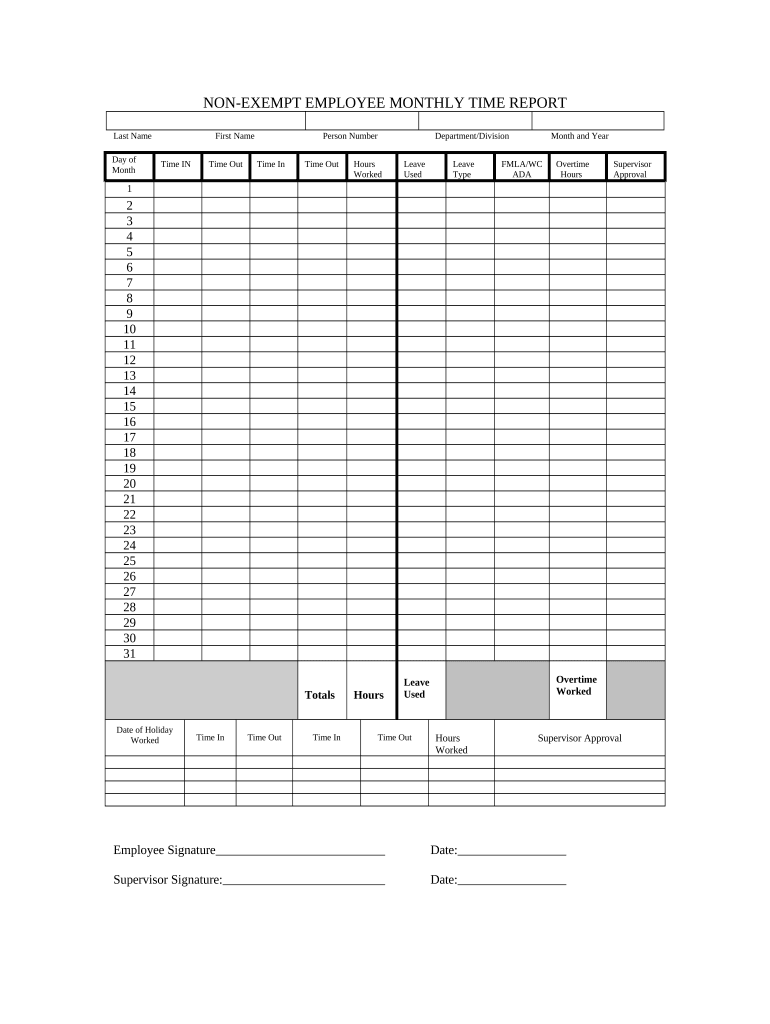

Nonexempt Form

What is the nonexempt employee?

A nonexempt employee is an individual who is entitled to receive overtime pay under the Fair Labor Standards Act (FLSA). These employees typically earn hourly wages and must be compensated for any hours worked beyond forty in a workweek at a rate of one and a half times their regular pay. Understanding the classification of nonexempt employees is crucial for both employers and employees to ensure compliance with labor laws and to protect workers' rights. Nonexempt employees are often involved in roles that do not meet the criteria for exemption, such as certain administrative, service, and labor positions.

Key elements of the nonexempt employee

Several key elements define a nonexempt employee's status. These include:

- Hourly wage: Nonexempt employees are typically paid on an hourly basis rather than a salary.

- Overtime eligibility: They are entitled to overtime pay for hours worked beyond the standard forty-hour workweek.

- Job duties: The nature of their job responsibilities often does not meet the criteria for exemption, which includes executive, administrative, and professional roles.

- Recordkeeping: Employers are required to maintain accurate records of hours worked by nonexempt employees to ensure proper compensation.

Steps to complete the nonexempt employee timekeeping

Accurate timekeeping for nonexempt employees is vital for compliance and payroll accuracy. Here are the steps to ensure proper reporting:

- Track hours: Use a reliable system to log hours worked each day, including start and end times.

- Account for breaks: Ensure that meal and rest breaks are documented, as these can affect total hours worked.

- Calculate overtime: Identify any hours worked over forty in a week and calculate overtime pay accordingly.

- Submit reports: Prepare and submit timekeeping reports to the payroll department in a timely manner.

- Review for accuracy: Regularly check timekeeping records for any discrepancies or errors before final submission.

Legal use of the nonexempt employee

Employers must adhere to legal requirements when managing nonexempt employees. This includes:

- Compliance with FLSA: Ensure that all nonexempt employees are classified correctly and receive proper compensation.

- Overtime regulations: Familiarize yourself with state-specific overtime laws, as some states have more stringent requirements than federal law.

- Recordkeeping practices: Maintain accurate and detailed records of hours worked, wages paid, and any adjustments made.

- Employee rights: Educate nonexempt employees about their rights regarding overtime and wage disputes.

State-specific rules for the nonexempt employee

Each state may have unique regulations governing nonexempt employees. For instance:

- Minimum wage variations: Some states set a higher minimum wage than the federal standard, impacting nonexempt employee pay.

- Overtime thresholds: Certain states may define overtime eligibility differently, necessitating awareness of local laws.

- Reporting requirements: States may have specific mandates regarding how and when nonexempt employee hours must be reported.

Examples of using the nonexempt employee

Understanding practical applications of nonexempt employee classification can clarify its significance. Common examples include:

- Retail workers: Employees in retail settings often work hourly and are classified as nonexempt due to their job duties.

- Hospitality staff: Nonexempt employees in hotels and restaurants typically receive overtime pay for hours worked beyond forty per week.

- Manufacturing laborers: Workers in manufacturing roles are usually nonexempt, entitled to overtime compensation for extended hours.

Quick guide on how to complete nonexempt 497334880

Complete Nonexempt effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-conscious alternative to conventional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Manage Nonexempt on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to modify and eSign Nonexempt without any hassle

- Locate Nonexempt and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, invite link, or download it to your computer.

Wave goodbye to lost or misplaced files, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Nonexempt and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What defines a nonexempt employee?

A nonexempt employee is an individual who is covered by the Fair Labor Standards Act (FLSA) and must be paid overtime for hours worked over 40 in a workweek. Understanding this classification is crucial for businesses to ensure compliance with labor laws. airSlate SignNow can help streamline documentation related to nonexempt employee classifications.

-

How can airSlate SignNow assist with managing nonexempt employees?

airSlate SignNow offers features that simplify the process of sending and eSigning documents related to nonexempt employees. You can automate workflows, ensuring that all necessary documents are completed and stored securely. This efficiency saves time and reduces errors in managing nonexempt employee information.

-

What types of documents can be sent for nonexempt employees using airSlate SignNow?

With airSlate SignNow, you can send a variety of documents for nonexempt employees, including contracts, time-off requests, and employee agreements. The platform allows for straightforward customization and secure eSigning for all necessary documentation. This flexibility supports regulatory compliance and enhances HR processes.

-

Is airSlate SignNow cost-effective for businesses with nonexempt employees?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including those with nonexempt employees. Our pricing plans provide various features suitable for different business needs, enabling you to manage documentation without breaking the bank. This ensures that your investment in compliance pays off by minimizing potential errors and legal risks.

-

What security measures does airSlate SignNow implement for nonexempt employee documentation?

AirSlate SignNow prioritizes the security of all documents, including those related to nonexempt employees. The platform uses encryption protocols and secure data storage to protect sensitive information. Additionally, user authentication steps ensure that only authorized personnel can access important documents.

-

Can airSlate SignNow integrate with other tools for managing nonexempt employees?

Absolutely! airSlate SignNow offers integrations with various HR and payroll software, enhancing your ability to manage nonexempt employees effectively. These integrations allow for seamless data transfer and reduce manual entry, making it easier to stay compliant with regulations.

-

How does airSlate SignNow improve the onboarding process for nonexempt employees?

AirSlate SignNow streamlines the onboarding process for nonexempt employees by allowing you to quickly send and sign all necessary paperwork electronically. This accelerates the time to get new hires set up while ensuring all documentation is completed accurately. The efficient onboarding process contributes to a better employee experience and retention.

Get more for Nonexempt

- Administrative driveramp39s license revocation office adlro courts state hi form

- Request to be excused from attending the kids first program courts state hi form

- Petition for adoption non consent hawaii state judiciary 332943366 form

- Hcrr form 2 09 12 courts state hi

- Hawaii compact disc proceedings form

- Hrap 6 form

- Request for administrative hearing courts state hi form

- Notice of appeal as related to act 48 hawaii state judiciary courts state hi form

Find out other Nonexempt

- eSignature Washington Life Sciences Permission Slip Now

- eSignature West Virginia Life Sciences Quitclaim Deed Free

- Can I eSignature West Virginia Life Sciences Residential Lease Agreement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed