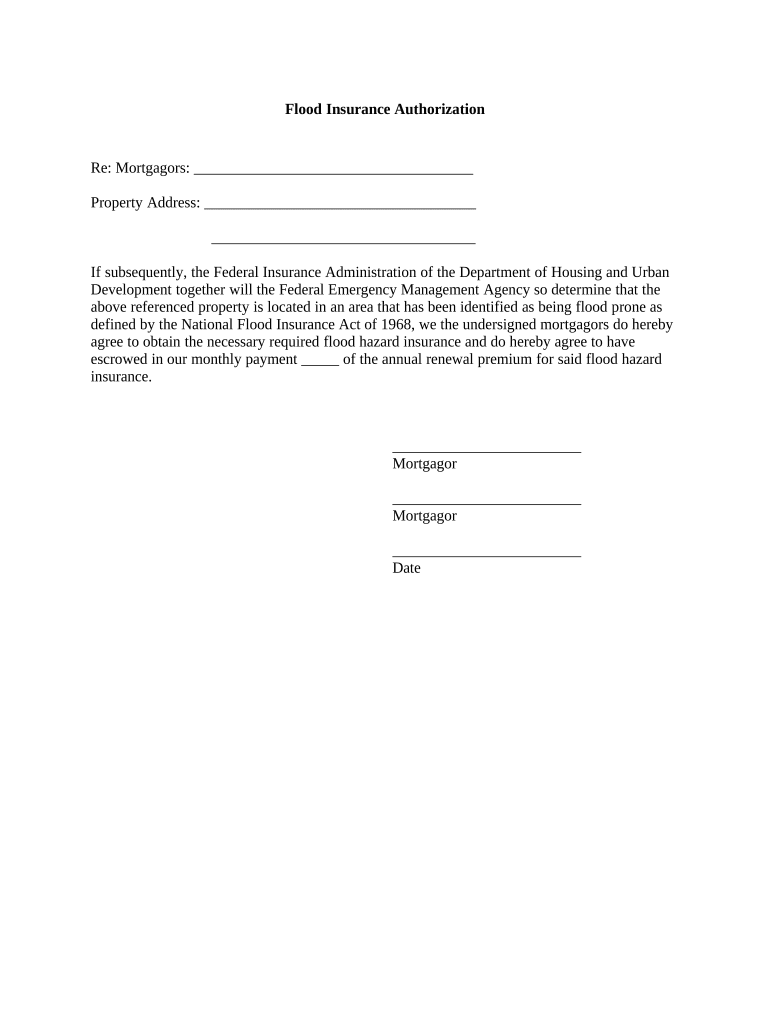

Several key elements must be included in the Flood Insurance Authorization to ensure its effectiveness. These elements typically include:

- Property Information: Details about the property being insured, including address and type of structure.

- Policyholder Information: The name and contact information of the individual or entity holding the insurance policy.

- Authorization Statement: A clear statement granting permission for the insurance provider to access and manage the flood insurance policy.

- Signature: The signature of the policyholder, which can be electronic or handwritten, confirming the authorization.

How to use the Flood Insurance Authorization

Using the Flood Insurance Authorization form effectively involves understanding its purpose and ensuring it is submitted correctly. After filling out the form, you can use it to communicate with your insurance provider about your flood insurance policy. This may include requests for updates, changes to coverage, or claims processing. It is advisable to keep a copy of the completed form for your records, as it serves as proof of authorization and can be referenced in future communications with your insurer.

Who Issues the Form

The Flood Insurance Authorization form is typically issued by insurance providers that offer flood insurance policies. These providers may include private insurance companies or government programs such as the National Flood Insurance Program (NFIP). It is essential to obtain the correct form from your specific insurance provider to ensure compliance with their requirements and to facilitate the authorization process.

Quick guide on how to complete flood insurance authorization 497334716

Complete Flood Insurance Authorization effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents rapidly without any holdups. Manage Flood Insurance Authorization on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Flood Insurance Authorization seamlessly

- Locate Flood Insurance Authorization and click on Get Form to begin.

- Make use of the tools we provide to finalize your form.

- Emphasize relevant sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature with the Sign feature, which takes only a few seconds and possesses the same legal validity as a conventional ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Alter and eSign Flood Insurance Authorization and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Flood Insurance Authorization?

Flood Insurance Authorization is a crucial document that allows insurers to access vital information needed to provide coverage. It streamlines the process of obtaining flood insurance by granting permission to review necessary records. airSlate SignNow simplifies this process, ensuring that users can easily eSign and send the authorization.

-

How does airSlate SignNow facilitate Flood Insurance Authorization?

airSlate SignNow provides a user-friendly interface that allows businesses to create, send, and eSign Flood Insurance Authorization documents effortlessly. With customizable templates and straightforward navigation, users can streamline the authorization process without any hassle. This not only saves time but also enhances productivity.

-

What are the benefits of using airSlate SignNow for Flood Insurance Authorization?

Using airSlate SignNow for Flood Insurance Authorization offers several benefits, including faster processing times, reduced paperwork, and enhanced security. Users can track the status of their authorizations in real-time, ensuring they stay informed throughout the process. Additionally, eSigning eliminates the need for printing and scanning, making the process more efficient.

-

Is there a cost associated with Flood Insurance Authorization on airSlate SignNow?

Yes, there are costs associated with using airSlate SignNow for Flood Insurance Authorization; however, the solution is designed to be cost-effective. The pricing plans cater to various business needs, providing flexibility and scalability. Investing in this system can lead to signNow time and cost savings in the long run.

-

Can I integrate airSlate SignNow with other applications for Flood Insurance Authorization?

Absolutely, airSlate SignNow offers integrations with various applications, enhancing its functionality for Flood Insurance Authorization. Integrating with CRM systems, document management tools, and other platforms allows for seamless workflows. This connectivity optimizes user experience and improves overall efficiency.

-

How secure is the Flood Insurance Authorization process with airSlate SignNow?

The security of Flood Insurance Authorization processes is a top priority for airSlate SignNow. The platform complies with industry standards and utilizes encryption protocols to protect sensitive information. Users can rest assured that their data is safe while eSigning and managing authorizations.

-

Is training available for using airSlate SignNow for Flood Insurance Authorization?

Yes, airSlate SignNow provides comprehensive training and support for users managing Flood Insurance Authorization documents. Resources include tutorials, webinars, and customer support to help users navigate the platform effectively. This ensures that businesses maximize the benefits of using airSlate SignNow.

Get more for Flood Insurance Authorization

- Australian humanitarian visa form 842 2011

- Filled form 80 personal particulars for assessment including 2012

- Effective 23 march 2013 australian embassy in the philippine form

- Form b 1006 2013

- Online forms immigration and citizenship department of home

- 842 application for an offshore humanitarian visa refugee and form

- Form 80 visa resident australia 2014

- Certificate of evidence of resident status form

Find out other Flood Insurance Authorization

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation