Oak Lawn Transfer Stamps Form

What is the Oak Lawn Transfer Stamps

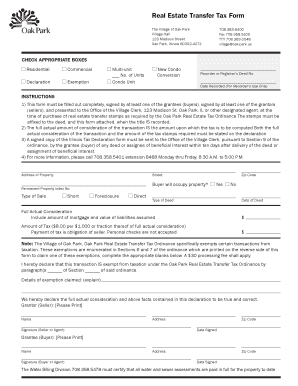

The Oak Lawn transfer stamps are essential documents used in real estate transactions within the Village of Oak Lawn, Illinois. These stamps signify that the appropriate transfer tax has been paid when property changes ownership. The transfer tax is calculated based on the sale price of the property, and the stamps serve as proof of compliance with local tax regulations. Understanding the purpose and requirements of these stamps is crucial for both buyers and sellers involved in real estate transactions.

How to Obtain the Oak Lawn Transfer Stamps

To obtain the Oak Lawn transfer stamps, individuals must visit the Village of Oak Lawn's Finance Department. The process typically involves submitting a completed application along with the required payment for the transfer tax. It is advisable to prepare all necessary documentation, such as the property deed and sales contract, to expedite the process. In some cases, the application may also be submitted electronically, allowing for a more efficient transaction.

Steps to Complete the Oak Lawn Transfer Stamps

Completing the Oak Lawn transfer stamps involves several key steps:

- Gather necessary documents, including the property deed and sales agreement.

- Calculate the transfer tax based on the property's sale price.

- Complete the transfer stamp application form accurately.

- Submit the application along with the required payment to the Finance Department.

- Receive the transfer stamps, which must be affixed to the property deed.

Following these steps ensures compliance with local regulations and facilitates a smooth property transfer process.

Legal Use of the Oak Lawn Transfer Stamps

The legal use of the Oak Lawn transfer stamps is critical for validating property transfers. These stamps must be affixed to the property deed before the transaction can be recorded with the Cook County Recorder of Deeds. Failure to obtain and use the transfer stamps may result in penalties or delays in the property transfer process. It is essential for both buyers and sellers to understand their responsibilities regarding the use of these stamps to ensure all legal requirements are met.

Required Documents for Oak Lawn Transfer Stamps

When applying for Oak Lawn transfer stamps, several documents are typically required:

- Completed transfer stamp application form.

- Property deed reflecting the current ownership.

- Sales contract or agreement between the buyer and seller.

- Proof of payment for the transfer tax.

Having these documents prepared in advance can streamline the application process and help avoid delays.

Penalties for Non-Compliance

Failure to comply with the requirements for obtaining and using Oak Lawn transfer stamps can result in significant penalties. These may include fines or additional taxes imposed by local authorities. In some cases, non-compliance can delay the recording of the property deed, complicating the transfer process. It is crucial for all parties involved in a real estate transaction to adhere to the regulations surrounding transfer stamps to avoid these potential issues.

Quick guide on how to complete oak lawn transfer stamps

Prepare Oak Lawn Transfer Stamps effortlessly on any device

Digital document management has become increasingly favored by both businesses and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to obtain the correct form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Handle Oak Lawn Transfer Stamps on any device with the airSlate SignNow applications for Android or iOS and streamline any document-based task today.

The easiest way to edit and electronically sign Oak Lawn Transfer Stamps without any hassle

- Locate Oak Lawn Transfer Stamps and then click Get Form to begin.

- Utilize the resources we provide to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Craft your signature using the Sign tool, which takes seconds and carries the same legal significance as a traditional wet ink signature.

- Review all the details and then click on the Done button to secure your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and electronically sign Oak Lawn Transfer Stamps to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the oak lawn transfer stamps

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are oak lawn transfer stamps?

Oak Lawn transfer stamps are legal documents required for property transfers within Oak Lawn. They are used to ensure that the correct taxes and fees are paid when real estate changes ownership. Understanding these stamps is essential for anyone involved in a property transaction in the area.

-

How can airSlate SignNow help with oak lawn transfer stamps?

AirSlate SignNow streamlines the process of signing and sending oak lawn transfer stamps electronically. With its user-friendly interface, you can easily prepare your transfer documents and gather necessary signatures from parties involved. This helps reduce delays and ensures compliance with local requirements.

-

What are the costs associated with oak lawn transfer stamps?

The cost of oak lawn transfer stamps can vary depending on the property value and local regulations. Typically, transfer tax rates are calculated based on the sale price of the property. Utilizing airSlate SignNow can save you on administrative costs, as it provides a cost-effective solution to manage your transactions digitally.

-

What features does airSlate SignNow offer for oak lawn transfer stamps?

AirSlate SignNow includes features such as document templates, bulk sending, and real-time tracking that enhance the signing process for oak lawn transfer stamps. These functionalities enable users to manage multiple transactions efficiently and maintain compliance with local laws. You can also customize documents to fit specific requirements.

-

Are there any benefits of using airSlate SignNow for oak lawn transfer stamps?

One of the major benefits of using airSlate SignNow for oak lawn transfer stamps is the speed and efficiency it brings to the process. With electronic signatures, documents can be signed and returned much faster than traditional methods. This helps expedite property transfers and ensures a smooth transaction experience for all parties involved.

-

Can I integrate airSlate SignNow with other tools for managing oak lawn transfer stamps?

Yes, airSlate SignNow offers integrations with various third-party applications, which is beneficial for managing oak lawn transfer stamps. Whether you use CRM systems, accounting tools, or document management software, airSlate SignNow's integrations can enhance your workflow and keep everything synchronized. This allows for a more efficient transaction process.

-

Is airSlate SignNow secure for handling oak lawn transfer stamps?

Absolutely, airSlate SignNow prioritizes security when handling oak lawn transfer stamps and other sensitive documents. The platform employs encryption, secure storage, and multi-factor authentication to protect your data. This ensures that all transactions are conducted with the highest level of security to safeguard your information.

Get more for Oak Lawn Transfer Stamps

- Sampke copy of new jersey restraining order 2007 form

- Mn id with blank picture cards printable 2011 form

- Contracts form

- Civ sc 70 form

- New york state statement of net worth form form

- Sample answer to divorce complaint with counterclaim form

- New york certificate acceptance form

- Ny franklin county form

Find out other Oak Lawn Transfer Stamps

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement