Schedule B Number Form

What is the Schedule B Number

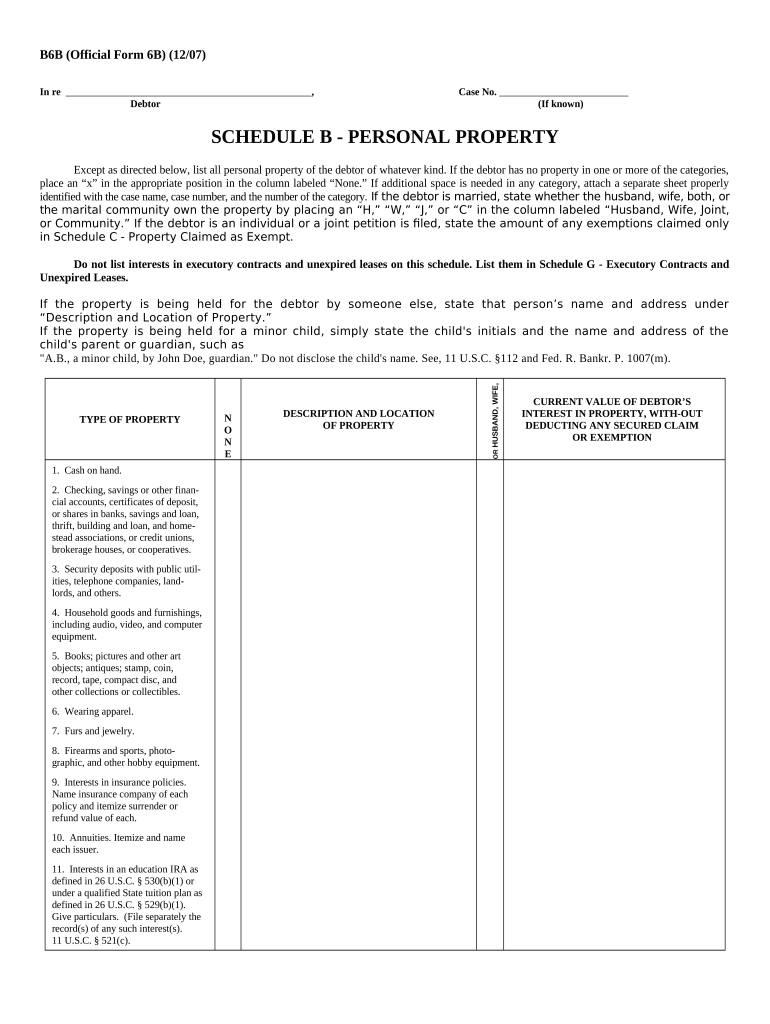

The Schedule B number is a crucial component in various financial and tax-related documents, particularly in the context of reporting interest and dividend income. It serves as a means to categorize and identify specific types of income that taxpayers must report to the Internal Revenue Service (IRS). Understanding the Schedule B number is essential for ensuring compliance with federal tax regulations.

How to use the Schedule B Number

Using the Schedule B number involves accurately reporting interest and dividends on your tax return. Taxpayers must include this number on their Form 1040, which details their total income. The Schedule B section requires individuals to list each source of interest and dividends, along with the corresponding amounts. This ensures that the IRS can verify the income reported and assess any tax liabilities accordingly.

Steps to complete the Schedule B Number

Completing the Schedule B number is a straightforward process that requires careful attention to detail. Here are the steps to follow:

- Gather all relevant financial documents, including bank statements and investment reports.

- Identify each source of interest and dividends received during the tax year.

- List the sources and amounts on the Schedule B form, ensuring accuracy.

- Transfer the total amounts to your Form 1040.

- Review the completed forms for accuracy before submission.

Legal use of the Schedule B Number

The Schedule B number must be used in compliance with IRS regulations. Failing to report interest and dividends accurately can lead to penalties and interest charges. It is essential to maintain accurate records and ensure that all reported amounts align with the information provided by financial institutions. Legal use also involves understanding the implications of any discrepancies that may arise during audits.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule B number coincide with the annual tax return due date. Typically, individual taxpayers must file their tax returns by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should be aware of these deadlines to avoid late filing penalties and ensure timely compliance with tax obligations.

Required Documents

To accurately complete the Schedule B number, taxpayers need to gather several key documents:

- Form 1040: The main tax return form.

- Bank statements: To verify interest income.

- Investment statements: To confirm dividend income.

- Any relevant tax documents received from financial institutions.

Who Issues the Form

The Schedule B number is part of the IRS Form 1040, which is issued by the Internal Revenue Service. Taxpayers can obtain the form directly from the IRS website or through tax preparation software. It is essential to use the most current version of the form to ensure compliance with any updates or changes in tax law.

Quick guide on how to complete schedule b number

Effortlessly Manage Schedule B Number on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to obtain the correct format and securely store it online. airSlate SignNow equips you with all the tools required to produce, modify, and eSign your documents swiftly without delays. Handle Schedule B Number on any platform with the airSlate SignNow applications for Android or iOS, and enhance any document-based process today.

How to Modify and eSign Schedule B Number with Ease

- Find Schedule B Number and click on Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize pertinent portions of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Craft your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign Schedule B Number to ensure clear communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a property schedule b in airSlate SignNow?

A property schedule b in airSlate SignNow refers to a specific section of a document that outlines pertinent property details and exceptions. It serves as a critical component for legal agreements, ensuring that all property-related stipulations are clearly stated and accessible. Understanding property schedule b is essential for accurate documentation and compliance.

-

How does airSlate SignNow ensure the security of my property schedule b?

airSlate SignNow employs advanced encryption and security protocols to protect your property schedule b and any related documents. With features like secure cloud storage and access controls, you can be confident that your information is safeguarded from unauthorized access. Our platform is designed to prioritize the confidentiality of your sensitive documents.

-

What are the benefits of using airSlate SignNow for creating a property schedule b?

Using airSlate SignNow to create a property schedule b offers several benefits, including ease of use and time savings. The platform provides customizable templates that streamline the process, making it simple to include all necessary information. Additionally, features like electronic signatures enhance efficiency and help expedite the approval process.

-

Can I integrate airSlate SignNow with other tools for managing my property schedule b?

Yes, airSlate SignNow supports integrations with a variety of third-party tools that can enhance your property schedule b management. You can connect with platforms like CRM systems, document management software, and project management tools to streamline workflows. These integrations help ensure that your property schedule b is always up-to-date and easily accessible.

-

What pricing plans does airSlate SignNow offer for managing property schedule b?

airSlate SignNow provides flexible pricing plans tailored to fit different business needs, including options for individual users and teams. Each plan includes features designed for managing documents like property schedule b, ensuring you get value for your investment. You can choose a plan that best suits your volume of use and specific requirements.

-

Is it possible to edit my property schedule b after it's been sent for eSignature?

Once your property schedule b has been sent for eSignature in airSlate SignNow, any modifications to the document may require rescinding the initial request. However, you can easily make edits to the original draft before sending it, ensuring all information is accurate. Keeping your property schedule b up-to-date is essential for effective legal documentation.

-

How can I track the status of my property schedule b in airSlate SignNow?

airSlate SignNow includes features that allow you to track the status of your property schedule b in real time. You can see when it has been viewed, signed, or completed, providing peace of mind during the signing process. This tracking capability helps you stay informed and manage expectations effectively.

Get more for Schedule B Number

- Insurerself insurer contacts form

- New york workers compensation law section 13 a health care providers workers compensation formsworkers compensation board all

- Supplement to certificate of insurance form

- Po box 5200 binghamton ny 13902 5200 form

- Pamphlet 400 476743242 form

- Employment of children alaska department of labor and form

- Email statewide form

- Mac app ilovepdf v1180 download form

Find out other Schedule B Number

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document