Notice Violation Letter Form

What is the Notice Violation Letter

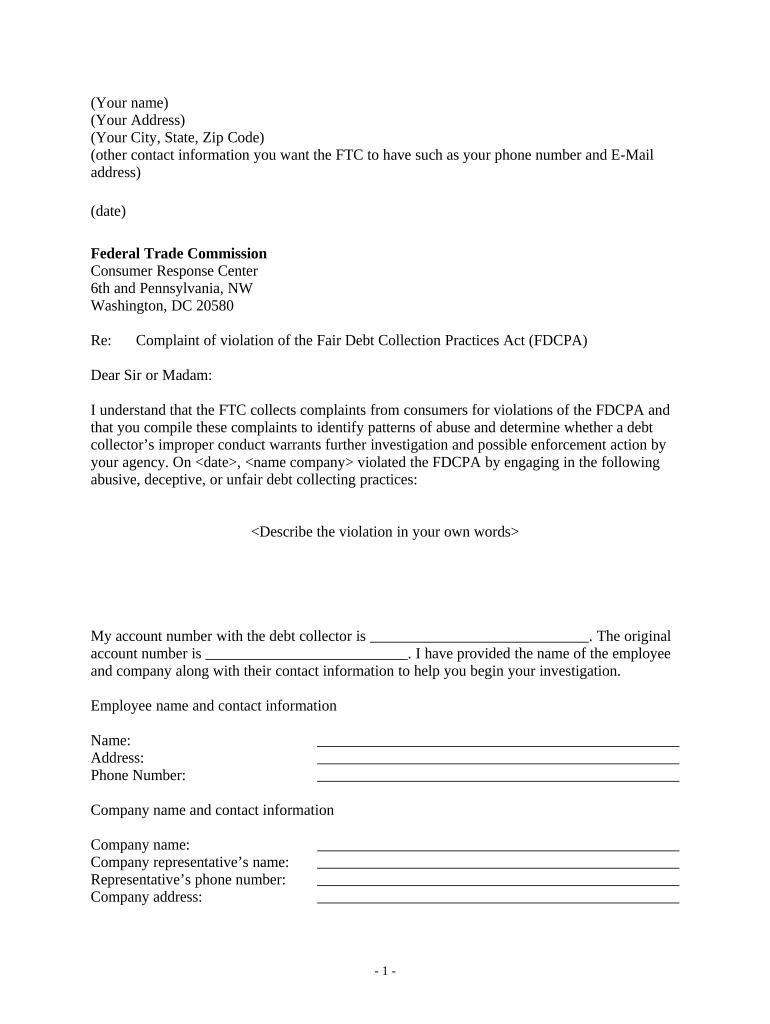

A Notice Violation Letter is a formal document used to inform an individual or entity of a breach of rules or regulations. In the context of debt collection, this letter serves to notify the debtor about their rights under the Fair Debt Collections Practices Act. It outlines the specific violations that have occurred, such as improper communication methods or failure to provide required information. This letter is essential for maintaining transparency and ensuring that debtors are aware of their rights and the actions they can take in response to unfair practices.

Key elements of the Notice Violation Letter

When drafting a Notice Violation Letter, it is important to include several key elements to ensure its effectiveness:

- Identification of the parties: Clearly state the names and contact information of both the sender and the recipient.

- Description of the violation: Provide specific details about the alleged violations, including dates and any relevant communications.

- Legal references: Cite applicable laws, such as the Fair Debt Collections Practices Act, to support your claims.

- Request for action: Specify what you expect from the recipient, such as a response or correction of the violation.

- Deadline for response: Indicate a reasonable timeframe for the recipient to address the issues raised in the letter.

How to use the Notice Violation Letter

The Notice Violation Letter can be used as a tool for debtors to assert their rights and seek resolution. When a debtor receives this letter, they should carefully review the claims made and gather any supporting documentation. Responding promptly to the letter is crucial, as it demonstrates a willingness to resolve the issue. Debtors may also use the letter as a basis for further action, such as filing a complaint with the Consumer Financial Protection Bureau or seeking legal counsel if the violations persist.

Steps to complete the Notice Violation Letter

Completing a Notice Violation Letter requires careful attention to detail. Here are the steps to follow:

- Gather information: Collect all relevant details about the alleged violations, including dates, names, and specific incidents.

- Draft the letter: Use clear and concise language to outline the violations and your expectations.

- Review legal requirements: Ensure that your letter complies with the Fair Debt Collections Practices Act and any other relevant laws.

- Proofread: Check for any errors or omissions that could undermine the letter's effectiveness.

- Send the letter: Choose a reliable method to deliver the letter, such as certified mail, to ensure it is received.

Legal use of the Notice Violation Letter

The legal use of a Notice Violation Letter is crucial for ensuring compliance with debt collection laws. This letter serves as a formal record of the debtor's claims and can be used as evidence in case of disputes. It is important that the letter is factual and free from any aggressive language, as this could lead to further legal complications. By adhering to the guidelines set forth in the Fair Debt Collections Practices Act, debtors can protect their rights and hold collectors accountable for their actions.

Examples of using the Notice Violation Letter

Examples of using a Notice Violation Letter can provide valuable insights into its practical application. For instance, a debtor may receive a call from a debt collector outside of permissible hours. In this case, the debtor can draft a Notice Violation Letter detailing the incident, referencing the specific law violated, and requesting that the collector cease such actions. Another example is when a debtor receives misleading information regarding their debt. The debtor can use the letter to clarify the inaccuracies and demand correction. These examples illustrate how the letter can be a powerful tool for asserting rights and seeking resolution in debt collection matters.

Quick guide on how to complete notice violation letter 497336190

Effortlessly Prepare Notice Violation Letter on Any Device

Managing documents online has gained signNow traction among companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the right format and securely keep it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without any hold-up. Handle Notice Violation Letter on any device with airSlate SignNow mobile applications for Android or iOS and simplify any document-related process today.

The Easiest Way to Edit and eSign Notice Violation Letter with Ease

- Locate Notice Violation Letter and click on Acquire Form to begin.

- Make use of the tools we offer to fill out your form.

- Emphasize important parts of your documents or obscure sensitive data using specialized tools provided by airSlate SignNow.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Complete button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or disorganized documents, tiresome form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Notice Violation Letter and ensure excellent communication throughout every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a fair debt act letter?

A fair debt act letter is a formal communication sent to a debt collector that outlines your rights under the Fair Debt Collection Practices Act (FDCPA). It typically requests verification of the debt and can help consumers communicate with collectors more effectively. Using airSlate SignNow, you can easily create and send these letters electronically.

-

How does airSlate SignNow help with sending fair debt act letters?

airSlate SignNow provides a user-friendly platform that allows you to quickly draft, send, and eSign fair debt act letters. Our solution enables you to streamline the process, ensuring your communications are both timely and compliant with the FDCPA. This can signNowly ease the stress of dealing with debt collectors.

-

Are there any costs associated with using airSlate SignNow for fair debt act letters?

Yes, airSlate SignNow offers various pricing plans that are cost-effective and designed to fit different business needs. You'll find that our services provide excellent value, especially when you consider the convenience and efficiency in sending fair debt act letters. Choose a plan that best meets your requirements and budget.

-

What features are included when I use airSlate SignNow for fair debt act letters?

When using airSlate SignNow for your fair debt act letters, you gain access to a variety of features such as customizable templates, secure eSigning, and automated workflows. These features simplify the document preparation and signing process, making it easier for you to stay compliant with debt collection laws.

-

Can I track the delivery of my fair debt act letter sent through airSlate SignNow?

Yes, airSlate SignNow offers tracking capabilities that allow you to monitor the status of your fair debt act letter. You'll receive updates when the letter is sent, opened, and signed, providing you peace of mind and ensuring that your correspondence is received promptly.

-

Is airSlate SignNow compliant with the Fair Debt Collection Practices Act?

Absolutely, airSlate SignNow is designed with compliance in mind, including features that facilitate adherence to the Fair Debt Collection Practices Act. By using our platform for your fair debt act letters, you can ensure that your communications uphold the standards set by the FDCPA, minimizing legal risks.

-

What integrations does airSlate SignNow offer for managing fair debt act letters?

airSlate SignNow seamlessly integrates with various applications and CRM systems, enhancing your workflow when managing fair debt act letters. These integrations allow for easier document access, sharing, and management, giving you greater flexibility in handling debt collection processes.

Get more for Notice Violation Letter

Find out other Notice Violation Letter

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself