Letter Requesting Credit Form

What is the letter requesting credit?

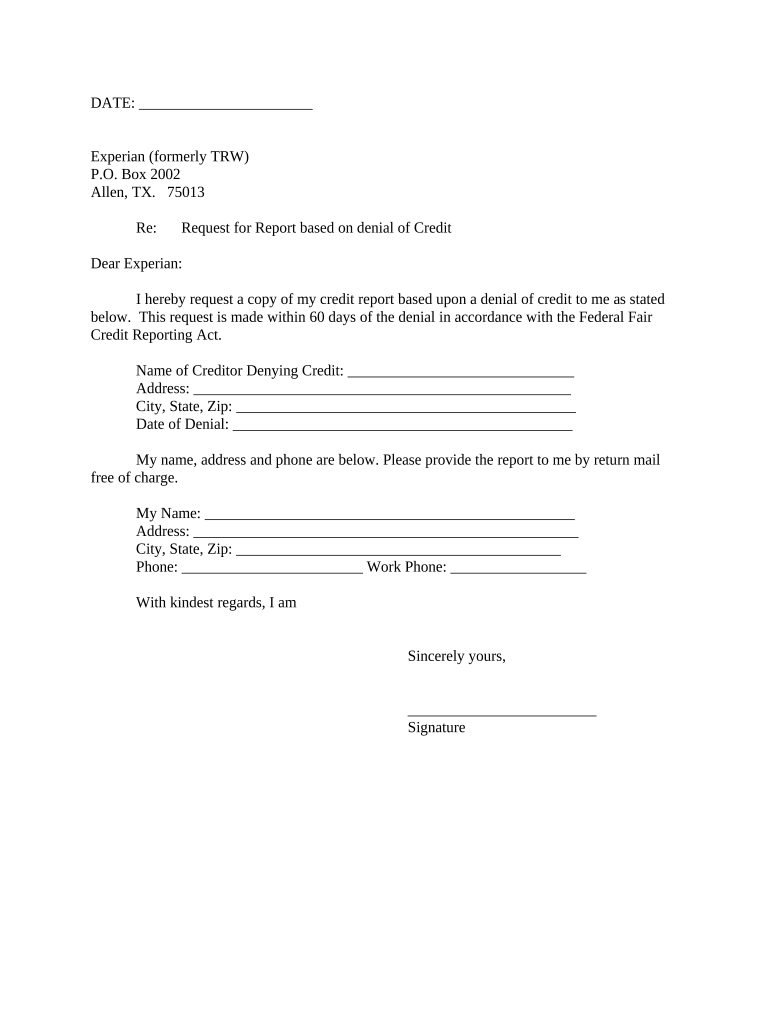

The letter requesting credit is a formal document used by individuals or businesses to apply for credit from a lender or financial institution. This letter outlines the applicant's financial situation, credit history, and reasons for requesting credit. It serves as a critical tool in the credit application process, allowing the lender to assess the applicant's eligibility and determine the terms of credit, such as interest rates and repayment schedules.

How to use the letter requesting credit

To effectively use the letter requesting credit, begin by clearly stating your intent to apply for credit. Include essential information such as your name, contact details, and the amount of credit you seek. Additionally, provide a brief overview of your financial background, including income, debts, and any assets. It's important to be honest and transparent, as this builds trust with the lender. Finally, express your willingness to provide further documentation if needed and thank the lender for their consideration.

Key elements of the letter requesting credit

A well-structured letter requesting credit should include several key elements to ensure clarity and professionalism. These elements are:

- Header: Your name and address, followed by the date.

- Lender's information: The name and address of the financial institution.

- Subject line: A clear statement indicating the purpose of the letter.

- Introduction: A brief introduction stating your request for credit.

- Financial details: A summary of your financial situation, including income and existing debts.

- Conclusion: A polite closing statement thanking the lender for their consideration.

Steps to complete the letter requesting credit

Completing the letter requesting credit involves several straightforward steps:

- Gather information: Collect all relevant financial documents, such as pay stubs, tax returns, and credit reports.

- Draft the letter: Use a formal tone and structure your letter according to the key elements outlined above.

- Review and edit: Check for grammatical errors and ensure that all information is accurate and complete.

- Submit the letter: Send the completed letter to the appropriate lender, either electronically or via mail, depending on their submission guidelines.

Legal use of the letter requesting credit

When using the letter requesting credit, it is essential to adhere to legal standards to ensure that the document is valid and enforceable. This includes providing accurate information and avoiding misrepresentation. Additionally, it should comply with applicable laws and regulations governing credit applications, including the Fair Credit Reporting Act (FCRA) and the Equal Credit Opportunity Act (ECOA). Understanding these legal frameworks helps protect both the applicant and the lender during the credit evaluation process.

Eligibility criteria

Eligibility criteria for credit applications can vary by lender, but common requirements include:

- Credit score: A minimum credit score may be required to qualify for credit.

- Income level: Proof of sufficient income to support repayment of the credit.

- Debt-to-income ratio: A ratio that compares monthly debt payments to monthly income.

- Employment history: A stable employment history can enhance your application.

Quick guide on how to complete letter requesting credit

Complete Letter Requesting Credit effortlessly on any device

Digital document management has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without unnecessary delays. Handle Letter Requesting Credit on any device using the airSlate SignNow apps available on Android or iOS, and streamline any document-related tasks today.

How to modify and eSign Letter Requesting Credit with ease

- Locate Letter Requesting Credit and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to preserve your changes.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, burdensome form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and eSign Letter Requesting Credit to guarantee outstanding communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a letter credit denial?

A letter credit denial occurs when a bank refuses to honor a requested letter of credit due to various reasons such as insufficient documentation or non-compliance with terms. Understanding the process is crucial for businesses to navigate financial transactions effectively. airSlate SignNow offers tools to ensure document accuracy and compliance, potentially reducing instances of letter credit denial.

-

How can airSlate SignNow help prevent letter credit denial?

By utilizing airSlate SignNow, businesses can streamline their documentation process, ensuring that all necessary information is accurately included before submission. This helps mitigate the risk of letter credit denial due to missing or incorrect documentation. Our platform’s eSigning capabilities allow for quick approvals, thus decreasing turnaround time.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to fit different business needs. Our cost-effective solutions range from basic eSigning features to advanced integrations that can help prevent issues like letter credit denial. By choosing the right plan, companies can ensure they have the tools necessary for seamless transactions and document management.

-

Does airSlate SignNow integrate with other software solutions?

Yes, airSlate SignNow integrates with various software solutions that assist in managing documentation and transactions effectively. Such integrations can streamline processes to avoid letter credit denial scenarios by facilitating quick data sharing and communication. This ultimately enhances your document workflow and efficiency.

-

What features does airSlate SignNow offer to support international transactions?

airSlate SignNow provides features such as multi-language support and international eSignature compliance to assist with international transactions. These features help prevent letter credit denial, ensuring all documents meet cross-border requirements. Users can also customize workflows to adapt to different regulatory environments.

-

Can airSlate SignNow help in tracking the status of documents?

Yes, airSlate SignNow includes tracking features that allow users to monitor the status of sent documents easily. Keeping an eye on document progress is essential in avoiding delays that could lead to letter credit denial. Clients can see when documents are viewed, signed, or need additional action.

-

Is there a trial period available for airSlate SignNow?

airSlate SignNow offers a free trial period that allows businesses to explore the platform's capabilities without commitment. During this trial, users can test features that help mitigate risks such as letter credit denial. This provides an excellent opportunity for organizations to assess the platform's suitability for their needs.

Get more for Letter Requesting Credit

- Chore contract template 317988274 form

- Fillable forms

- Acrostic poem evolution form

- Flybe firearms declaration form

- Hrsa nhsc site data form 2018 nhsc site data report

- Disaster recovery toolkit for small businesses connecticut form

- Applicant agreement form rmit university

- Special consideration application cpa australia form

Find out other Letter Requesting Credit

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT