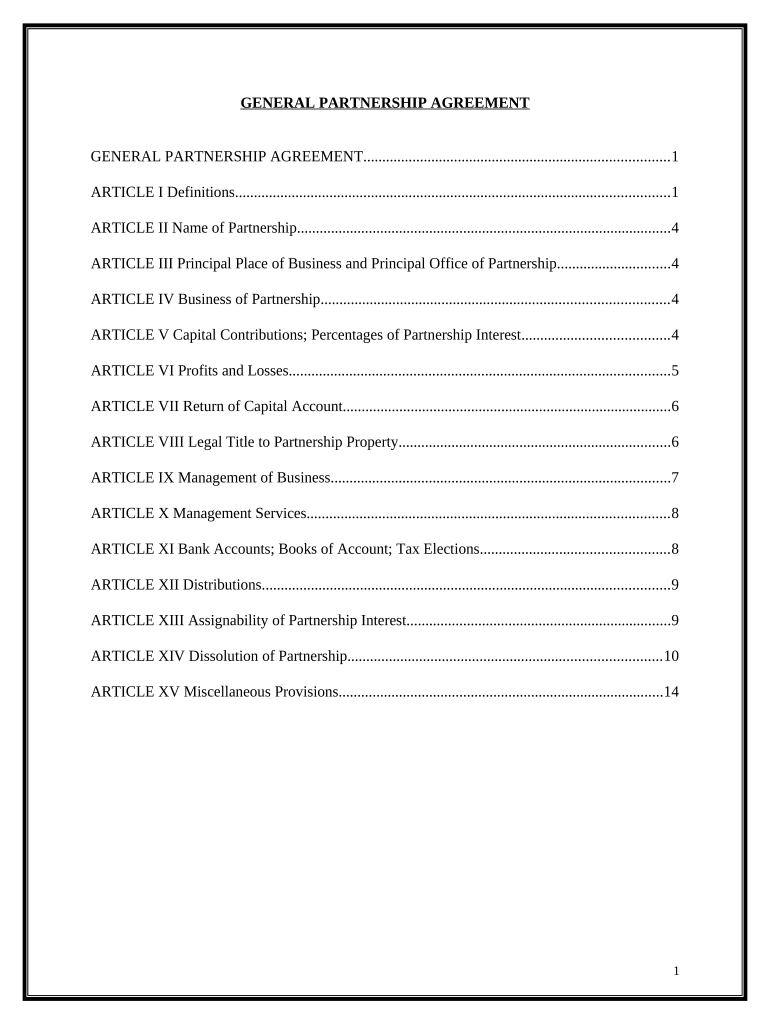

General Partnership Agreement Form

What is the General Partnership Agreement

A general partnership agreement is a legal document that outlines the terms and conditions under which two or more individuals or entities operate a business together. This agreement serves as a foundational framework for the partnership, detailing each partner's roles, responsibilities, profit-sharing arrangements, and procedures for resolving disputes. It is essential for establishing clear expectations and protecting the interests of all parties involved.

Key elements of the General Partnership Agreement

Several key elements are crucial to include in a general partnership agreement to ensure it is comprehensive and effective:

- Names of the partners: Clearly identify all partners involved in the agreement.

- Business purpose: Define the nature of the business and its objectives.

- Capital contributions: Specify the amount of money or assets each partner contributes to the partnership.

- Profit and loss distribution: Outline how profits and losses will be shared among partners.

- Decision-making process: Describe how decisions will be made, including voting rights and procedures.

- Duration of the partnership: State whether the partnership is for a fixed term or ongoing.

- Exit strategy: Include terms for how partners can leave the partnership and how assets will be divided.

Steps to complete the General Partnership Agreement

Completing a general partnership agreement involves several steps to ensure that all necessary details are included and that the document is legally binding:

- Gather all partners to discuss and agree on the terms of the partnership.

- Draft the agreement, incorporating all key elements and specific terms discussed.

- Review the draft with all partners to ensure clarity and agreement on all points.

- Make any necessary revisions based on feedback from partners.

- Have all partners sign the agreement in the presence of a notary, if required by state law.

- Store the signed agreement in a secure location and provide copies to all partners.

Legal use of the General Partnership Agreement

The general partnership agreement is legally binding when it meets specific requirements set forth by state laws. It must be written, signed by all partners, and include essential elements such as the business purpose, capital contributions, and profit-sharing arrangements. To ensure compliance with legal standards, partners may consider consulting with a legal professional during the drafting process.

How to use the General Partnership Agreement

Using a general partnership agreement effectively involves adhering to the terms outlined within the document throughout the partnership's duration. Partners should refer to the agreement when making decisions, resolving disputes, or when changes in the partnership occur. Regular reviews of the agreement can help ensure it remains relevant and reflective of the partnership's evolving needs.

Quick guide on how to complete general partnership agreement

Effectively Prepare General Partnership Agreement on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents promptly without interruptions. Handle General Partnership Agreement on any device using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to edit and electronically sign General Partnership Agreement effortlessly

- Find General Partnership Agreement and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose how you want to share your form, whether via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs within a few clicks from your chosen device. Modify and electronically sign General Partnership Agreement to ensure outstanding communication at any point in your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a general partnership agreement?

A general partnership agreement is a legally binding document that outlines the terms and conditions of a business partnership. It specifies responsibilities, profit sharing, and management duties among partners. Using a general partnership agreement helps prevent disputes and provides a clear framework for business operations.

-

How can airSlate SignNow help with creating a general partnership agreement?

airSlate SignNow offers an intuitive platform for drafting and electronically signing a general partnership agreement. With customizable templates and easy-to-use tools, you can create a tailored agreement that meets your specific business needs. Additionally, our solution ensures that all parties can sign the document securely and conveniently.

-

What features does airSlate SignNow provide for managing a general partnership agreement?

airSlate SignNow includes features like document tracking, reminders, and cloud storage to effectively manage your general partnership agreement. You can easily monitor who has signed, when they signed, and store all important documents in one secure location. These functionalities streamline the signing process and enhance collaboration among partners.

-

What are the benefits of using airSlate SignNow for a general partnership agreement?

Using airSlate SignNow for your general partnership agreement offers several benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform allows for quick document turnaround, meaning your partnership can start operating sooner. Plus, electronic signatures are legally binding, giving you peace of mind.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore the features and capabilities of our platform. You can test the creation and eSigning of a general partnership agreement without any commitment. This trial helps you understand how our solution can meet your business needs before making a purchase.

-

How does pricing work for airSlate SignNow when creating a general partnership agreement?

Pricing for airSlate SignNow is designed to be flexible and affordable, catering to various business sizes. Plans are available at different price points, allowing you to choose one that fits your budget and usage needs. Whether you need basic features or advanced options, there's a plan that will accommodate your needs for managing a general partnership agreement.

-

Can I integrate airSlate SignNow with other tools for my general partnership agreement?

Yes, airSlate SignNow integrates seamlessly with various applications and tools, enhancing your workflow when managing a general partnership agreement. You can connect with popular platforms such as Google Drive, Salesforce, and more. This allows you to consolidate your processes and improve efficiency across your business operations.

Get more for General Partnership Agreement

Find out other General Partnership Agreement

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed