Self Employed Independent Contractor Employment Agreement General Form

What is the Self Employed Independent Contractor Employment Agreement General

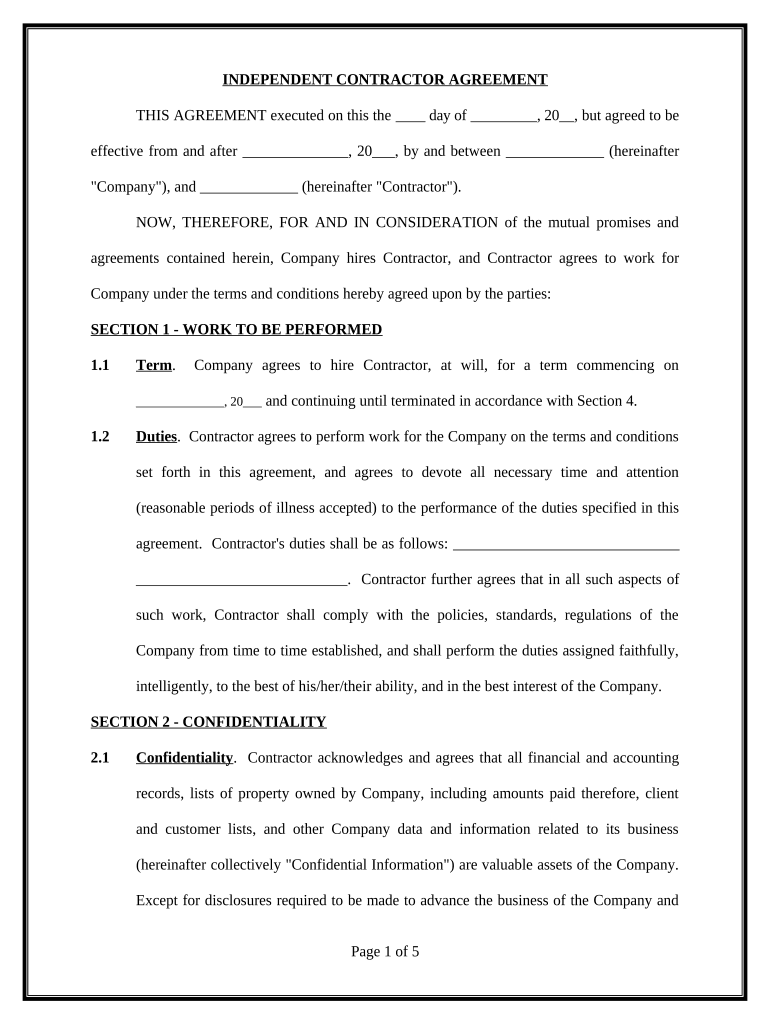

The Self Employed Independent Contractor Employment Agreement General is a formal document that outlines the relationship between a business and an independent contractor. This agreement specifies the terms of engagement, including the scope of work, payment structure, and responsibilities of both parties. It serves to protect the interests of both the contractor and the hiring entity by clearly defining expectations and obligations. By establishing these terms, the agreement helps to prevent misunderstandings and legal disputes.

Key elements of the Self Employed Independent Contractor Employment Agreement General

Several critical components should be included in the Self Employed Independent Contractor Employment Agreement General to ensure it is comprehensive and legally binding. These elements typically include:

- Parties involved: Identification of the contractor and the business.

- Scope of work: Detailed description of the services to be provided.

- Payment terms: Information on compensation, including rates and payment schedules.

- Duration of the agreement: Start and end dates of the contract.

- Confidentiality clauses: Provisions to protect sensitive information.

- Termination conditions: Guidelines for ending the agreement prematurely.

How to use the Self Employed Independent Contractor Employment Agreement General

Using the Self Employed Independent Contractor Employment Agreement General involves several steps to ensure that it is filled out correctly and legally binding. Start by downloading the form from a trusted source. Next, fill in the necessary details, including the names of both parties and the specific terms of the agreement. Review the document for accuracy and completeness, ensuring that all required sections are addressed. Once completed, both parties should sign the agreement, ideally using a secure digital signature platform to maintain compliance with eSignature laws.

Steps to complete the Self Employed Independent Contractor Employment Agreement General

Completing the Self Employed Independent Contractor Employment Agreement General involves a systematic approach:

- Download the agreement template from a reliable source.

- Fill in the names and contact information of both the contractor and the business.

- Detail the scope of work, including specific tasks and responsibilities.

- Outline payment terms, including rates and payment schedules.

- Specify the duration of the agreement and any renewal conditions.

- Include any confidentiality or non-disclosure clauses as necessary.

- Review the document for completeness and accuracy.

- Sign the agreement, preferably using a digital signature for security.

Legal use of the Self Employed Independent Contractor Employment Agreement General

The legal use of the Self Employed Independent Contractor Employment Agreement General is crucial for ensuring that both parties are protected under the law. To be legally binding, the agreement must comply with relevant federal and state laws, including those governing independent contractor relationships. It is important to ensure that the terms do not inadvertently classify the contractor as an employee, which could lead to legal complications. Utilizing a digital signature platform that complies with the ESIGN Act and UETA can further enhance the legal standing of the agreement.

State-specific rules for the Self Employed Independent Contractor Employment Agreement General

Each state may have specific regulations that affect the use of the Self Employed Independent Contractor Employment Agreement General. It is essential to be aware of these rules to ensure compliance. For instance, some states may have additional requirements regarding payment terms, worker classification, or tax obligations. Consulting with a legal professional or researching state-specific guidelines can help ensure that the agreement meets all necessary legal standards and protects the interests of both parties involved.

Quick guide on how to complete self employed independent contractor employment agreement general

Complete Self Employed Independent Contractor Employment Agreement General effortlessly on any device

Managing documents online has become popular among enterprises and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed paperwork, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without interruptions. Handle Self Employed Independent Contractor Employment Agreement General on any platform using airSlate SignNow applications for Android or iOS and simplify any document-centric process today.

The easiest way to modify and electronically sign Self Employed Independent Contractor Employment Agreement General with ease

- Locate Self Employed Independent Contractor Employment Agreement General and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Choose how you wish to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Self Employed Independent Contractor Employment Agreement General while ensuring effective communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Self Employed Independent Contractor Employment Agreement General?

A Self Employed Independent Contractor Employment Agreement General is a contract that outlines the terms of engagement between a self-employed individual and a business. This agreement clarifies responsibilities, payment terms, and the scope of work, ensuring both parties understand their obligations. Utilizing airSlate SignNow makes it easy to create and sign this agreement digitally.

-

How can airSlate SignNow help with Self Employed Independent Contractor Employment Agreement General?

airSlate SignNow provides a user-friendly platform to create, send, and eSign your Self Employed Independent Contractor Employment Agreement General. With templates and customizable options, businesses can streamline the paperwork process and maintain a professional appearance. This efficiency can save time and reduce potential errors.

-

What are the pricing options for using airSlate SignNow for my Self Employed Independent Contractor Employment Agreement General?

airSlate SignNow offers a range of pricing plans to fit different business needs, including options for freelancers and small businesses. You can choose a plan based on how frequently you need to send and sign documents, allowing for a cost-effective solution when managing a Self Employed Independent Contractor Employment Agreement General. Check our website for the latest pricing details and promotions.

-

Are there templates available for Self Employed Independent Contractor Employment Agreement General?

Yes, airSlate SignNow offers various templates for the Self Employed Independent Contractor Employment Agreement General. These templates can be customized to fit your specific needs, ensuring all legal clauses are included. This feature allows you to draft agreements quickly while ensuring compliance with industry standards.

-

How does airSlate SignNow ensure the security of my Self Employed Independent Contractor Employment Agreement General?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your Self Employed Independent Contractor Employment Agreement General. All documents are stored securely, and user authentication processes are in place to prevent unauthorized access. You can sign contracts confidently, knowing your sensitive information is protected.

-

Can I integrate airSlate SignNow with other applications for managing my Self Employed Independent Contractor Employment Agreement General?

Indeed, airSlate SignNow supports integrations with several popular applications and services. This flexibility allows you to incorporate your Self Employed Independent Contractor Employment Agreement General into your existing workflows, whether you use CRM systems or project management tools. The integrations enhance productivity and streamline your operations.

-

What are the benefits of using airSlate SignNow for a Self Employed Independent Contractor Employment Agreement General?

Using airSlate SignNow for your Self Employed Independent Contractor Employment Agreement General comes with numerous benefits, including faster turnaround times, reduced paperwork, and improved organization. The digital signature feature eliminates the need for printing and scanning, making the process more efficient. Plus, you can access contracts from anywhere, ensuring you stay connected with your business.

Get more for Self Employed Independent Contractor Employment Agreement General

- This application is provided for your use in filing an initial application for unemployment compensation form

- Youth employment certificate wilkes county north carolina form

- Health care flexible spending account fsafeds form

- Divisions department of finance new york city form

- Application for copy of fire marshal report nycgov form

- Download the background investigation questionnaire nycgov form

- Bail bond format

- Dv 901 california courts courts ca form

Find out other Self Employed Independent Contractor Employment Agreement General

- eSignature Florida Real estate investment proposal template Free

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online