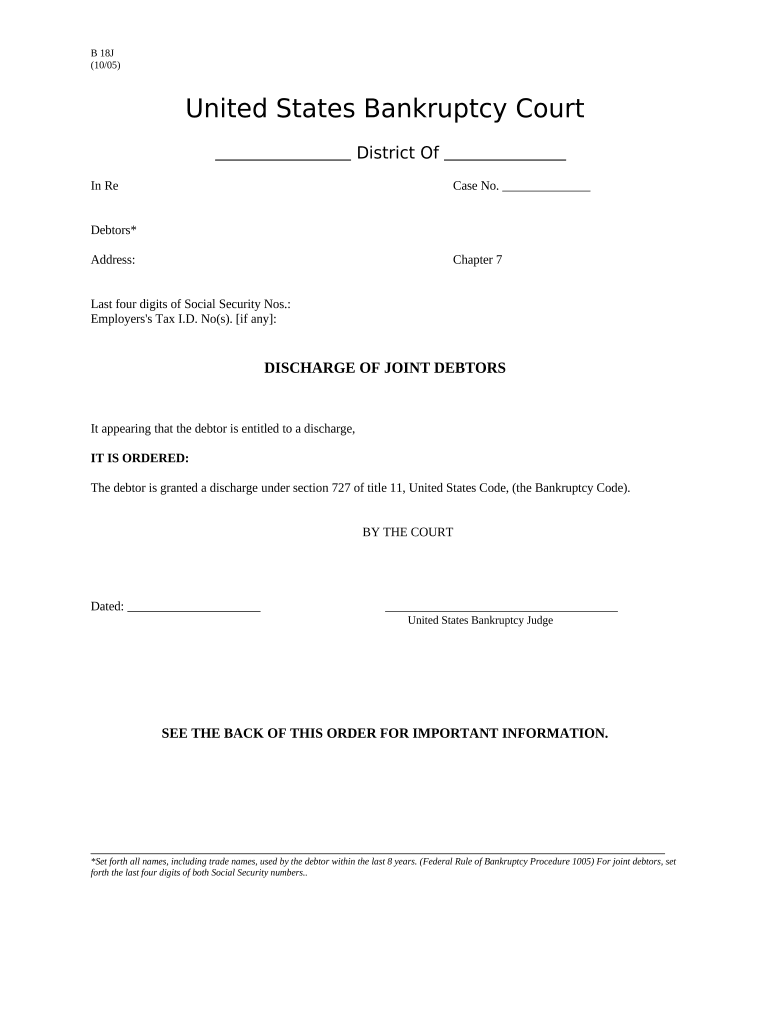

Chapter 7 Form

What is the Chapter 7

The Chapter 7 discharge is a legal process under the U.S. Bankruptcy Code that allows individuals or businesses to eliminate most of their unsecured debts. This process is often referred to as "liquidation bankruptcy" because it involves the sale of non-exempt assets to repay creditors. However, many individuals find that they can keep their essential assets, such as their home and vehicle, through exemptions provided by state laws. The goal of Chapter 7 is to provide a fresh financial start to debtors who are unable to repay their debts.

Steps to complete the Chapter 7

Completing the Chapter 7 process involves several important steps:

- Credit Counseling: Before filing, debtors must undergo credit counseling from an approved agency within six months prior to filing.

- Filing the Petition: Debtors must file a bankruptcy petition with the appropriate bankruptcy court, including schedules of assets, liabilities, income, and expenses.

- Automatic Stay: Once the petition is filed, an automatic stay goes into effect, preventing creditors from pursuing collection actions.

- 341 Meeting: Debtors must attend a meeting of creditors, known as the 341 meeting, where they answer questions about their financial situation.

- Trustee Review: A bankruptcy trustee reviews the case and may sell non-exempt assets to pay creditors.

- Discharge Order: If the court approves the discharge, a discharge order is issued, eliminating most debts.

Legal use of the Chapter 7

The legal use of Chapter 7 is governed by federal bankruptcy laws, which allow eligible individuals and businesses to seek relief from overwhelming debt. To qualify for Chapter 7, debtors must pass the means test, which compares their income to the median income for their state. If their income is below the median, they may file for Chapter 7. If it is above, they may need to consider Chapter 13 bankruptcy instead. It is essential to comply with all legal requirements, as failure to do so can result in dismissal of the case or denial of the discharge.

Eligibility Criteria

To be eligible for Chapter 7 bankruptcy, debtors must meet specific criteria:

- Debtors must reside, have a domicile, or have a place of business in the United States for at least 180 days prior to filing.

- They must pass the means test, which assesses their income against the median income in their state.

- Debtors must not have received a Chapter 7 discharge in the past eight years.

- They must complete the required credit counseling before filing.

Required Documents

Filing for Chapter 7 requires several important documents to be submitted with the bankruptcy petition:

- Income Documentation: Recent pay stubs, tax returns, and any other income sources.

- Asset Information: A detailed list of all assets, including property, vehicles, and bank accounts.

- Debt Information: A comprehensive list of all debts, including credit cards, loans, and any outstanding obligations.

- Credit Counseling Certificate: Proof of completion of the required credit counseling session.

Form Submission Methods

Debtors can submit their Chapter 7 bankruptcy forms through various methods:

- Online: Many courts allow electronic filing through their websites, making the process faster and more efficient.

- Mail: Forms can be printed and mailed to the appropriate bankruptcy court. It is crucial to send them via certified mail to ensure delivery.

- In-Person: Debtors can also file their forms in person at the bankruptcy court clerk's office.

Quick guide on how to complete chapter 7

Complete Chapter 7 effortlessly on any device

Managing documents online has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Handle Chapter 7 on any device with the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Chapter 7 with ease

- Locate Chapter 7 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal significance as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and eSign Chapter 7 and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is discharge 7 and how does it work?

Discharge 7 is a feature in airSlate SignNow that allows users to streamline the document signing process efficiently. It simplifies the workflow by enabling electronic signatures on discharge forms, ensuring that documents are completed faster and securely.

-

How much does it cost to use discharge 7 with airSlate SignNow?

The cost of using discharge 7 with airSlate SignNow depends on the subscription plan you choose. Plans provide access to various features, including customizable templates for discharge forms, making it a cost-effective solution for businesses of all sizes.

-

What are the benefits of using discharge 7 in airSlate SignNow?

Using discharge 7 in airSlate SignNow offers several benefits, including increased efficiency, reduced paper usage, and improved document tracking. This feature also enhances compliance and security for sensitive discharge documents.

-

Can I integrate discharge 7 with other applications?

Yes, discharge 7 can be integrated with many popular applications through airSlate SignNow's API. This allows for seamless data flow between platforms, enhancing the overall efficiency of your document management process.

-

Is discharge 7 suitable for small businesses?

Absolutely! Discharge 7 is designed to be user-friendly and cost-effective, making it an ideal solution for small businesses looking to digitize their document signing processes. It helps save time and resources that can be redirected to core business activities.

-

How secure is discharge 7 with airSlate SignNow?

Discharge 7 provides top-notch security features to ensure your documents are protected. With end-to-end encryption and compliance with industry standards, airSlate SignNow guarantees that your discharge documents remain confidential and secure throughout the signing process.

-

How can discharge 7 improve my team's workflow?

Discharge 7 improves your team's workflow by automating the document signing process, reducing delays caused by manual signatures. This efficiency allows your team to focus on other important tasks, improving overall productivity.

Get more for Chapter 7

- Minnesota form m1wfc working family credit 2020 printable 2020 minnesota form m1wfc working family creditworking family

- Minnesota form m15c additional charge for underpayment of

- Long term care insurance creditminnesota department of revenue form

- Child and dependent care creditminnesota department of revenue form

- Printable 2020 minnesota form m11l insurance premium tax return for life and health companies

- Minnesota form m1mtc alternative minimum tax credit minnesota form m1mtc alternative minimum tax credit minnesota form m1mtc

- Minnesota form m1c other nonrefundable credits onscreen

- Printable 2020 minnesota form m1cr credit for income tax paid to another state

Find out other Chapter 7

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple