Exempt Form

What is the Exempt Employee Classification?

The term "exempt employees" refers to workers who are exempt from the Fair Labor Standards Act (FLSA) minimum wage and overtime pay requirements. This classification typically includes employees who perform specific types of work, such as executive, administrative, professional, and outside sales roles. Understanding this classification is crucial for both employees and employers, as it impacts compensation structures and work expectations.

Exempt employees usually receive a salary rather than an hourly wage and must meet certain criteria, including job duties and salary thresholds set by the Department of Labor. This designation helps businesses manage labor costs while ensuring that employees in these roles are compensated fairly for their responsibilities.

Eligibility Criteria for Exempt Employees

To qualify as exempt employees, individuals must meet specific eligibility criteria outlined by the FLSA. These criteria include:

- Salary Basis: Employees must earn a minimum salary, which is currently set at $684 per week in most cases.

- Job Duties: The employee's primary duties must fall within one of the exempt categories, such as executive, administrative, or professional tasks.

- Independent Judgment: Employees must regularly exercise discretion and independent judgment in their roles.

Employers must carefully evaluate these criteria to ensure compliance and avoid misclassification, which can lead to legal issues and financial penalties.

Steps to Complete the Exempt Employee Documentation

When documenting exempt employee status, employers should follow a structured process to ensure compliance with legal requirements. The steps include:

- Assess Job Roles: Review job descriptions to determine if the roles meet the criteria for exemption.

- Document Salary Information: Ensure that salary levels meet or exceed the required thresholds.

- Maintain Records: Keep thorough records of employee duties, salary, and any relevant evaluations.

- Review Regularly: Periodically reassess employee classifications to adapt to any changes in job responsibilities or labor laws.

By following these steps, businesses can maintain compliance and protect themselves from potential claims related to misclassification.

Legal Use of the Exempt Employee Classification

Understanding the legal framework surrounding exempt employees is essential for compliance. The FLSA outlines the criteria for exemption, and employers must adhere to these guidelines to avoid penalties. Misclassifying employees as exempt when they do not meet the criteria can result in back pay for unpaid overtime and legal action.

Employers should also be aware of state-specific laws that may impose stricter requirements than federal regulations. It is important to consult legal counsel or human resources professionals to ensure that all classifications are compliant with both federal and state laws.

IRS Guidelines for Exempt Employees

The Internal Revenue Service (IRS) provides guidelines that help define the tax implications for exempt employees. While exempt employees are not entitled to overtime pay, they are subject to income tax withholding just like non-exempt employees. Employers must accurately report wages and withhold appropriate taxes on salaries paid to exempt employees.

Additionally, employers should ensure that their payroll systems are equipped to handle the unique tax considerations associated with exempt classifications, including any benefits that may differ from those of hourly employees.

Examples of Exempt Employee Roles

Common examples of exempt employee roles include:

- Executives: Individuals responsible for managing a company or a department.

- Administrative Professionals: Employees who perform office tasks that support the operations of the business.

- Creative Professionals: Workers in artistic fields, such as graphic designers or writers, who exercise creativity and independent judgment.

These roles typically require specialized knowledge and skills, justifying their exempt status under the FLSA.

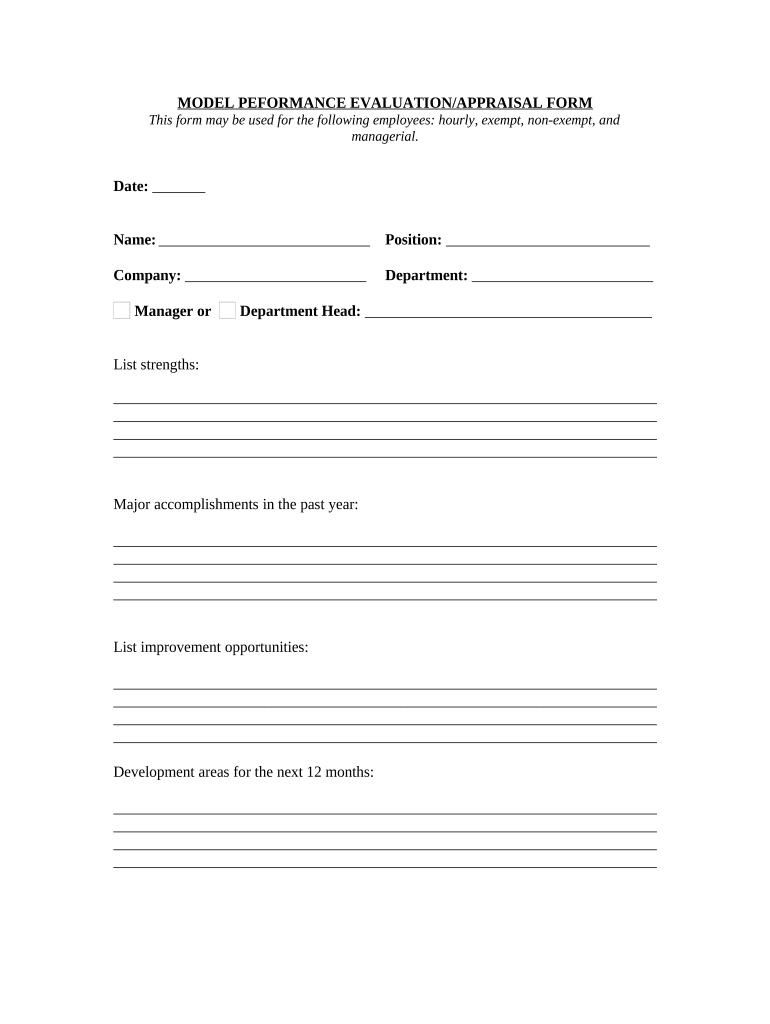

Quick guide on how to complete exempt 497334857

Prepare Exempt effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to easily find the necessary form and securely save it online. airSlate SignNow provides you with all the tools needed to create, modify, and eSign your documents swiftly and without delays. Handle Exempt on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign Exempt effortlessly

- Obtain Exempt and select Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and eSign Exempt and guarantee clear communication at every stage of the form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are exempt employees and how does it impact document signing?

Exempt employees are those not entitled to overtime pay under the Fair Labor Standards Act (FLSA). Understanding this classification is crucial for businesses when managing workflows related to document signing, as it can affect the approval hierarchies and compliance requirements when using solutions like airSlate SignNow.

-

How can airSlate SignNow help manage agreements with exempt employees?

airSlate SignNow provides a streamlined process for creating, sending, and signing agreements specifically tailored to exempt employees. By automating the document flow, businesses can ensure that all forms are properly signed and stored, which enhances compliance and reduces administrative burdens for exempt employee agreements.

-

What features does airSlate SignNow offer for managing exempt employee contracts?

airSlate SignNow offers features like customizable templates, secure electronic signatures, and audit trails that are beneficial for managing exempt employee contracts. These features help businesses ensure that they are compliant with laws regarding exemptions and streamline contract management processes.

-

Is there a pricing plan that supports small businesses with exempt employees?

Yes, airSlate SignNow offers various pricing plans to accommodate businesses of all sizes, including those with exempt employees. The plans are cost-effective and designed to provide essential eSigning features that small businesses need without overwhelming costs.

-

What benefits does airSlate SignNow provide for HR departments managing exempt employees?

For HR departments, airSlate SignNow enhances efficiency by simplifying the signing process for exempt employees' contracts and documents. It reduces the time spent on manual tasks and enables HR teams to focus on strategic initiatives by automating document workflows.

-

Can airSlate SignNow integrate with other HR software for managing exempt employees?

Absolutely! airSlate SignNow can integrate seamlessly with popular HR software solutions. This integration allows businesses to manage records and documents related to exempt employees more effectively, ensuring that all eSigned documents are easily accessible within existing systems.

-

How does airSlate SignNow ensure the security of documents for exempt employees?

Security is a top priority for airSlate SignNow. It employs advanced encryption methods and secure servers to safeguard documents related to exempt employees, ensuring that sensitive information is protected throughout the document signing process.

Get more for Exempt

- 2018 gaston college registration form

- 2019 norco college parent income verification form

- 2019 drexel university verification checklist form

- 2017 uco dependent student verification form v5

- 2020 drexel university consortium agreement form

- 2019 uco dependent student verification form v4

- 2019 uconn program policies consents and liability waiver form

- 2020 lone star college application for prior learning assessment form

Find out other Exempt

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice