W 9 Rev January Form

What is the W-9 Rev January Form

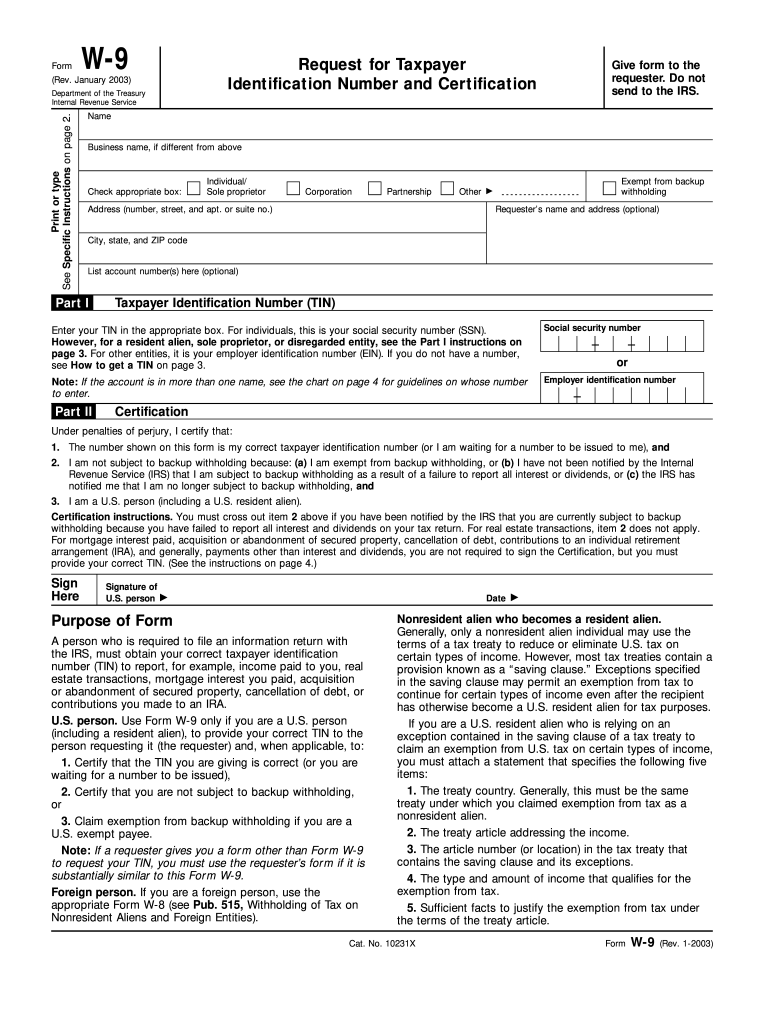

The W-9 Rev January Form is an official document used by the Internal Revenue Service (IRS) in the United States. It is primarily utilized by individuals and businesses to provide their taxpayer identification information to other parties, such as employers or clients. The form collects essential details, including the name, business name (if applicable), address, and taxpayer identification number (TIN). This information is crucial for tax reporting purposes, ensuring that income is accurately reported to the IRS.

How to use the W-9 Rev January Form

Using the W-9 Rev January Form involves a straightforward process. First, download the form from the IRS website or obtain it from the requesting party. Fill in the required fields, including your name, TIN, and any applicable business information. Once completed, submit the form to the entity that requested it, ensuring that it is done securely, especially if sent electronically. It is important to retain a copy for your records, as it may be needed for future tax filings or verification purposes.

Steps to complete the W-9 Rev January Form

Completing the W-9 Rev January Form requires careful attention to detail. Follow these steps for accurate completion:

- Download the latest version of the form from the IRS website.

- Enter your name as it appears on your tax return in the first field.

- If applicable, provide your business name in the second field.

- Fill in your address, ensuring it matches the IRS records.

- Input your TIN, which can be your Social Security Number (SSN) or Employer Identification Number (EIN).

- Sign and date the form to certify that the information provided is accurate.

Legal use of the W-9 Rev January Form

The W-9 Rev January Form serves a legal purpose in the context of tax compliance. By providing accurate information on this form, individuals and businesses help ensure that income is reported correctly to the IRS. This form is often required by entities that need to report payments made to independent contractors or freelancers. Failing to submit a W-9 when requested can lead to backup withholding, where the payer is required to withhold a percentage of payments for tax purposes.

Filing Deadlines / Important Dates

While the W-9 Rev January Form itself does not have a specific filing deadline, it is essential to submit it promptly when requested by a payer. Timely submission helps avoid delays in payment processing and ensures compliance with IRS regulations. Additionally, if you are an independent contractor, keep in mind that the income reported on your W-9 may need to be included in your tax return by April 15 of the following year.

Form Submission Methods (Online / Mail / In-Person)

The W-9 Rev January Form can be submitted in various ways, depending on the preferences of the requesting party. Common submission methods include:

- Electronic submission via secure email or a designated online platform.

- Mailing a printed copy of the completed form to the requester.

- Hand-delivering the form to the requesting entity's office.

It is essential to follow the submission method specified by the requester to ensure compliance and proper processing.

Quick guide on how to complete w 9 rev january form

Prepare W 9 Rev January Form effortlessly on any device

Digital document management has gained signNow popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, enabling you to access the required form and securely save it online. airSlate SignNow provides all the resources you need to create, edit, and electronically sign your documents quickly, without any delays. Manage W 9 Rev January Form on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to edit and eSign W 9 Rev January Form without hassle

- Locate W 9 Rev January Form and click on Get Form to begin.

- Utilize the available tools to complete your form.

- Highlight important sections of the documents or obscure sensitive data using the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional handwritten signature.

- Verify the information and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from your preferred device. Edit and eSign W 9 Rev January Form and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the w 9 rev january form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the W 9 Rev January Form?

The W 9 Rev January Form is an official IRS document used by businesses to request the taxpayer identification number of a contractor or employee. It's essential for accurate tax reporting and helps ensure compliance with IRS regulations. Understanding how to properly fill out the W 9 Rev January Form can streamline your business’s documentation processes.

-

How can airSlate SignNow help with the W 9 Rev January Form?

airSlate SignNow allows users to easily fill out and eSign the W 9 Rev January Form digitally. This saves time compared to traditional paper methods and enhances security with encryption features. With airSlate SignNow, businesses can ensure their forms are completed accurately and stored safely.

-

Is there a cost associated with using airSlate SignNow for the W 9 Rev January Form?

Yes, airSlate SignNow offers competitive pricing for its electronic signature services, which include handling the W 9 Rev January Form. Subscription plans vary based on features and usage needs, but the cost is generally lower than traditional paper and ink methods. Investing in airSlate SignNow can lead to long-term savings by streamlining your document processes.

-

What features does airSlate SignNow provide for managing the W 9 Rev January Form?

airSlate SignNow offers numerous features for managing the W 9 Rev January Form, including customizable templates, automated workflows, and secure storage. Additionally, users can track the status of their forms in real-time and send reminders to signatories. These features help ensure that your document handling is efficient and organized.

-

Can I integrate airSlate SignNow with other tools for handling the W 9 Rev January Form?

Yes, airSlate SignNow offers integrations with various business tools, making it easier to manage the W 9 Rev January Form within your existing workflows. These integrations can include CRMs, accounting software, and document management systems. This flexibility allows businesses to maintain their preferred operational tools while enhancing their document signing processes.

-

What are the advantages of using airSlate SignNow for the W 9 Rev January Form?

Using airSlate SignNow for the W 9 Rev January Form improves efficiency, reduces paper waste, and enhances security. E-signing is faster and can be done from anywhere, making it ideal for remote teams and busy schedules. Additionally, the ability to easily track and store signed documents simplifies compliance and record-keeping.

-

How secure is the airSlate SignNow platform for handling the W 9 Rev January Form?

airSlate SignNow takes security seriously, offering encryption and secure access protocols to protect your sensitive information, including the W 9 Rev January Form. The platform complies with industry standards to keep your documents safe from unauthorized access. You can trust airSlate SignNow to maintain the confidentiality of your business’s important documents.

Get more for W 9 Rev January Form

- Ecde admin 06 form

- Rc1c form

- Sartell compost 24558415 form

- Survival certificate application form

- Fda form 1572

- Votre employeur fait appel medex pour la gestion de vos absences pour cause de maladie accident du travail ou maladie health form

- Pci level iii renewal application pci form

- Confidentiality hipaa agreement template form

Find out other W 9 Rev January Form

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile