Real Property Form

What is the Real Property Form

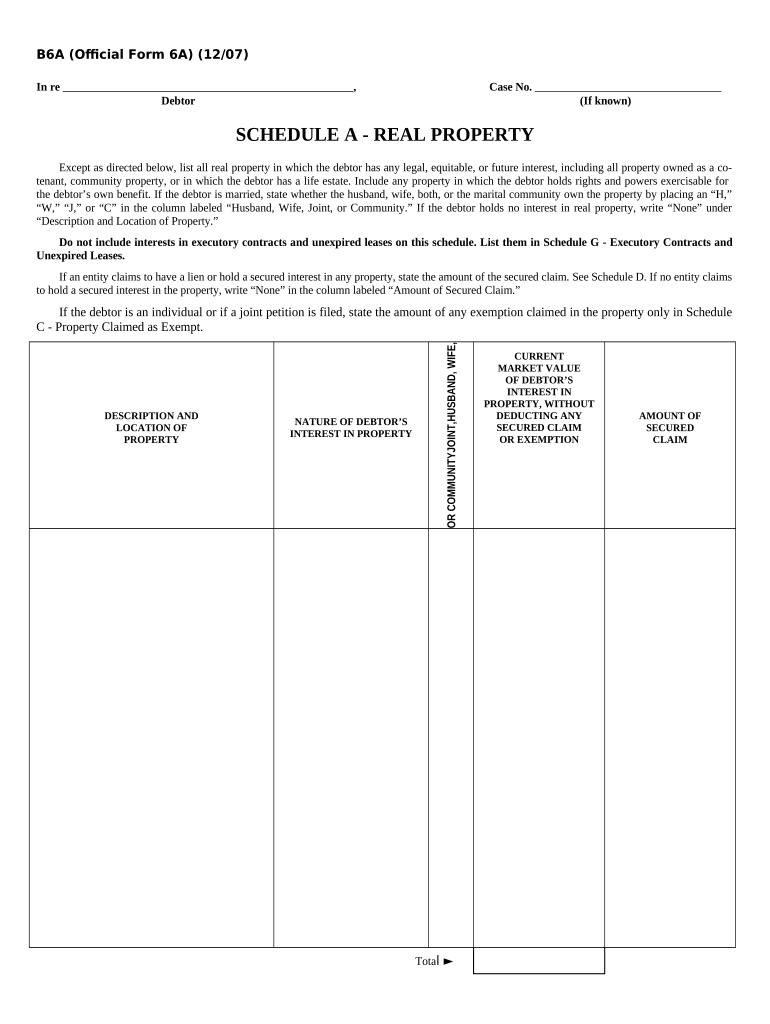

The Real Property Form, specifically the Schedule 6A, is a crucial document used in various real estate transactions within the United States. This form typically captures essential information regarding the property in question, including its legal description, ownership details, and any encumbrances that may affect its value or transferability. Understanding the purpose and structure of this form is vital for both buyers and sellers to ensure a smooth transaction process.

How to use the Real Property Form

Using the Schedule 6A effectively involves several key steps. First, it is important to gather all necessary information about the property, including its address, parcel number, and any existing liens or mortgages. Once the information is compiled, you can begin filling out the form accurately. It is advisable to review the completed form for any errors before submission, as inaccuracies can lead to delays or complications in the transaction. Digital tools, such as signNow, can streamline this process by allowing for easy editing and eSigning of the document.

Steps to complete the Real Property Form

Completing the Schedule 6A requires careful attention to detail. Here are the essential steps:

- Gather all relevant property information, including ownership details and legal descriptions.

- Fill in the required fields accurately, ensuring that all information is current and correct.

- Review the form for any potential errors or omissions.

- Utilize digital signing solutions to eSign the document, ensuring compliance with legal standards.

- Submit the completed form to the appropriate authority, whether online, by mail, or in person.

Legal use of the Real Property Form

The Schedule 6A is legally binding when filled out and signed according to specific regulations. It is essential to comply with local laws governing real estate transactions, including the requirements for signatures and notarization. Utilizing a trusted eSignature platform, such as signNow, ensures that the document meets legal standards and provides an electronic certificate of authenticity, which can be critical in case of disputes.

Filing Deadlines / Important Dates

When dealing with the Schedule 6A, it is important to be aware of any filing deadlines that may apply. These deadlines can vary by state and the nature of the transaction. Typically, forms should be submitted promptly to avoid penalties or complications in the property transfer process. Keeping track of important dates, such as closing dates and local filing deadlines, can help ensure a smooth transaction.

Who Issues the Form

The Schedule 6A is typically issued by state or local government agencies responsible for property transactions. This may include the county recorder's office or the department of revenue, depending on the jurisdiction. It is advisable to check with the relevant authority to obtain the most current version of the form and to understand any specific requirements that may apply in your area.

Quick guide on how to complete real property form 497335417

Manage Real Property Form seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Tackle Real Property Form on any device using airSlate SignNow applications for Android or iOS and enhance any document-centric process today.

Steps to modify and eSign Real Property Form with ease

- Find Real Property Form and click on Get Form to begin.

- Employ the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searching, or errors that necessitate new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Real Property Form and guarantee excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is schedule 6a in the context of airSlate SignNow?

Schedule 6a refers to a specific process within the airSlate SignNow platform that allows users to manage document signing seamlessly. By utilizing schedule 6a, businesses can streamline their workflow, ensuring that all documents are eSigned in a timely manner, enhancing efficiency and productivity.

-

How does airSlate SignNow integrate with other tools to support schedule 6a?

airSlate SignNow offers a range of integrations that enhance the functionality of schedule 6a. By connecting with popular applications like Salesforce, Google Drive, and others, users can easily manage their document flows, ensuring that all tasks related to schedule 6a are handled efficiently.

-

What are the pricing options available for airSlate SignNow's schedule 6a feature?

The pricing for airSlate SignNow varies based on the plan selected, but all plans include the capability to manage schedule 6a efficiently. Whether you're a small business or a large enterprise, you can choose a pricing tier that best fits your needs and budget while accessing comprehensive document signing features.

-

What benefits does schedule 6a offer to businesses using airSlate SignNow?

By implementing schedule 6a within airSlate SignNow, businesses can signNowly reduce the time spent on document handling. This feature enhances compliance, simplifies the signing process, and ensures that documents are signed and returned quickly, leading to improved customer satisfaction.

-

Can I customize my document templates for schedule 6a in airSlate SignNow?

Yes, airSlate SignNow allows users to fully customize document templates for schedule 6a. This feature ensures that your branding and specific requirements are met, enabling a personalized experience that enhances professional image and improves user interaction.

-

Is schedule 6a suitable for all types of businesses?

Absolutely, schedule 6a is designed to cater to businesses of all sizes and industries. Whether you are in real estate, healthcare, or education, airSlate SignNow provides the flexibility needed to manage your document signing processes efficiently.

-

How secure is the eSigning process using schedule 6a in airSlate SignNow?

The eSigning process for schedule 6a in airSlate SignNow is highly secure, utilizing advanced encryption technologies. This ensures that all your documents are protected, maintaining the confidentiality and integrity of sensitive information throughout the signing process.

Get more for Real Property Form

Find out other Real Property Form

- How To Sign Alabama Employee Emergency Notification Form

- How To Sign Oklahoma Direct Deposit Enrollment Form

- Sign Wyoming Direct Deposit Enrollment Form Online

- Sign Nebraska Employee Suggestion Form Now

- How Can I Sign New Jersey Employee Suggestion Form

- Can I Sign New York Employee Suggestion Form

- Sign Michigan Overtime Authorization Form Mobile

- How To Sign Alabama Payroll Deduction Authorization

- How To Sign California Payroll Deduction Authorization

- How To Sign Utah Employee Emergency Notification Form

- Sign Maine Payroll Deduction Authorization Simple

- How To Sign Nebraska Payroll Deduction Authorization

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online