Letter Debt Form

What is the Letter Debt

The letter debt refers to a formal document that individuals may use to communicate with debt collectors regarding outstanding debts. This letter serves multiple purposes, such as disputing the validity of the debt, requesting verification, or negotiating payment terms. It is crucial for consumers to understand that the letter debt can also protect their rights under the Fair Debt Collection Practices Act (FDCPA), which governs how collectors can interact with debtors.

How to use the Letter Debt

Using the letter debt effectively involves a few key steps. First, identify the specific purpose of the letter, whether it is to dispute a debt, request validation, or communicate payment arrangements. Next, ensure that the letter is clearly written and includes all necessary details, such as the account number, the amount owed, and any relevant dates. Finally, send the letter via a method that provides proof of delivery, such as certified mail, to ensure that the debt collector receives it.

Steps to complete the Letter Debt

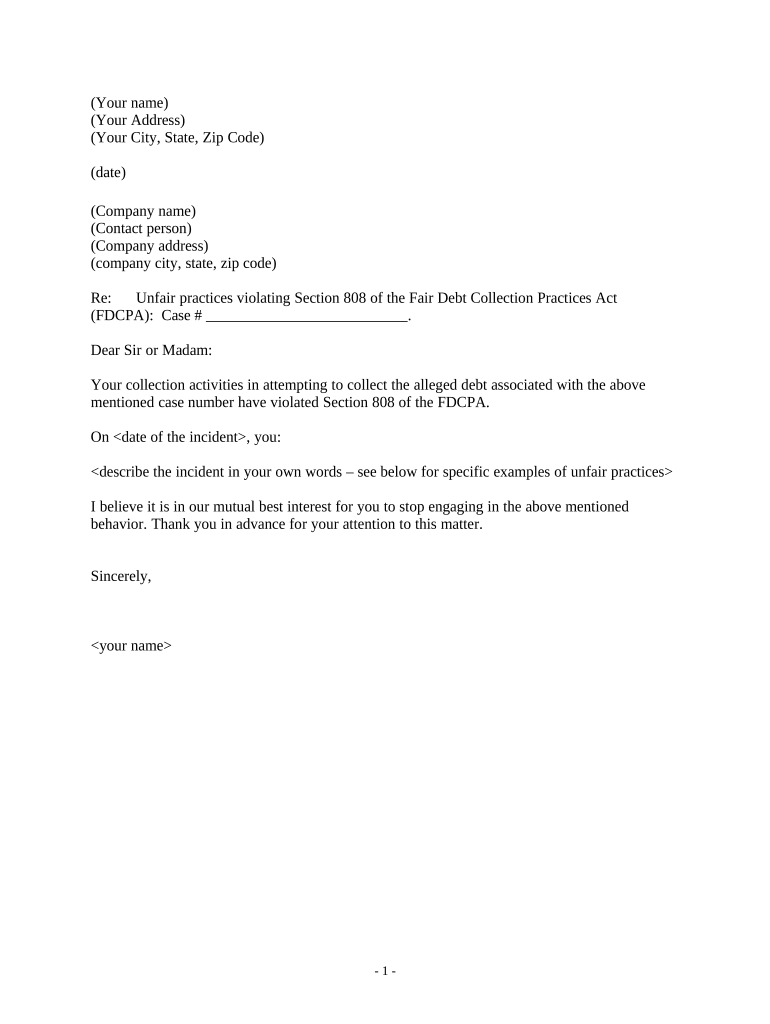

Completing the letter debt requires careful attention to detail. Follow these steps:

- Begin with your contact information at the top, followed by the date.

- Include the debt collector's name and address.

- Clearly state the purpose of the letter in the opening paragraph.

- Provide specific details about the debt, including the amount and account number.

- Request any necessary actions, such as validation of the debt or confirmation of payment arrangements.

- Conclude with a polite closing and your signature.

Key elements of the Letter Debt

A well-structured letter debt should contain several key elements to ensure its effectiveness. These include:

- Identification: Clearly identify yourself and the debt in question.

- Purpose: State the intent of the letter, whether it's to dispute, validate, or negotiate.

- Legal References: Mention relevant laws, such as the FDCPA, to reinforce your rights.

- Request for Action: Specify what you want the debt collector to do next.

- Documentation: Reference any supporting documents that accompany the letter.

Legal use of the Letter Debt

The legal use of the letter debt is essential for protecting consumer rights. Under the FDCPA, consumers have the right to request validation of a debt within thirty days of being contacted by a debt collector. Using the letter debt appropriately can help ensure compliance with this law and provide a formal record of communication. It is advisable to keep copies of all correspondence for future reference, as this documentation can be crucial in case of disputes.

Examples of using the Letter Debt

There are various scenarios in which individuals may use the letter debt. Common examples include:

- Disputing a debt: If a consumer believes the debt is invalid, they can send a letter requesting verification.

- Negotiating payment terms: A debtor may propose a payment plan or settlement amount to the collector.

- Requesting cessation of communication: Consumers can instruct collectors to stop contacting them if they choose.

Quick guide on how to complete letter debt

Effortlessly Prepare Letter Debt on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, as you can obtain the correct template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Letter Debt on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Letter Debt effortlessly

- Obtain Letter Debt and then click Get Form to begin.

- Use the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which only takes a few seconds and carries the same legal validity as a traditional signature with ink.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Letter Debt, ensuring effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are common debt collector practices that businesses should be aware of?

Common debt collector practices include frequent phone calls, sending letters, and negotiating payment plans. It's essential for businesses to understand these methods to ensure compliance with relevant laws. Being informed about debt collector practices helps businesses create effective strategies for managing outstanding debts.

-

How can airSlate SignNow help in adhering to debt collector practices?

airSlate SignNow provides a secure platform for sending and signing documents related to debt collection. By using eSignatures and document tracking, businesses can maintain compliance with debt collector practices. This not only speeds up the process but also ensures that all communications are legally binding.

-

What are the pricing options for using airSlate SignNow in debt collection?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Whether you're a small startup or a large corporation, there are options available to suit your budget while ensuring compliance with debt collector practices. Check our website for the latest pricing details and promotions.

-

What features does airSlate SignNow offer to support debt collector practices?

Key features of airSlate SignNow include customizable document templates, real-time tracking, and multi-party signing. These features enhance the efficiency of debt collection processes while ensuring that best practices are followed. By leveraging these tools, businesses can streamline their operations and improve communication with debtors.

-

Can airSlate SignNow integrate with other platforms for debt collection?

Yes, airSlate SignNow easily integrates with various CRM and accounting platforms to enhance your debt collection efforts. These integrations allow for seamless data transfer and help maintain compliance with debt collector practices. This ensures that all aspects of debt management are connected and efficient.

-

What benefits does airSlate SignNow provide for debt collection teams?

Using airSlate SignNow empowers debt collection teams by simplifying the documents they need to manage. The platform saves time and reduces the risk of errors, which is critical in adhering to debt collector practices. Teams can focus more on communication and resolution rather than administrative logistics.

-

How does airSlate SignNow ensure security in debt collector practices?

airSlate SignNow employs advanced security measures including data encryption and secure access controls to protect sensitive information during debt collection. This ensures that your business complies with debt collector practices while safeguarding your clients' data. You can trust that your communications and documents are protected.

Get more for Letter Debt

Find out other Letter Debt

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple