13 2015

What is the 13

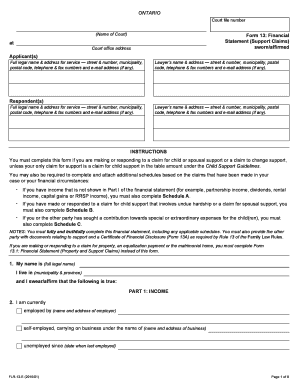

The 13 refers to a specific form used in Canada, often associated with financial reporting or tax purposes. It is essential for individuals and businesses to understand this form, as it plays a critical role in ensuring compliance with financial regulations. The 2015 Canada form is particularly relevant for those who need to report their financial activities accurately for that year. Understanding its purpose can help streamline the filing process and avoid potential penalties.

How to use the 13

Using the 13 involves several key steps that ensure accurate completion. First, gather all necessary financial documents, such as income statements and expense reports. Next, fill out the form carefully, ensuring that all information is accurate and complete. It is important to double-check figures and calculations to avoid errors. Once completed, the form can be submitted electronically or via traditional mail, depending on the specific requirements set forth by the governing body.

Steps to complete the 13

Completing the 13 can be broken down into a series of straightforward steps:

- Gather all relevant financial documents.

- Review the instructions provided with the form for specific guidelines.

- Fill out the form, ensuring that all sections are completed accurately.

- Double-check all entries for accuracy.

- Submit the form by the designated deadline, either online or by mail.

Legal use of the 13

Understanding the legal implications of the 13 is crucial for compliance. This form must be filled out accurately to ensure that all reported information is truthful and complete. Failing to comply with the requirements can lead to penalties or legal repercussions. It is advisable to consult with a tax professional or legal advisor if there are uncertainties regarding the form's completion or submission.

Key elements of the 13

The 13 contains several key elements that must be addressed when completing the form. These include:

- Personal identification information, such as name and address.

- Financial details, including income, expenses, and deductions.

- Signature and date to verify the authenticity of the information provided.

Ensuring that each of these elements is accurately filled out is vital for the form's acceptance and legal standing.

Filing Deadlines / Important Dates

Filing deadlines for the 13 can vary based on individual circumstances and the specific requirements of the governing body. Generally, it is important to be aware of the following:

- The standard deadline for submission, which is often April 15 for the previous tax year.

- Extensions that may be available under certain circumstances.

- Any specific dates related to state or local requirements that may differ from federal deadlines.

Staying informed about these dates helps ensure timely submission and compliance.

Quick guide on how to complete 13

Prepare 13 effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly alternative to traditional printed and signed papers, as you can easily access the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage 13 on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign 13 seamlessly

- Obtain 13 and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize key sections of the documents or redact sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you would like to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign 13 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 13

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer for documents related to 2015 Canada?

airSlate SignNow provides several features tailored for documents related to 2015 Canada, including electronic signatures, templates, and real-time collaboration. These features ensure that businesses can efficiently manage their documents while complying with Canadian regulations. By utilizing these tools, users can streamline their signing process and enhance productivity.

-

How does airSlate SignNow's pricing compare for businesses focusing on 2015 Canada?

The pricing for airSlate SignNow is designed to be cost-effective for businesses operating in 2015 Canada. We offer various subscription plans that scale with your business needs, providing flexibility and value. You can choose a plan that fits your volume of documents and e-signature needs.

-

Can I integrate airSlate SignNow with other software commonly used in 2015 Canada?

Yes, airSlate SignNow supports integration with popular software widely used in 2015 Canada, such as CRM systems, document management tools, and project management apps. This allows for seamless workflows and enhanced productivity by connecting various platforms. Integration helps businesses leverage existing tools while utilizing SignNow’s powerful features.

-

What are the benefits of using airSlate SignNow for documents pertaining to 2015 Canada?

The primary benefits of using airSlate SignNow for documents pertaining to 2015 Canada include improved efficiency, reduced paper usage, and enhanced security. You can easily send, sign, and manage documents from any device, ensuring a quick turnaround. These advantages are crucial for businesses aiming to stay competitive in a digital landscape.

-

Is airSlate SignNow secure for handling sensitive documents in 2015 Canada?

Absolutely! airSlate SignNow takes security seriously and complies with industry standards to protect sensitive documents relevant to 2015 Canada. With features such as end-to-end encryption and secure storage, you can trust that your information remains confidential. Regular security updates ensure that your data is always safeguarded.

-

How do I get started with airSlate SignNow for my business in 2015 Canada?

Getting started with airSlate SignNow for your business in 2015 Canada is simple. Sign up for a free trial on our website to explore our features and capabilities. Once you're ready, choose a plan that fits your needs and start sending and signing documents efficiently.

-

What types of documents can be signed using airSlate SignNow in 2015 Canada?

airSlate SignNow allows for a wide range of documents to be signed in 2015 Canada, including contracts, agreements, and forms. This versatility is ideal for businesses that frequently handle various transactions. By using SignNow, you can ensure that all documents are signed quickly and securely.

Get more for 13

- Arkansas department of health employee temperature log form

- Khbe form

- Department of health amp human services maine center for form

- Services division of public health systemsmaine dhhs form

- Attending physician end of life reporting form

- Residential lease agreement eforms

- North dakota general bill of sale form

- Tennessee general bill of sale form

Find out other 13

- How Can I Electronic signature Texas Car Dealer Document

- How Do I Electronic signature West Virginia Banking Document

- How To Electronic signature Washington Car Dealer Document

- Can I Electronic signature West Virginia Car Dealer Document

- How Do I Electronic signature West Virginia Car Dealer Form

- How Can I Electronic signature Wisconsin Car Dealer PDF

- How Can I Electronic signature Wisconsin Car Dealer Form

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document