Business Deductibility Form

What is the Business Deductibility

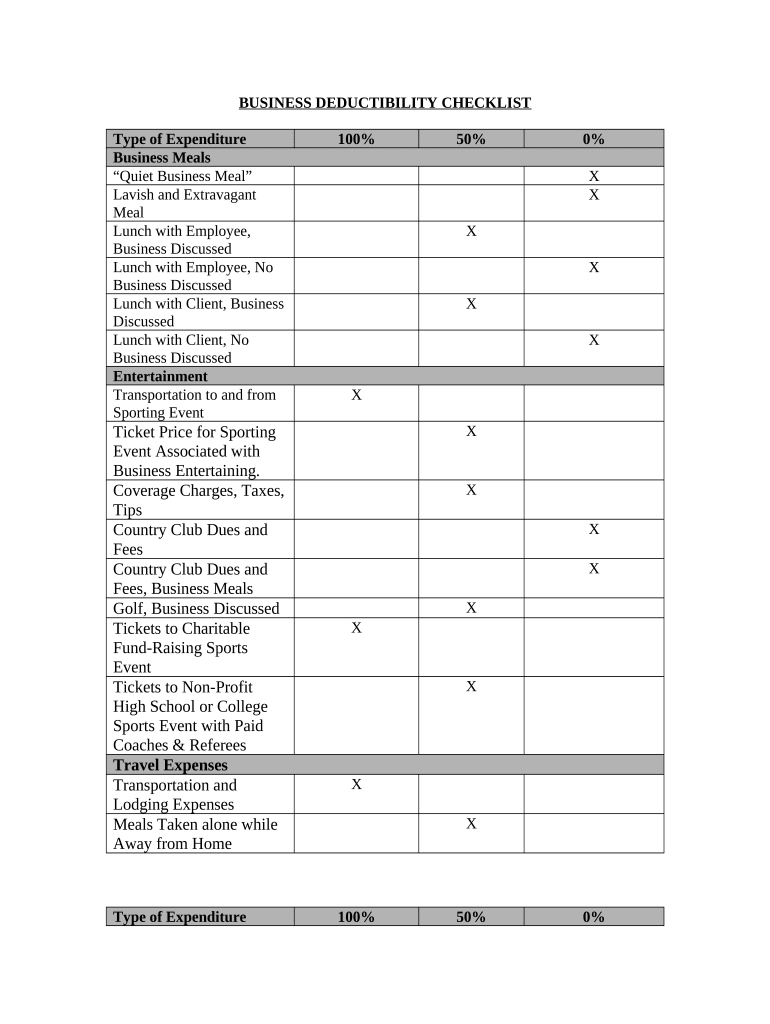

Business deductibility refers to the ability of a business to subtract certain expenses from its total income when calculating taxable income. This process reduces the overall tax burden, allowing businesses to retain more of their earnings. Common deductible expenses include operating costs, salaries, and certain types of interest. Understanding what qualifies for business deductibility is crucial for effective financial planning and compliance with IRS regulations.

How to Use the Business Deductibility

Utilizing business deductibility effectively involves identifying eligible expenses and accurately documenting them. Businesses should maintain detailed records of all expenditures, including receipts and invoices. This documentation is essential for substantiating claims during tax filing. Additionally, using accounting software can streamline the process by categorizing expenses and generating reports that highlight deductible items. Regularly reviewing these deductions can also help businesses maximize their tax benefits.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding what constitutes a deductible business expense. According to IRS rules, the expense must be ordinary and necessary for the business's operations. Ordinary expenses are common and accepted in the industry, while necessary expenses are helpful and appropriate for the business. Familiarity with IRS publications, such as Publication 535, can help businesses navigate these guidelines effectively.

Required Documents

To substantiate business deductions, maintaining accurate and comprehensive documentation is vital. Required documents typically include:

- Receipts for purchases and expenses

- Invoices for services rendered

- Bank and credit card statements

- Payroll records for employee-related expenses

- Travel logs for business trips

Organizing these documents in a systematic manner can facilitate smoother tax preparation and ensure compliance with IRS requirements.

Steps to Complete the Business Deductibility

Completing the business deductibility process involves several key steps:

- Identify all potential deductible expenses related to your business operations.

- Gather and organize all necessary documentation to support your claims.

- Consult IRS guidelines to ensure compliance and accuracy.

- Utilize accounting software or spreadsheets to track and categorize expenses.

- Prepare your tax return, ensuring all deductions are accurately reported.

Following these steps can help businesses effectively manage their deductions and optimize their tax outcomes.

Legal Use of the Business Deductibility

Understanding the legal aspects of business deductibility is essential for compliance and avoiding penalties. Businesses must ensure that all claimed deductions adhere to IRS regulations and are substantiated with adequate documentation. Misrepresenting expenses or failing to comply with tax laws can lead to audits and financial penalties. Consulting with a tax professional can provide guidance on legal requirements and best practices for maximizing deductions.

Quick guide on how to complete business deductibility

Easily Prepare Business Deductibility on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed files, allowing you to easily find the correct form and store it securely online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly and efficiently. Handle Business Deductibility on any device using the airSlate SignNow apps for Android or iOS and simplify any document-related process today.

Effortlessly Modify and eSign Business Deductibility

- Obtain Business Deductibility and click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Select important sections of your documents or obscure private information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which only takes seconds and carries the same legal validity as a standard handwritten signature.

- Review the details and click on the Done button to finalize your changes.

- Select how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign Business Deductibility to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is business deductibility in relation to airSlate SignNow?

Business deductibility refers to the ability of businesses to deduct certain expenses from their taxable income. With airSlate SignNow, the costs associated with eSigning and managing documents can often be considered deductible expenses, enhancing your overall business deductibility.

-

How does airSlate SignNow help improve business deductibility?

By using airSlate SignNow to manage and eSign documents, businesses can streamline operations and reduce costs. These efficiencies not only enhance productivity but may also lead to increased business deductibility through various expense deductions.

-

Are airSlate SignNow subscription fees tax-deductible?

Yes, subscription fees for airSlate SignNow can generally be classified as a business expense, making them tax-deductible. This contributes positively to your business deductibility, allowing you to maximize savings while benefiting from our eSigning solutions.

-

What features of airSlate SignNow can enhance document business deductibility?

AirSlate SignNow includes features such as automated workflows and compliance tracking that can help businesses maintain accurate records. By keeping detailed documentation of eSigned agreements, businesses can substantiate their expenses and improve overall business deductibility.

-

Can airSlate SignNow integrate with accounting software for better financial management?

Absolutely! AirSlate SignNow integrates seamlessly with several accounting software tools, making it easier for businesses to manage their financial records. This integration can help you track expenses related to eSigning, further supporting your business deductibility efforts.

-

What benefits does airSlate SignNow provide beyond business deductibility?

Beyond enhancing business deductibility, airSlate SignNow offers ease of use, improved document security, and accelerated transaction cycles. These benefits empower businesses to operate more efficiently and confidently in their financial dealings.

-

Is airSlate SignNow suitable for businesses of all sizes regarding business deductibility?

Yes, airSlate SignNow is designed to be a cost-effective solution that scales with your business size. Whether you are a small startup or a large enterprise, our service can help improve your operational efficiency and business deductibility.

Get more for Business Deductibility

- Financial statement for foster andor adoptive applicants alabama dhr alabama form

- Alabama ems patient care protocols edition 901 january 2020 form

- This financial statement is prepared for the alabama department of human resources as part of the application to 1 operate a form

- Petition to add a debliltating medical condition petition to add a debliltating medical condition form

- Arkansas prescription drug monitoring program pharmacy form

- Summary of arkansas department of health arkansasgov form

- Arkansas department of health trauma awin radio application form

- Adosh 70 notice of alleged safety or health hazards the industrial commission of arizona division of occupational safety ampamp form

Find out other Business Deductibility

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document